3 min read

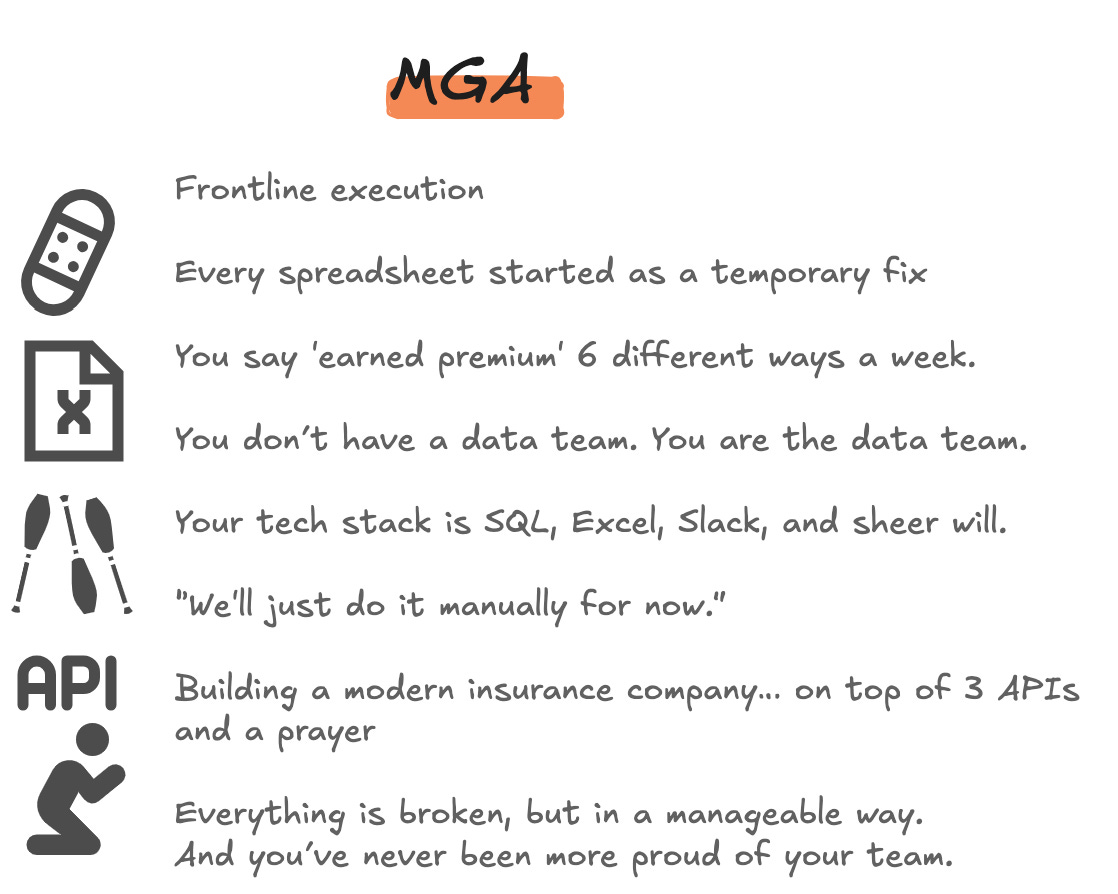

Profiles in Risk: E453 – Eliminating Manual Spreadsheet Reporting For MGA and Delegated Authority Business; Dave Connors, Co-Founder and CEO at DistriBind

Profiles in Risk: E453 – Eliminating Manual Spreadsheet Reporting For MGA and Delegated Authority Business; Dave Connors, Co-Founder and CEO at...

Michelle Bothe

Michelle Bothe

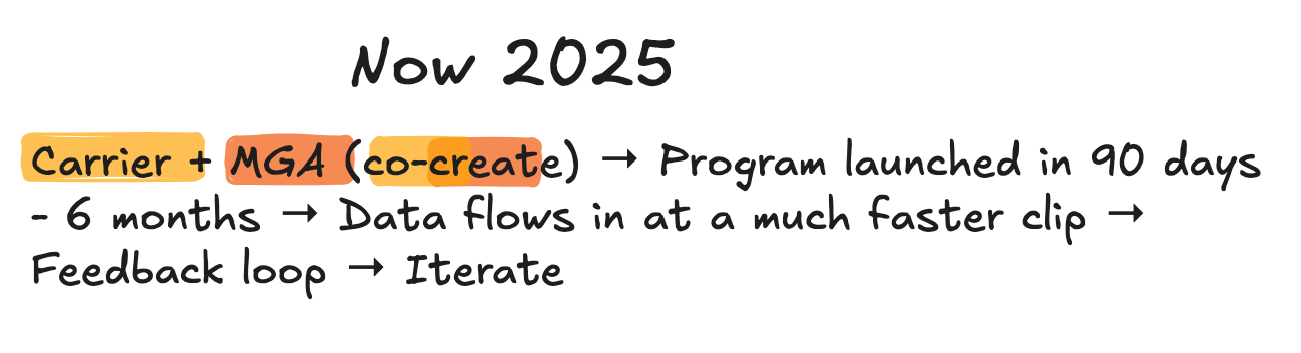

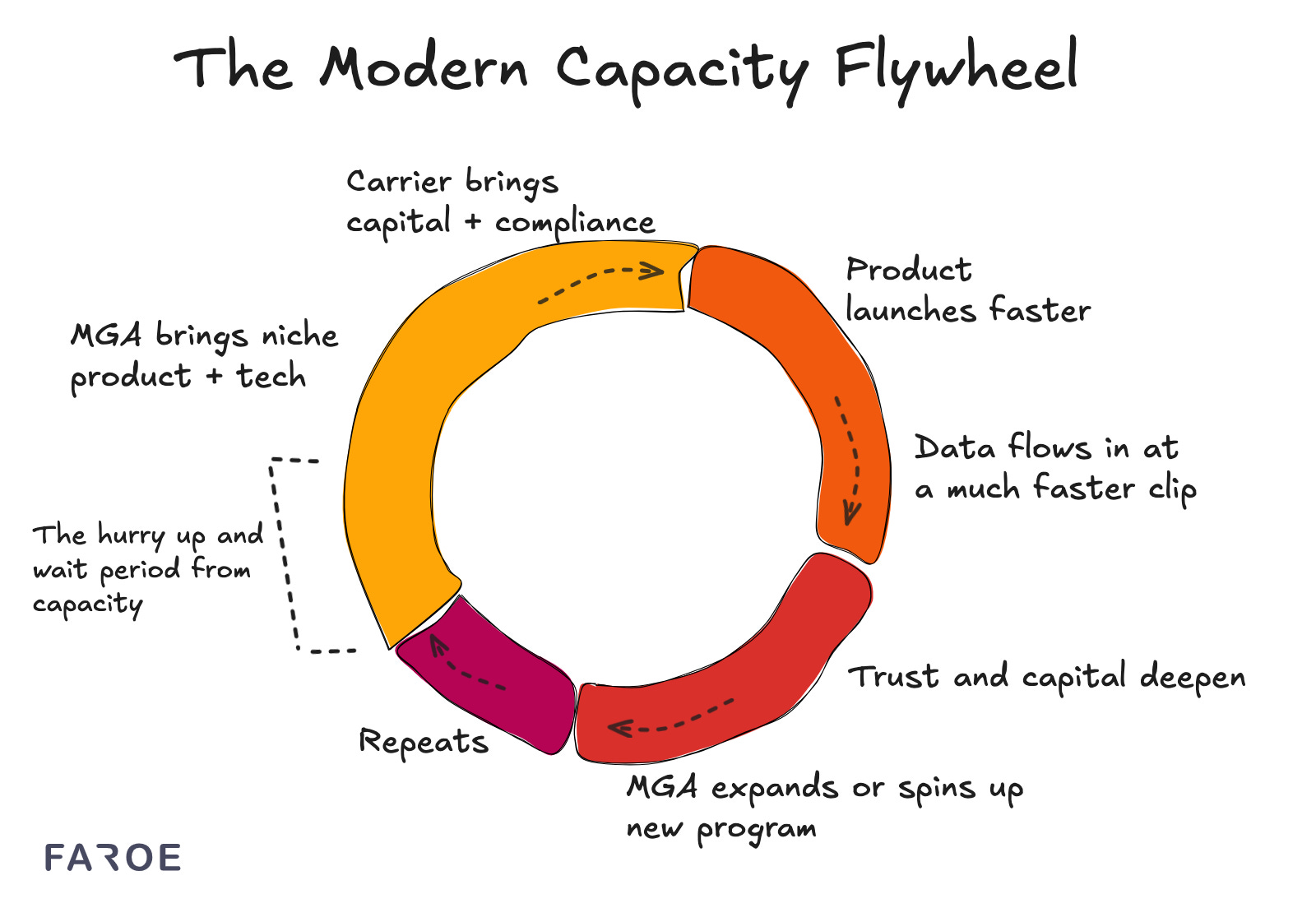

We’re in the early innings of what I call “The MGA Reformation.”

We’re in the early innings of what I call “The MGA Reformation.”