2 min read

Navigating Natural Disaster Losses: Strategic Insights from 2025

Executive Summary In 2025, natural disasters resulted in an estimated $224 billion in total economic losses globally, with insured losses reaching...

3 min read

.jpg) Nicholas Lamparelli

:

Feb 9, 2026 1:51:25 PM

Nicholas Lamparelli

:

Feb 9, 2026 1:51:25 PM

Executive Summary

Extreme weather events are intensifying globally, bringing significant financial and operational challenges to commercial property owners. Recent data highlights a steep increase in catastrophic incidents such as floods, wildfires, hurricanes, and heatwaves, with Europe experiencing its highest flood levels in over a decade. The economic toll is staggering, with climate-related disasters costing the global economy more than $2 trillion over the past ten years. This evolving risk landscape demands that insurance professionals move beyond traditional indemnification roles and adopt proactive, data-driven strategies to support clients in climate risk assessment and mitigation.

In this context, insurers are uniquely positioned to lead resilience-building efforts. By leveraging advanced hazard modeling, artificial intelligence, and extensive engineering expertise, insurers can provide tailored risk evaluations and actionable insights at the site level. These capabilities enable insurers to collaborate closely with commercial property owners on adaptive measures that reduce vulnerability and potential losses. Integrating pre-emptive risk management with innovative insurance products enhances portfolio stability and client confidence in an increasingly volatile climate environment.

Key Insights

Insurance Industry Applications

Conclusion and Recommendations

The surge in extreme weather events compels the insurance industry to evolve from reactive claim handlers to proactive risk partners. By embracing advanced data analytics, AI-enhanced modeling, and client-centered risk mitigation strategies, insurers can safeguard commercial property portfolios against escalating climate threats. Insurance professionals should prioritize developing tailored risk assessments, fostering collaborative relationships with clients, and promoting resilience through innovative incentive programs.

To remain competitive and fulfill their risk management mandate effectively, insurers must invest in research capabilities and technological tools that provide actionable insights. Emulating leading practices will position insurers to better serve commercial property owners and contribute to broader economic stability.

Original Source: https://www.fm.com/insights/securing-commercial-property-amid-extreme-weather-events

2 min read

Executive Summary In 2025, natural disasters resulted in an estimated $224 billion in total economic losses globally, with insured losses reaching...

2 min read

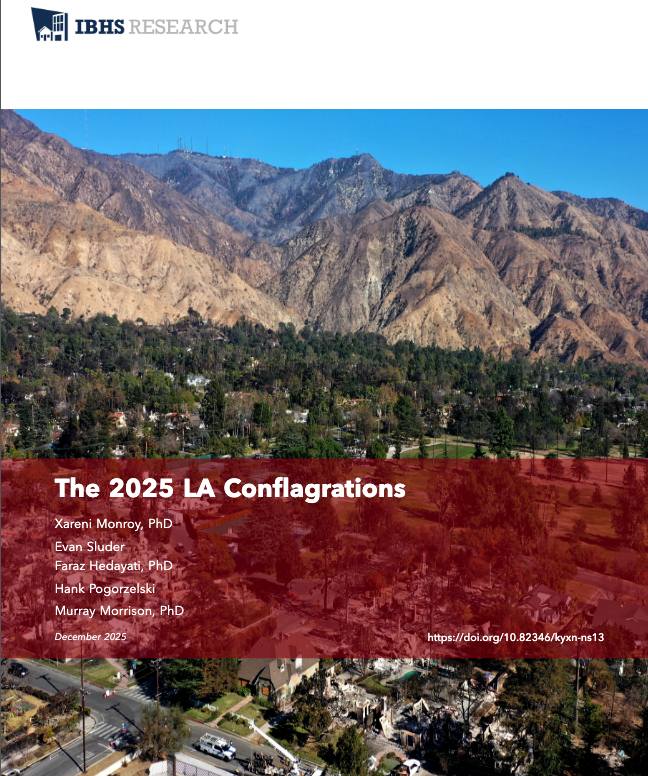

Executive Summary The 2025 LA Conflagrations report by the Insurance Institute for Business & Home Safety (IBHS) highlights the escalating wildfire...

3 min read

This guest article first appeared HERE In today's insurance market, especially within program insurance and Managing General Agent (MGA) models,...