2 min read

#InsuranceRocks – Let’s Start a Movement in 2016!

#InsuranceRocks – Let’s Start a Movement in 2016! by Antonio Canas This is our updated 2016 version of this post, just in time for the Insurance

2 min read

Fritz Merizon

:

Jun 22, 2025 11:45:18 AM

Fritz Merizon

:

Jun 22, 2025 11:45:18 AM

At this year’s The Future of Insurance USA 2025 in Chicago, the message was clear: insurance is undergoing a fundamental transformation.

All attendees recognized the change our industry is experiencing, so the sessions focused on what insurers need to do to adapt. With AI adoption accelerating and digital transformation redefining traditional models, the industry has reached an inflection point. Known for typically lagging in innovation, the insurance sector received a strong message: carriers that move decisively toward smarter, more agile operations will define the next decade.

AI took center stage, not as a distant vision but as a practical tool already reshaping core functions. In sessions like “AI Transition: Address Fear & Uncertainty Headfirst,” speakers - including carrier and broker executives, along with consultants - emphasized the need to move past hesitation and drive change at scale. Claims management is proving to be a clear-cut use case, emphasized in “Reimagining Claims: From Manual Headaches to Intelligent Automation,” where panelists showed how AI is cutting cycle times and reducing errors. We saw some of this automation in action during live demos, including weav.ai’s underwriting agents, which showcased how intelligent automation is already being deployed in live environments.

A recurring theme was the internal resistance many organizations face when implementing AI. Change management strategies such as celebrating early wins and providing transparency around new tools were key takeaways.

Beyond traditional automation, there’s a clear shift toward more intelligent, adaptive systems. Discussions around agentic AI, tools capable of autonomous decision-making, revealed how insurers are beginning to move from static workflows to dynamic, problem-solving architectures with an emphasis on automation.

On the digital transformation front, agility was the dominant theme. Sessions like “Embrace Agility” and “Put Trust Back into the Heart of Insurance” reinforced the value of flexible, iterative operating models. Carriers are now building hybrid workforces, implementing orchestration tools, and restructuring teams to move faster and respond more effectively to change. Coupled with this was a strong push toward customer-centric innovation by leveraging data and AI to design personalized products, improve service delivery, and foster stronger customer engagement. Carriers also emphasized the importance of a partnerships strategy to work with peers who can deliver customer-facing tech they may not be able to build alone.

Something all the executives in the room acknowledged: none of this happens without talent. Many speakers highlighted the growing urgency of digital skill development. From building pipelines through career partnerships to re-skilling existing teams, it’s clear the industry must prioritize talent as much as technology.

The Future of Insurance conference painted a picture of an industry in active transition, moving from legacy systems and siloed processes to integrated, intelligent ecosystems. Insurers must modernize quickly but responsibly, ensuring customers and employees stay at the center of these changes.

2 min read

#InsuranceRocks – Let’s Start a Movement in 2016! by Antonio Canas This is our updated 2016 version of this post, just in time for the Insurance

1 min read

The Nerds Appeared on Spot On Insurance by Antonio Canas Your favorite Insurance Nerds made a special appearance on the Spot On Insurance...

3 min read

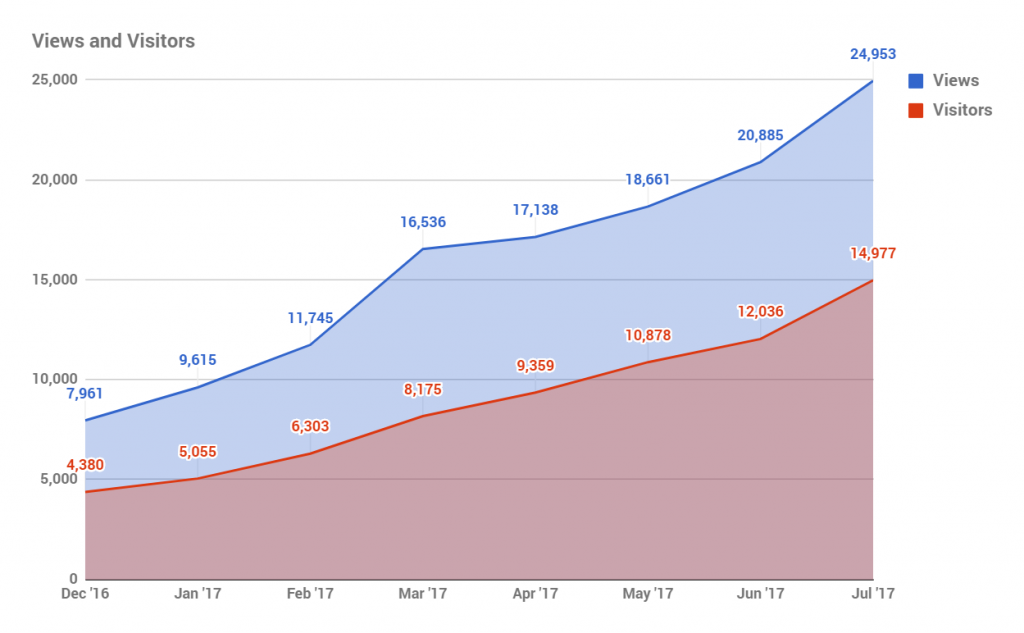

Advertise on InsNerds – We are Growing FAST! by Antonio Canas InsNerds is completely unique. No other publication is dedicated to helping ...