4 min read

A Deeper Dive into Medical Cost Rising for Lost-Time Claims

A Deeper Dive into Medical Cost Rising for Lost-Time Claims by Richard Krasner A Deeper Dive into Medical Cost Rising for Lost-Time Claims It...

3 min read

.jpg) Nicholas Lamparelli

:

Jan 14, 2026 1:55:31 PM

Nicholas Lamparelli

:

Jan 14, 2026 1:55:31 PM

The landscape of workplace safety is rapidly evolving with the integration of advanced technologies that directly impact Workers’ Compensation outcomes. Innovations such as smart personal protective equipment (PPE), intelligent camera systems, and wearable devices are demonstrating measurable success in reducing injury frequency and severity. For insurance professionals, these technological advancements offer promising avenues to mitigate risk, improve underwriting accuracy, and foster safer insured workplaces, ultimately leading to lower claims and loss costs.

A recent pilot program highlighted by Gen Re illustrates how smart cameras on construction sites led to a 50% reduction in claims frequency, alongside notable declines in severe injuries and fatalities. Similarly, wearable safety devices have helped manufacturers achieve a 62% decrease in injury rates and nearly a 50% drop in claim costs over a year. These examples underscore the transformative potential of tech-enabled safety measures across high-risk industries such as construction, manufacturing, oil and gas, warehousing, and agriculture. Understanding and incorporating these technologies is crucial for insurance carriers, agents, and underwriters aiming to optimize Workers’ Compensation portfolios and support policyholders in risk mitigation.

The integration of smart safety technologies represents a paradigm shift in how workplace hazards are managed and Workers’ Compensation risks controlled. Insurance professionals must become conversant with these innovations to guide underwriting decisions, develop effective loss control programs, and support insureds in reducing workplace injuries. Proactive collaboration with technology vendors and policyholders can create a mutually beneficial environment where safer workplaces translate to fewer claims and lower costs.

It is advisable for insurance carriers and agents to:

By embracing these technological tools, the insurance industry can play a pivotal role in advancing workplace safety and achieving sustainable reductions in Workers’ Compensation losses.

For a comprehensive overview of these trends and case studies, readers are encouraged to consult the original article from Gen Re titled "Using Technology to Cut Workers’ Compensation Costs," available at https://www.genre.com/us/knowledge/publications/2026/january/using-technology-to-cut-workers-compensation-costs-en?utm_campaign=Subscription%20Management%20Center&utm_medium=email&_hsenc=p2ANqtz--dEpvnSgyH0D3YxLPhXT7YaRpvDElV_BOj80sU9vgl_JDzq6p5uCS2Y08yqG5h0LUzfCc6vIH4CXvp_iuQOWprqwpOLQ&_hsmi=398470044&utm_content=398470044&utm_source=hs_email.

4 min read

A Deeper Dive into Medical Cost Rising for Lost-Time Claims by Richard Krasner A Deeper Dive into Medical Cost Rising for Lost-Time Claims It...

4 min read

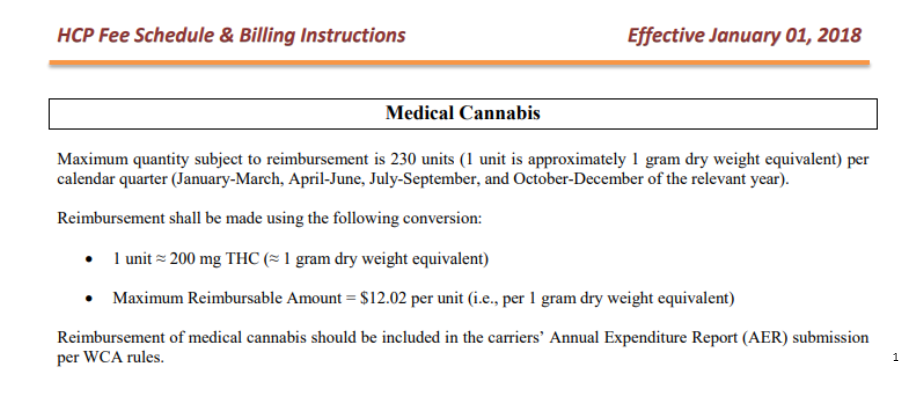

Worker’s Compensation and Marijuana Part 2: Do more states need to adopt a fee schedule or reimbursement rates for marijuana? by Brian Reardon...

4 min read

WorkComp and Marijuana Part 5: What opportunities exist to create beneficial relationships between the workers’ compensation and marijuana...