4 min read

Greatest lesson from the “worst” feedback

Greatest lesson from the “worst” feedback by Alicia Gross I learned a great lesson with feedback early on in my career that I have carried with...

1 min read

.jpeg) Rock Schindler

:

Feb 27, 2025 12:12:19 PM

Rock Schindler

:

Feb 27, 2025 12:12:19 PM

Every claim leader faces a fundamental challenge: Should they invest in improving the system—the machine—or developing their people? In an industry increasingly driven by automation and AI, it’s tempting to lean into technology as the answer. But is it the highest ROI on claim outcomes and loss costs?

A recent analysis conducted by SDRefinery AI delivered a stark realization for one of our clients: The top-performing adjusters were consistently executing critical, time-sensitive actions that their peers were missing. This revelation, while valuable, underscored a dilemma that claim leaders face daily—where should they focus their efforts?

It’s easy to see the appeal of feeding the machine. With a few clicks, any number of AI-powered vendors can step in and automate the gap left by underperforming adjusters. These technologies promise efficiency, consistency, and scalability—attributes that any claim operation would find attractive.

Automating these missing actions ensures that claims are processed with speed and accuracy, reducing cycle times and mitigating unnecessary costs. But here’s the catch: Every time a claim leader chooses to invest in technology, they must engage IT resources, account for nuances and complexities in the system, and navigate implementation challenges that can slow progress.

Moreover, when the machine takes over, adjusters lose the opportunity to develop critical decision-making skills. This can create a reliance on automation that masks deeper issues within the claims process.

On the other hand, feeding the people—providing claim professionals with objective insights to enhance their decision-making—offers a different kind of return. When adjusters receive clear, actionable feedback on how their actions (or inactions) impact claim outcomes, they can quickly adapt and improve.

This approach taps into the power of behavioral change. Unlike automation, which simply corrects deficiencies behind the scenes, equipping adjusters to make faster, better decisions improves their expertise, creates better judgment, and elevates the overall performance of the claims organization.

In many ways, claim leaders have been forced to starve their teams of this essential feedback. Traditional training methods are often generic, retrospective, or disconnected from real-time performance data. Without clear, objective measures of what top performers do differently, adjusters lack the guidance needed to refine their skills and improve outcomes.

Make no mistake—both the machine and the people must be fed. The challenge lies in knowing when and how to invest in each. While automation can drive efficiency, it should not come at the cost of adjuster development. Conversely, focusing exclusively on training without leveraging AI’s potential can leave claim operations lagging behind competitors who embrace digital transformation.

4 min read

Greatest lesson from the “worst” feedback by Alicia Gross I learned a great lesson with feedback early on in my career that I have carried with...

4 min read

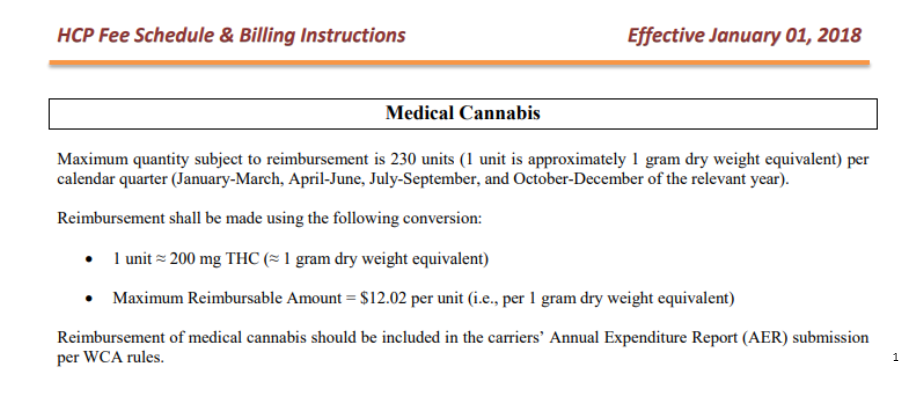

Worker’s Compensation and Marijuana Part 2: Do more states need to adopt a fee schedule or reimbursement rates for marijuana? by Brian Reardon...

3 min read

WC and Marijuana Legalization Part 8: What impacts will state or federal legalization have on Medicare-set-Asides? by Brian Reardon MBA,ARM,AIS