4 min read

The Top 5 things in Common Between the Insurance and Space Industry

The Top 5 things in Common Between the Insurance and Space Industry by Colby Tunick Space is exciting – it’s shiny and bold. The Internet from...

3 min read

Scott Quiana

:

Nov 11, 2025 7:04:58 PM

Scott Quiana

:

Nov 11, 2025 7:04:58 PM

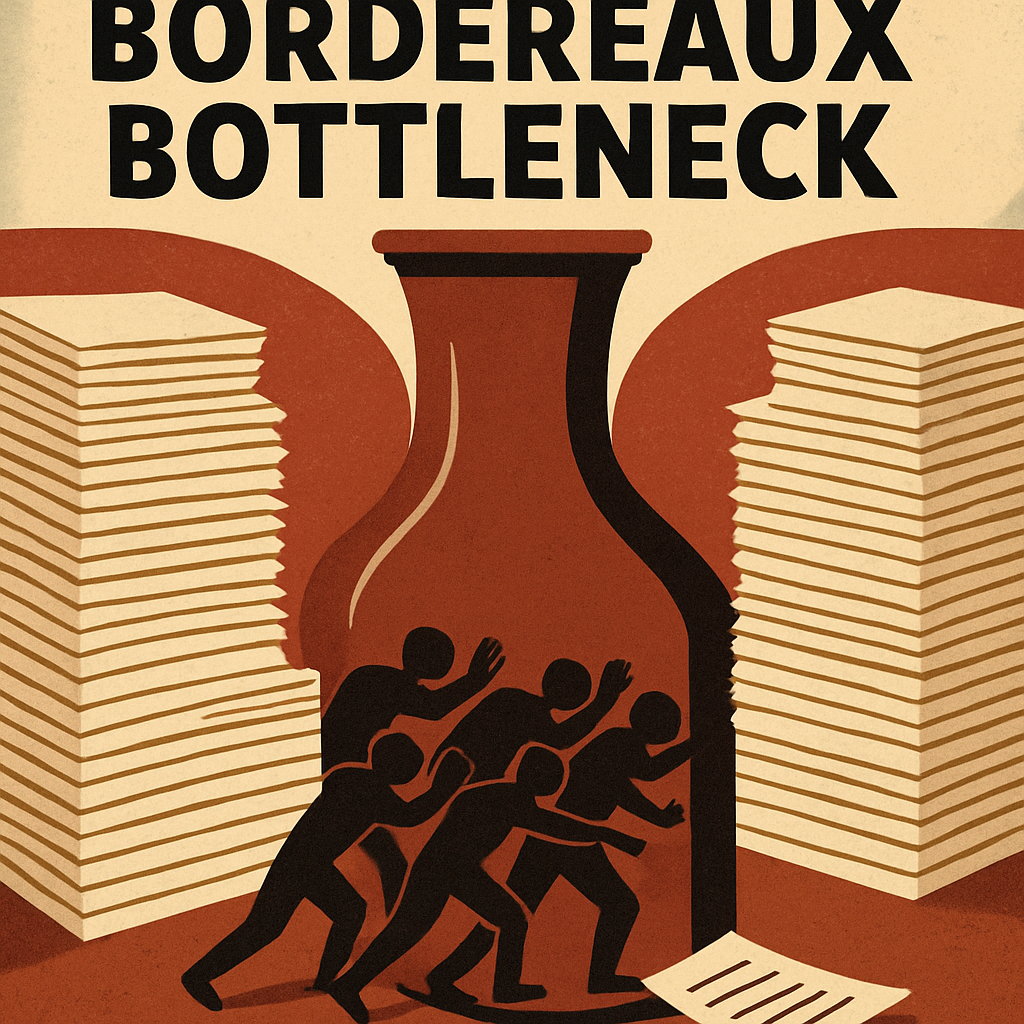

In program insurance, few words carry more weight—and more baggage—than “bordereaux.”

For decades, bordereaux reporting has been the default method of communicating performance between MGAs, carriers, TPAs, and reinsurers. What was once a simple way to share policy and claim level data has become one of the most persistent sources of operational friction in the entire delegated authority model.

Despite growing investment in digital tools, standards like Lloyd’s v5.2, and the promises of insurtech, the industry is still reliant on manual, messy, and delayed reporting workflows.

It’s more than just an inconvenience. The bordereaux process is a structural bottleneck—and it’s one of the key reasons why the program market remains inefficient, illiquid, and difficult to scale.

Ask any carrier, reinsurer, or MGA working with program business what their biggest pain point is, and “data reconciliation” is likely in the top 3.

At the center of that pain is the bordereaux.

In theory, a bordereaux should be a clean, structured data set that provides accurate performance insight. After all, how hard is it to represent total premium? In practice, it’s often:

This forces everyone in the chain to spend weeks—sometimes months—cleaning, reformatting, validating, and aligning data. Capacity and capital providers wait on outdated performance metrics. Errors and inconsistencies trigger rounds of back-and-forth emails. Trust in data and partnerships declines. And instead of investing time into strategic decisions, teams burn hours just trying to get to a reliable baseline.

That isn’t just inefficient. It’s a tax on the entire system.

It’s not just operations. Bordereaux bottlenecks restrict capital flow.

Reinsurers and carriers depend on up-to-date, validated performance data to make allocation decisions. But when reporting lags by 30, 60, or even 90 days, capital partners are left flying blind.

The implications are serious:

This delayed access to clean data creates systemic drag. It reduces confidence, inflates risk, and undermines trust—precisely when the delegated authority model is growing.

Lloyd’s v5.2, ISO, and other market-wide data standards have been important steps toward modernization. But they do not work.

Why?

Because they only benefit the recipient. They don’t solve the data struggle. Standardization without infrastructure leaves more work on the table, not less. Even with standardized formats:

The problem isn’t the data destination—it’s the journey from beginning to end..

Solving the bordereaux problem means rethinking the process entirely.

Data is not static. It’s dynamic and changes over time and in real time. So why treat reporting like it is static? We need to shift to a streamlined data infrastructure that:

This kind of system doesn’t just remove friction—it unlocks the potential of the entire delegated model.

Carriers gain confidence to scale. Reinsurers make faster, smarter capital decisions. MGAs can prove performance without delay. Everyone moves with greater speed and precision.

The bordereaux doesn’t have to be the anchor that holds the market back. With the right infrastructure, it can become the backbone of a more connected, liquid, and data-driven program ecosystem.

At Noldor, we’ve built exactly that: a platform that automates data ingestion, validation, and reporting across all parties—turning slow, inconsistent bordereaux into a real-time source of truth.

Because when you eliminate the bottlenecks, capital flows.

And when capital flows, programs grow.

Noldor is more than a data platform—it’s the infrastructure powering the future of insurance program business. Built to transform fragmented, inconsistent insurance data into a strategic asset, Noldor bridges the gap between MGAs, carriers, reinsurers, and brokers by offering real-time insights, seamless system integrations, and automated workflows that scale with your business. For more information, please contact us at questions@noldor.com.

4 min read

The Top 5 things in Common Between the Insurance and Space Industry by Colby Tunick Space is exciting – it’s shiny and bold. The Internet from...

6 min read

The Insurance Industry Has An Image Problem by Taryn Haas When discussing generations it’s impossible not to generalize. This article won’t...

5 min read

8 Forces That Will Change The Insurance Industry – Part I by Antonio Canas The insurance industry is in a unique place right now, something...