On July 4th, 1776, a remarkable startup was born.

Dubbed the United States of America, this fledgling entity struggled in a world dominated by established powers. Much like any new business venture, the USA had to fight—quite literally—to establish its place. Once it found its footing, the next challenge was determining how to survive and thrive amidst formidable competitors.

Dubbed the United States of America, this fledgling entity struggled in a world dominated by established powers. Much like any new business venture, the USA had to fight—quite literally—to establish its place. Once it found its footing, the next challenge was determining how to survive and thrive amidst formidable competitors.

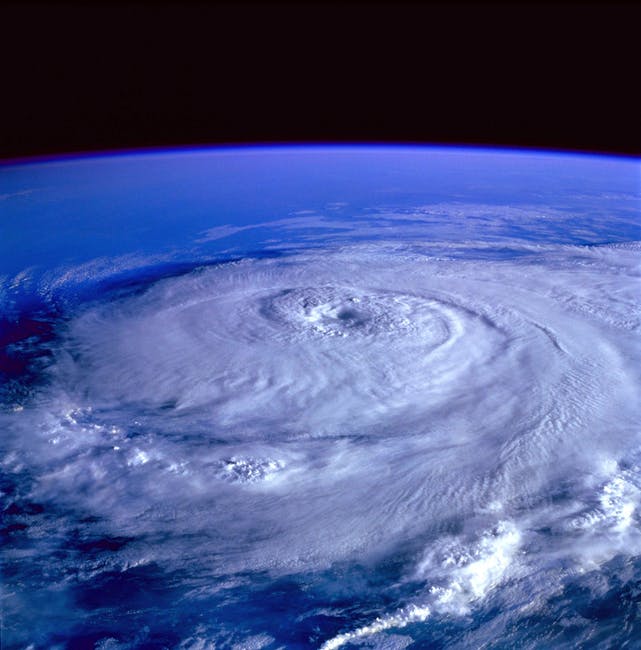

The parallels between the early USA and a modern startup insurer or managing general agency (MGA) are striking. As soon as you gain some traction, you face an immediate exposure management problem. For the USA, the exposure was not just financial but existential. Surrounded to the North by the British Empire (which they just fought against for several years), to the West by the French Empire, and to the South and Southwest by the Spanish Empire, the USA had to navigate an unstable geopolitical landscape.

Exposure Management: A Critical Skill

Great exposure management involves understanding your vulnerabilities and avoiding unforeseen aggregate exposures. For the fledgling USA, aggregate exposure meant potential recurring conflicts with both the French and Spanish Empires. Another critical exposure was securing essential resources like food and water. The lakes, rivers, and plains controlled by the French and Spanish offered a threat and a possible lifeline.

Expanding Horizons: The Need for Growth

Much like a startup that needs to scale to survive, the USA needed to expand. The first significant step was incorporating Ohio as the 14th state. This move was more than just adding territory; it was about securing a buffer zone against encroaching threats.

The Louisiana Purchase was another monumental step in this expansion strategy. Acquired from France in 1803, this vast tract of land guaranteed wider protection from conflict, especially with the French. It also provided access to massive farmable land and freshwater resources. Perhaps most importantly, however, it offered one of the best navigable river systems in the world—the “Mighty” Mississippi—which was crucial for transporting goods and ensuring economic stability.

Lessons for Modern Insurance Startups

The story of the early USA provides valuable lessons for modern insurance-focused startups:

1. Understand Your Exposure: Identify your vulnerabilities and take steps to mitigate them. This could mean diversifying your product offerings and geographic distribution or securing key partnerships.

2. Expand Strategically: Growth should not be for growth’s sake. Each expansion should serve a strategic purpose, whether it’s establishing a model for future growth, entering new markets, or acquiring assets that provide long-term benefits.

3. Secure Essential Resources: Just as the USA needed access to food and water, modern startups need capital, talent, and technology. The talent and technology will identify your aggregate exposures, define ways to optimize your capita for use against that aggregate exposure and help minimize your tail risks.

4. Navigate Competitive Landscapes: Be aware of your competitors and understand their strengths and weaknesses. Use this knowledge to carve out your exposure and niche.

Summary

The five-year survival rate for startups across all industries is less than 50 percent. The experiment that grew into the United States of America would always be a precarious venture surrounded by powerful incumbents. Through strategic expansion and effective exposure management, it has not only survived but thrived. Modern startups can draw inspiration from this historical example to navigate their own challenges and achieve lasting success.

In essence, whether you’re founding a nation or a business, the principles of strategic growth, exposure management, and competitive awareness remain timeless.

Happy Independence Day to you all!

About Peter Crowe

Peter Crowe began his career in technology consulting, which led him to many cities, companies, and even a few countries doing system implementations, upgrades, and conversions. A tech project he worked on led to an opportunity at RE/MAX, a real estate franchise company. Pete joined RE/MAX in 2013 and while there, served in various capacities including Vice President of Investor and Public Relations, Sr. Vice President of Marketing, Communications, and Investor Relations, and Executive Vice President of Business and Product Strategy. Pete joined We Insure, a PEAK6 InsurTech company, in September 2019, where he served in the roles of Chief Revenue Officer and Service Operations lead. In these roles, Pete partnered with leadership and the We Insure team to help make We Insure an unstoppable force in the insurance industry. Through strong strategies and partnerships, Pete was able to assist in the expansion of We Insure into 25 new states, growing the agency footprint from 90 to 190 offices in just over two years. In 2021, Pete shifted to the role of Executive Vice President of Team Focus Insurance Group, another PEAK6 InsurTech company, and has served as President of Team Focus for two years. Pete holds a Bachelor of Business Administration from Indiana University, and an MBA from the University of Denver – Daniels College of Business.

Peter Crowe began his career in technology consulting, which led him to many cities, companies, and even a few countries doing system implementations, upgrades, and conversions. A tech project he worked on led to an opportunity at RE/MAX, a real estate franchise company. Pete joined RE/MAX in 2013 and while there, served in various capacities including Vice President of Investor and Public Relations, Sr. Vice President of Marketing, Communications, and Investor Relations, and Executive Vice President of Business and Product Strategy.

Pete joined We Insure, a PEAK6 InsurTech company, in September 2019, where he served in the roles of Chief Revenue Officer and Service Operations lead. In these roles, Pete partnered with leadership and the We Insure team to help make We Insure an unstoppable force in the insurance industry. Through strong strategies and partnerships, Pete was able to assist in the expansion of We Insure into 25 new states, growing the agency footprint from 90 to 190 offices in just over two years.

In 2021, Pete shifted to the role of Executive Vice President of Team Focus Insurance Group, another PEAK6 InsurTech company, and has served as President of Team Focus for two years.

Pete holds a Bachelor of Business Administration from Indiana University, and an MBA from the University of Denver – Daniels College of Business.