This is the second in a multi-part series on the effects of the ongoing legalization of marijuana in the worker’s compensation insurance ecosystem. In case you missed it here’s part one. This series is being ran in preparation for a panel on “Legalization of Marijuana and the Impaired Workforce” that the author is moderating at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp. Insurance Nerds readers can save 0 on registering for AmComp with discount code AMCOMPNERDS.

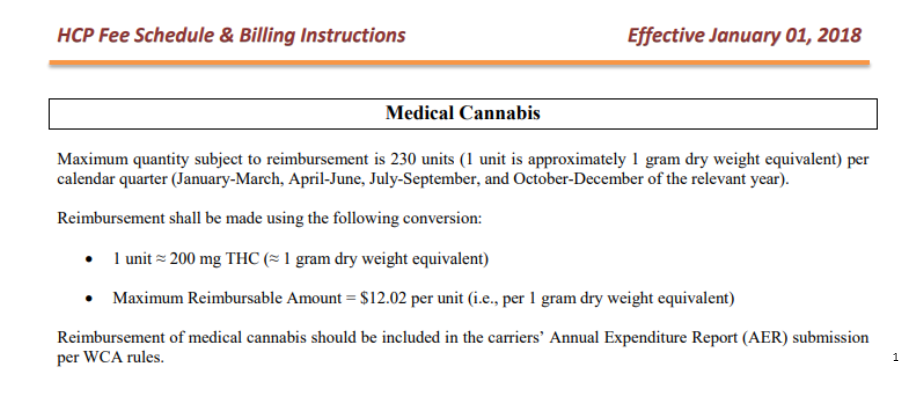

For the states that have addressed, or are planning to review, whether marijuana should be covered for injured workers, the next logical step is to define reimbursement amounts to claimants through a fee schedule. As long as the cannabis industry remains a cash-only business, submitting out-of-pocket expenses is the only current method of providing payment. New Mexico, beginning in 2016, was the first state to address the dollar reimbursement amount for marijuana. The landmark case of Vialpando v. Ben’s Automotive Services propelled the state to create a precedent on what constitutes a fair and suitable reimbursement for medical marijuana. Since 2016 the reimbursement rate has been set at $12.02 per unit (approximately 1 gram of dry flower), up to a maximum of 230 units per calendar quarter. The State of New Mexico’s Workers’ Compensation Administration has not changed the reimbursement rate and remains the same for the 2018 Health Care Provider Fee Schedule.

Local rates in Albuquerque as of July 2018, per Leafly, were $13.14 per gram; not far from the going market rate. However, the issue is that fee schedules may need to account for the complexities and strain varieties of marijuana. Prices vary widely across marijuana varieties and products. There are certainly varieties above the median price. Rates also fluctuate considerably in markets subject due to pure economic conditions, such as supply and demand. At present, most medical patients are not subject to state and municipal taxes attached to recreational pot. Should the allowable reimbursement rate for a low-grade, inexpensive strain, used to treat migraines, be reimbursed at the same rate as a more potent, expensive strain, used to help alleviate severe neuropathic pain fibromyalgia or complex regional pain syndrome? For example, the reimbursement rate for products with a THC, or CBD level, below a predetermined threshold may be reimbursed at $12.02, while those with higher potencies are reimbursed at a higher rate of $17.02 per gram. Prices in the cannabis market are likely to shift as the market matures. Keeping a close watch on prices will be imperative. States may also want to consider prices according to average wholesale prices (AWP), similar to pharmaceuticals. Many states have placed a maximum on the amount reimbursable to a prescription drug vendor. While pharmaceutical manufacturers’ often have patents or are the sole manufacturer of a single type of medication, this is not the case with cannabis. Many marijuana growers are all growing the same product, and it may be difficult to determine the AWP across an individual state (which is the price charged to local dispensaries). However, in time, there may be some opportunity to implement a similar system.

Additionally, states will need to decide what other forms of THC/CBD products may be covered for use such as wax, concentrates, oils and synthetics and address those reimbursement rates as well. Under New York’s Compassionate Care Act, the flower form of marijuana is not even an option for patients. Patients must opt for alternative forms of the drug.

Moreover, not all states have fee schedules, which only makes reasonable reimbursement more difficult. The National Council on Compensation Insurance (NCCI) found prescriptions in low-fee schedule states were significantly lower than prices paid for prescriptions in states where a fee schedule did not exist. States that do not adopt reimbursement rates may ultimately need to reimburse the claimant for out of pocket costs at retail prices. Without a set reimbursement rate or fee schedule, unchecked reimbursements to claimants will lead to complications and confusion for insurers, and create unpredictability in costs. For states that have legalized medical marijuana, not all have passed applicable legislation to address carrier’s obligation to provide reimbursement. These statutes are essential to provide direction and guidance to claimants and insurers. Instead, they have left the decision-making up the workers’ compensation administrative courts to answer whether or not medical marijuana is a covered benefit under the workers’ compensation system.

Brian Reardon is a Board Member of AmComp and AVP, WC Claims for Maiden Reinsurance. He will be moderating the upcoming panel session on “Legalization of Marijuana and the Impaired Workforce” at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp. Insurance Nerds readers can save 0 on registering for AmComp with discount code AMCOMPNERDS.

About Brian Reardon MBA,ARM,AIS

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.