4 min read

Risks Emerge and Competition Increases in Underwriting Markets Where Stakes are High

Risks Emerge and Competition Increases in Underwriting Markets Where Stakes are High by Larry Nicholson Complex challenges, emerging risks,...

3 min read

.jpg) Nicholas Lamparelli

:

Jan 16, 2026 7:52:38 AM

Nicholas Lamparelli

:

Jan 16, 2026 7:52:38 AM

Program underwriting, particularly within Managing General Agents (MGAs) and wholesale insurance operations, a subtle but profound shift is occurring.

Underwriting judgment, the core discipline assessing whether a risk should be accepted, has quietly ceded ground to routing logic, where the primary focus becomes identifying which carrier will accept a risk rather than whether the risk is appropriate to write. This transition happens incrementally and often goes unnoticed until its cumulative impact surfaces in portfolio performance and carrier relationships.

This phenomenon is especially relevant for insurance professionals operating in multi-carrier, multi-capacity frameworks. While the addition of carriers creates valuable optionality and growth opportunities, it also reshapes underwriting behavior, incentives, and ultimately risk selection criteria. Understanding this dynamic is critical for underwriters, agents, and insurance leaders seeking to preserve underwriting integrity while scaling operations.

The transition from underwriting judgment to routing logic in multi-carrier environments is a natural consequence of scaling but carries significant risks for portfolio quality and organizational coherence. Insurance professionals must recognize this shift proactively rather than reactively to emerging performance issues. Maintaining a disciplined risk thesis, reinforcing underwriting judgment, and aligning incentives with quality outcomes are critical steps for sustaining underwriting excellence.

Leaders in MGAs and wholesale operations should implement governance structures that preserve the primacy of risk evaluation, even as routing expertise remains essential for efficient placement. By balancing these dual competencies, insurance organizations can leverage multi-capacity growth opportunities without compromising underwriting integrity.

Original Source: https://faroeio.substack.com/p/when-underwriting-judgment-quietly

4 min read

Risks Emerge and Competition Increases in Underwriting Markets Where Stakes are High by Larry Nicholson Complex challenges, emerging risks,...

1 min read

Hey #Insurance – Ep 116 – I don’t feel like an underwriter… by Antonio Canas We have call centerized some “underwriting” roles so much,...

2 min read

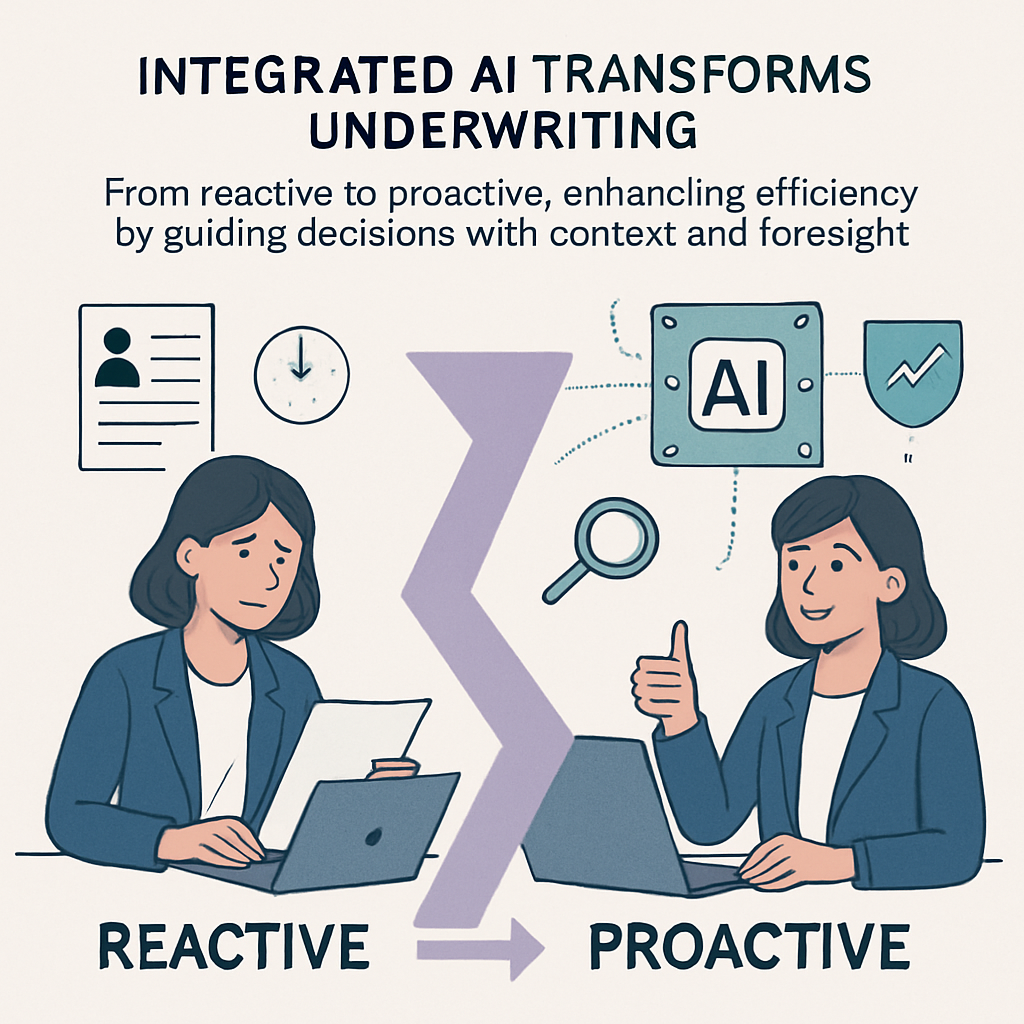

Efficiency Isn’t Just About Speed Underwriting has always been about making decisions under pressure. Faster quotes. Quicker responses to brokers....