1 min read

IRMI Directory of Risk Management and Insurance Programs at U.S. Colleges and Universities

IRMI Directory of Risk Management and Insurance Programs at U.S. Colleges and Universities by Nicholas Lamparelli Hattip to Bill Wilson for...

3 min read

.jpg) Nicholas Lamparelli

:

Jan 13, 2026 8:03:50 PM

Nicholas Lamparelli

:

Jan 13, 2026 8:03:50 PM

Executive Summary

The U.S. Supreme Court’s decision to hear Sripetch v. SEC marks a significant moment in securities enforcement law, focusing on the scope of the Securities and Exchange Commission’s (SEC) authority to seek disgorgement, essentially the recovery of ill-gotten gains, from alleged securities law violators. The central question is whether the SEC must prove that investors suffered pecuniary harm to justify disgorgement or if disgorgement can be ordered without such a showing. This issue has created a split among federal appellate courts, notably between the Second Circuit, which requires proof of investor harm, and the First and Ninth Circuits, which do not.

For insurance professionals, particularly those involved in underwriting and managing directors and officers (D&O) liability policies, this case carries important implications. The Court’s ruling could reshape the financial exposure of corporate executives and boards faced with SEC enforcement actions. It may affect the frequency and magnitude of disgorgement awards, which in turn influence claims patterns and underwriting risk assessments. Understanding this evolving legal landscape is critical for insurers, agents, and risk managers tasked with protecting insureds against securities-related regulatory actions.

Key Insights

Insurance Industry Applications

Conclusion and Recommendations

The Supreme Court’s impending decision in Sripetch v. SEC promises to resolve a critical legal ambiguity impacting SEC enforcement and, by extension, the exposure of insured directors and officers. Insurance professionals must stay informed about the case’s progress and potential ramifications. Proactive steps include incorporating jurisdictional risk into underwriting models, educating insureds on governance best practices to mitigate enforcement risk, and reviewing policy forms to address potential coverage gaps related to disgorgement.

Risk managers and brokers should also prepare to advise clients on the evolving regulatory environment and its implications for corporate liability. While the ruling’s immediate effect may be limited to a specific statutory question, its influence on the scale and nature of SEC enforcement remedies could be far-reaching, especially in markets with high securities activity.

For further details on the case and its legal context, see the original analysis at The D&O Diary: Supreme Court Agrees to Consider SEC’s Disgorgement Remedy Rights.

Original Source: https://www.dandodiary.com/2026/01/articles/securities-enforcement/supreme-court-agrees-to-consider-secs-disgorgement-remedy-rights/

1 min read

IRMI Directory of Risk Management and Insurance Programs at U.S. Colleges and Universities by Nicholas Lamparelli Hattip to Bill Wilson for...

4 min read

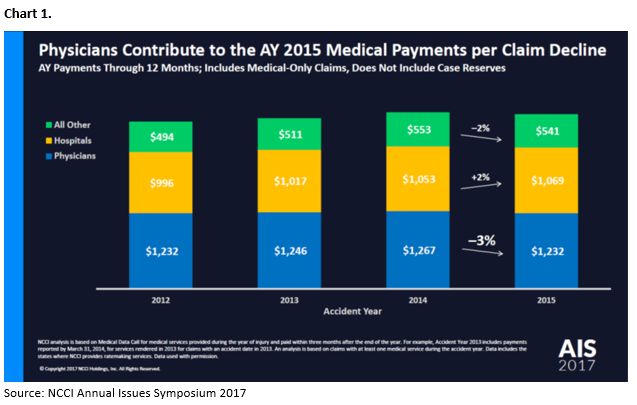

A Deeper Dive into Medical Cost Rising for Lost-Time Claims by Richard Krasner A Deeper Dive into Medical Cost Rising for Lost-Time Claims It...

2 min read

Profiles in Risk – E133: Mark Habersack, Director of Risk Management for MGM Casinos by Nicholas Lamparelli When it comes to Risk Management, ...