5 min read

The Financial GPS for Insurance Agencies – Double Entry Accounting

The Financial GPS for Insurance Agencies – Double Entry Accounting by Crystal Temple The advent of double entry bookkeeping is one of the most...

3 min read

Tom Capp

:

Jan 8, 2026 10:52:16 AM

Tom Capp

:

Jan 8, 2026 10:52:16 AM

Insurance companies present their rates and products on several comparative raters and platforms. How you go about making the decision to place rates on a platform and measuring the results is critical.

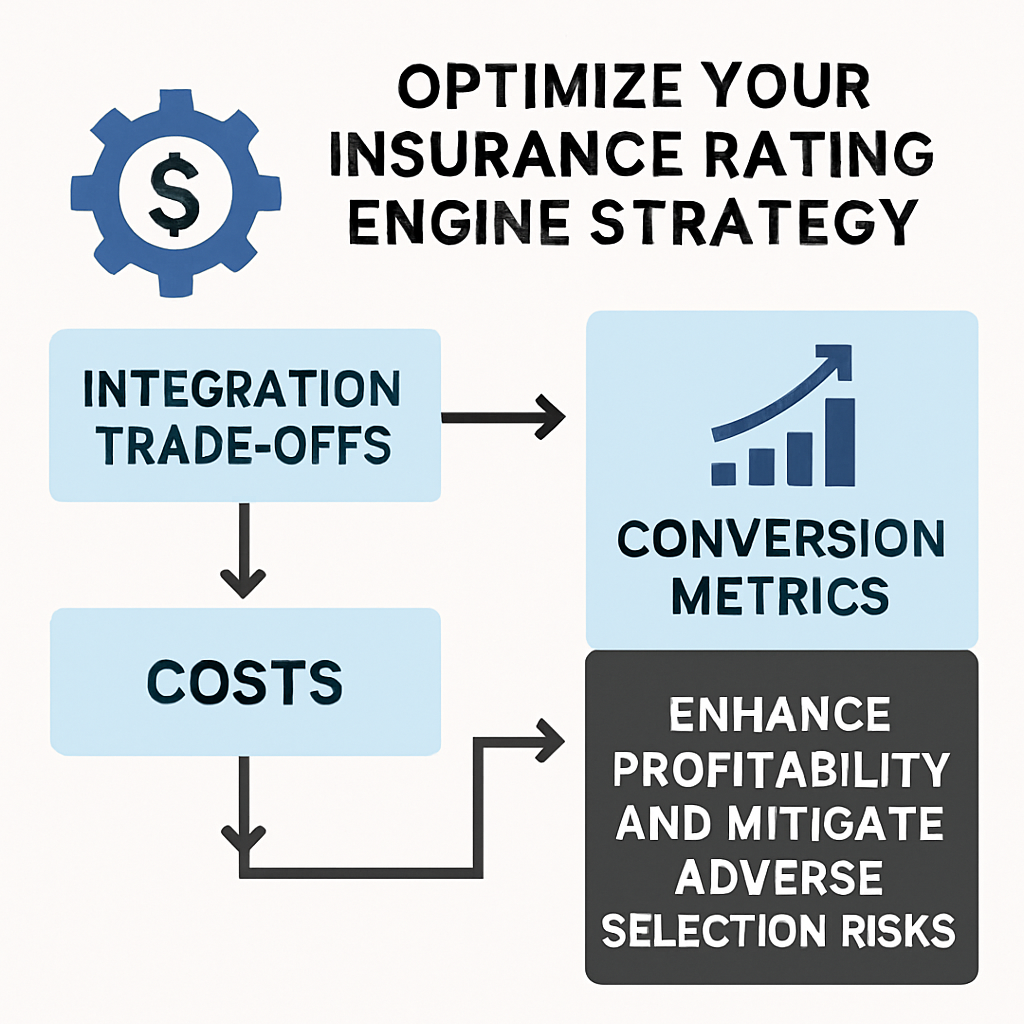

Comparative rater integration is often treated as a technical initiative, but in practice it is a strategic distribution decision with direct impact on cost, conversion, and profitability. While API connectivity and system integration are necessary, the real challenges lie in determining how deeply to integrate, which data to pull at each stage, and how to manage exposure to rater sourced business.

Success requires understanding your business goals (market share growth, specific segment penetration, brand visibility), the hidden costs at each integration level, and the risks of adverse selection or “spreadsheeting.

Carriers must determine how far they want to go in the process of presenting rates on other platforms. Most commercial products are sent to an underwriter for quoting. Personal lines products tend to have more automation in the process.

In general, the rate process is defined by three steps: Rate Call 1, Rate Call 2 and Bind call.

Determining how far to go in the process is not a simple task and depends on the product, the channel and your business goals.

You generally want to consider the following questions in determining how to present rates in a comparison environment:

The further you go in the rate call process, the greater the cost per quote but the higher potential conversion. Many carriers stop at Rate Call 1 or 2 to control costs, but this creates friction in the agent/customer journey. Rates are either not completely accurate or customers must leave the rating platform to complete binding.

Each step has pros and cons:

Stopping at Rate Call 1: Lower cost per quote, but lower conversion

Stopping at Rate Call 2: Higher cost per quote, better conversion

Full Rate Call 1 to Bind Call: Highest cost, highest potential conversion rate

Critical Metrics to Track:

It’s important to understand costs relative to yield and conversion early in the process. If the conversion rate improvement doesn't offset the data costs, deeper integration doesn't make financial sense.

In addition to the costs and associated conversion metrics carriers must also protect against adverse selection. When a carrier's rates are displayed amongst their competitors, customers and agents will find “holes” in their underwriting and rate plans. This may lead to a higher mix of business for which the carrier is not properly priced.

To protect against adverse selection is important to consider the following steps:

It is very important to understand the rater rules and have complete transparency into their logic. Ask the following questions when evaluating rater or platform options:

Rating engines and comparative platforms can be a very valuable and critical part of a carrier distribution strategy. Many teams often get the implementation setup and focus on the APIs initially. It’s equally important to have the financial target and reporting setup on day 1 to ensure success!!

These decisions must be approached thoughtfully, with a clear view of the trade-offs involved.

At Radity, we work with insurance carriers and MGAs to design and execute these strategies across rating engines, comparative raters, and core platforms. Handled well, these decisions can boost the profitability of a book of business; handled poorly, they create structural headwinds that are difficult to unwind.

About Radity: Radity accelerates digital transformation for P&C insurers, MGAs, and embedded insurance players. With deep expertise in both commercial and personal lines, Radity combines Swiss engineering precision with scalable modern tech. The company enables faster go-to-market for new products and channels, while delivering seamless user experiences. Radity is ISO 27001 and SOC 2 certified and serves clients across North America and Europe. Learn more at www.radity.com.

5 min read

The Financial GPS for Insurance Agencies – Double Entry Accounting by Crystal Temple The advent of double entry bookkeeping is one of the most...

1 min read

Hey #Insurance – Ep 50 – My Advice to “Lost” Insurance Agents by Antonio Canas Insurance</span> - Ep 50 - My Advice to “Lost”...

3 min read

Understanding the Insurance Agency by Ryan Deeds This article originally published on InsNerds.com Understanding the insurance agency. Let’s...