I am not only an insurance professional but someone who has always been fascinated by insurance for its real-world applications. From the way that insurance applies practically to how it affects people’s everyday lives – aware of it or not -it is something that I have always found deeply interesting. I also enjoy looking at the history of things like the insurance industry. With Super Bowl 52 coming up this weekend, I thought it would be fun to reflect on the past years where insurance almost leads to the Super Bowl being canceled.

Now when I talk about the Super Bowl being insured, which is no small undertaking, there are many things that jump to the forefront of thought as to what lines of business are required. General Liability, Liquor Liability, Personal Advertising and Injury, and much more make up the bulk of what most people would consider. But one of the keys to making sure there are no unintended exposures is terrorism insurance. Unfortunately, in the day and age we live in, terror has become a part of the modern reality of contingency planning and risk management by professionals in our industry. After all, we as an industry pride ourselves on providing the best mitigation solutions to our client’s worst case scenarios. And examining terrorism can show why insuring against it is critical to planners of events such as the Super Bowl. And one of the most important components of terrorism insurance is TRIA or the Terrorism Risk Insurance Act.

Before we look into just how insurance almost canceled the Super Bowl, I feel it is important for us to set some definitions for clarity’s sake. So first of all, what exactly is terrorism? The FBI defines it as “The unlawful use of force or violence against persons or property to intimidate or coerce a government, the civilian population, or any segment thereof, in furtherance of political or social objectives.” Put more simply, terrorism is more than just violence, rather it is directed violence with the intent of disrupting the country. I believe that it is also important to define the Terrorism Risk Insurance Act (TRIA). Almost everyone in the commercial insurance field knows about TRIA from the requirement by the government to offer it. But what exactly is it, and where did it come from?

The entire country changed in a very short amount of time during the events of the morning of September 11th, 2001. Insurance was no exception. Before the attacks on the World Trade Center, terrorism was something that was typically a common offering in commercial insurance for a low premium, similar to how rental car or roadside assistance can be offered on auto policies today. 9/11 changed this, and almost immediately thereafter terrorism coverage became extremely expensive if it could be had at all. This led to a great deal of distress in the market as suddenly and simultaneously people realized a need for terrorism insurance and insurers realized the great deal of expense that they could soon face. In an attempt to lessen fears of the marketplace, the government stepped in.

A little over a year after the events of 9/11, H.R. 3210 – Terrorism Risk Insurance Act of 2002 – was introduced as a part of the 107th Congress, and was signed into law by President George W. Bush on November 26, 2002. The stated point of the law was to “[Establish] a three-year Terrorism Insurance Program in the Department of the Treasury, administered by the Secretary of the Treasury, to pay the Federal share of compensation for insured losses resulting from acts of terrorism.” Basically, in the face of growing concerns about terrorism and the lack of insurance available on the market, the federal government established a program meant to insure against losses that might be sustained by citizens of the United States through a reinsurance program. This is not without precedent, as the US had set up similar programs in the past such as the National Flood Insurance Program. Rather than setting itself up to be the primary, similar to direct disaster relief that is administered by FEMA, the goal was for TRIA to kick-start the market into offering terrorism insurance as a standard cover option by requiring the insurance companies to provide terrorism on a primary basis in order to be eligible for the reinsurance. At this point I am sure you are asking yourself, “what does this all have to do with football and the Super Bowl?”

The Super Bowl is one of the most popular national events in the United States. Just to put some numbers to this statement and add perspective, the population in the United States according to the Census Bureau was 323 million people in 2016. With a peak viewership of 172 million and an average viewership of 111 million for the 2017 Super Bowl, the proportion of people watching the game fluctuated between 1 out of 2 and 1 out of 3 people in America. Also again, the point of terrorism is to cause fear and discord amongst the population of a country and attempt to cause them to either engage in or refrain from certain actions. Unfortunately this makes a national event like the Super Bowl an attractive target. But getting back to TRIA, the idea behind the bill’s purpose was that it was supposed to be a temporary boost to insurers to get them to start writing terrorism insurance again. It was also meant to allow consumers to purchase terrorism insurance on the open market. The bill did just that for its initial period of three years, but instead of being the spark that jumped the market back into action, it became wired into the framework of how terrorism insurance was marketed and sold as the full faith and credit of the United States became the primary reinsurer of terrorism policies. Due to this, when it came time for TRIA to expire congress amended the Act to reflect a higher coinsurance split and primary loss layer for the insurers that participated and renewed the bill in 2005, lasting until 2007 and then renewed the bill once again in 2007 until 2014.

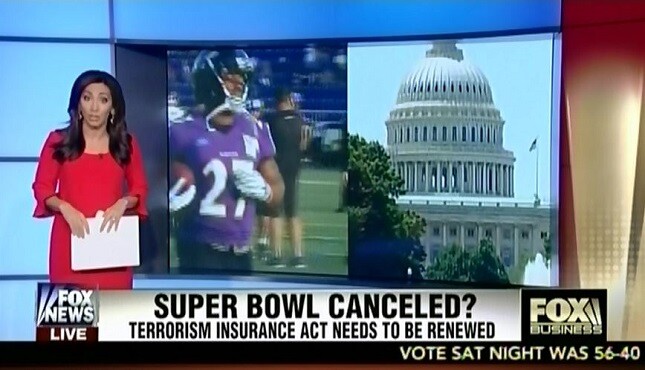

It is in the end of 2014 that we run into the potential problem with the market and the pinnacle of football that so many Americans look forward to each year. The renewal of TRIA was bounced back and forth between a few different bills in December of 2014. Faced with a lame duck session of congress and some strong objections to aspects of the various bills unrelated to TRIA, the 2014 legislative year was to end with TRIA expiring with no provision to replace it. During this time in the house and senate, many large industry groups in the real estate and entertainment industry were lobbying very heavily for passing the renewal of TRIA. Now, the NFL had insisted that the Super Bowl was going to be played regardless and any rumor of the Super Bowl being put on hold was merely sensationalized rumor. But in my opinion it does not take any huge leap to imagine many large enterprises being eager to undertake something as large as the Super Bowl without the benefit of TRIA.

The cost of the Super Bowl is truly enormous. One need only to look at one of the biggest aspects of Super Bowl marketing to see this. The true figure of what a 30 second commercial costs during this year’s Super Bowl has not yet been released but is confirmed to exceed the five million dollar price tag carried by last year’s Super Bowl. Some estimates have the commercial cost pegged at over seven point seven million dollars- which is greater than the salary for one of the starting quarterbacks. The infrastructure cost is also nothing to ignore either- US Bank Stadium, which will be hosting this year’s Super Bowl – had a construction cost of one point one billion dollars. Tax revenues from the associated crowd of fans coming for the game itself and the Super Bowl celebration is estimated in the millions, with total revenues reaching into the hundreds of millions. Even in personal costs, Time.com estimates the attending the super bowl to range anywhere from three thousand dollars with cheap seats to north of fifty thousand dollars for the big-spending football fan. So despite the NFL contending the contrary, I think it’s pretty easy see how something like losing the primary reinsurance market for terrorism for one of the largest cultural and economic events of the year only a month before the event could cause issues.

Fortunately the story has a happy ending. Congress came together in the very beginning of the 2015 session and made the reauthorization of TRIA one of the very first items accomplished, passing an extension for six years which will expire in 2020. So with a very small lapse there was no cause for worry and the NFL didn’t have to prove its mettle in hosting the game without coverage. But it is fascinating to me see just how important our industry is to this country, and not just in the typical day to day ways most of us are used to seeing. So if you are one of the many Americans that enjoy the Super Bowl, take a moment to appreciate the way your industry contributes!

About Patrick Stephens

Excess and Surplus Lines insurance broker, specializing in commercial property and commercial general liability.

Excess and Surplus Lines insurance broker, specializing in commercial property and commercial general liability.