Like a lot of students in college, I didn’t really know what I wanted to do when I graduated. I liked marketing, but I did not want to go into sales directly out of school. I had tons of student loans and I needed a steady income to pay them back. One day, I decided to check out a career fair that Pittsburg State was offering on campus. There were companies there from various industries. I handed out my resume like Halloween candy and kept my fingers crossed for a call back. When it was all said and done, I heard from two different insurance carriers and a couple of different agents wanting to interview me. I didn’t hear back from any other industry except for insurance. Ironically, both of my parents had gone to work for independent adjusting companies when hurricane Katrina hit, but they never pushed me towards insurance. I went to all four of the interviews, and I received four different offers. I decided to go with the offer that was only 50 miles from my hometown; it had a steady salary and benefits.

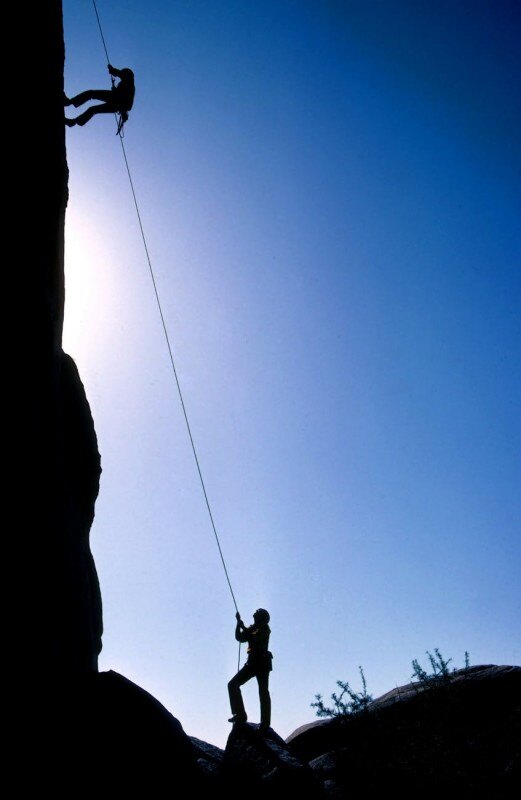

I really didn’t know what I was getting into when I became a fire claim representative (what the rest of the industry calls property claims) in 2012. I went through extensive training and learned the various policies and procedures. I picked up the role very quickly, and I was able to thoroughly and quickly complete my file work while naturally assisting those around me. I had some opportunities to do some developmental work in the field, but climbing roofs was not exactly my cup of tea. Not long into the job, my leader asked me if I would ever be interested in a leadership role. I thought to myself, “ME?!? In a leadership role??” I really hadn’t ever given it any thought. I was pretty quiet, and I just thought that I was doing what I was supposed to do. She said, “well, you have been identified as having leadership potential and I think it would really benefit you if you started taking these industry-specific courses.”

I had heard so many horror stories about how so many people struggled to pass these tests and how much work that had to go into them, so I was very apprehensive at first. I finally said, “fine, I will start with these designations with fewer parts, and I will see how it goes, and MAYBE I will get my CPCU.” I started by taking the courses for AIC, and then picked up the AINS designation after that. By this time, I had set some goals to obtain my CPCU before I turned 26, and I would get to attend the annual conference in Honolulu, Hawaii! I was taking one course per quarter, and two courses in some quarters. I spent several hours after work studying the books, listening to Big Daddy University lectures, and missing time with my family (there was a time or two I took my books out on the family boat, but that really didn’t work out very well). For the AIC and AINS tests, I only used The Institutes online study quizzes and I read the books cover to cover. For the CPCU tests, I used both Big Daddy and The Institutes’ online quizzes.

Fast forward…I passed all of the CPCU tests on the first try, except CPCU540. I put this one off until the last test because I knew if I failed in the middle of the series, I may not have kept going. I probably studied twice as long for this one and was passing all of the practice quizzes with 90-100%. I was so confident walking into the testing room that I had already spent the designation bonus (big mistake, but man, I love those boots). When I saw the “Non-Pass” screen, I was devastated. My birthday was less than a week away and there weren’t any slots to retake the test that week. The earliest slot was the day after my birthday. Feeling bummed that I wasn’t going to reach one of my goals, I was still determined to make it to Hawaii. I studied for several hours a night that week, and went in and crushed the final test! After completing CPCU, I continued to take different courses through The Institutes. I now hold the AIC-M, AINS, AIS, and API designations. I am currently working on obtaining the ARM to learn more about the risk management side of the business.

College came very easy for me and I never really had to study. CPCU was a different story, and it challenged me in many personal and professional ways. It has helped me grow as a leader and as an insurance professional. The biggest bonus: I have met so many awesome people along the way!

If you are on your journey to obtaining the CPCU designation, or any other designations, please feel free to reach out to me!

About Aslea Bearden

Ashlea is Currently a Claims Support Supervisor at State Farm in Tulsa, Oklahoma. She has been developing and coaching a team of 10-13 employees for the past 3 years. Ashlea is looking for a new role in the Tulsa area because the Tulsa Operations Center is scheduled to close in 2019. Ashlea is a passionate insurance professional that has extensive knowlege of the overall industry . She began her career with State Farm in 2012, as a Homeowners Adjuster. She then was selected for a Leadership Development Role supervising a team of 10. After her temporary role ended, she expanded her knowledge base in Auto Injury Claims. She excels at time management, collaborating with others, data analysis, and process improvements. She has obtained 6 different insurance designations, and has served on many different boards for Women's Networking Group, Young Business Professionals, and most recently she served as the NEOK CPCU Vice President for the 2017 year, and has chosen to remain on the board as a Member At Large for 2018. Ashlea holds herself to a very high standard, and expects the same out of the people she leads. She has experience in leading multiple projects; specifically business continuity planning, employee engagement, and diversity and inclusion efforts across the department. Ashlea enjoys mentoring and effectively coaching others to help reach their career goals, and she shares her experiences along the way. Ashlea has a strong reputation for utilizing different strategies to achieve individualized goals for employees of all backgrounds and tenures. She is proactive in identifying gaps in workflows and processes, and she communicates effectively with business partners to find resolutions. Ashlea has a positive attitude, and influences others to do the same.

Ashlea is Currently a Claims Support Supervisor at State Farm in Tulsa, Oklahoma. She has been developing and coaching a team of 10-13 employees for the past 3 years. Ashlea is looking for a new role in the Tulsa area because the Tulsa Operations Center is scheduled to close in 2019.

Ashlea is a passionate insurance professional that has extensive knowlege of the overall industry . She began her career with State Farm in 2012, as a Homeowners Adjuster. She then was selected for a Leadership Development Role supervising a team of 10. After her temporary role ended, she expanded her knowledge base in Auto Injury Claims. She excels at time management, collaborating with others, data analysis, and process improvements. She has obtained 6 different insurance designations, and has served on many different boards for Women's Networking Group, Young Business Professionals, and most recently she served as the NEOK CPCU Vice President for the 2017 year, and has chosen to remain on the board as a Member At Large for 2018.

Ashlea holds herself to a very high standard, and expects the same out of the people she leads. She has experience in leading multiple projects; specifically business continuity planning, employee engagement, and diversity and inclusion efforts across the department.

Ashlea enjoys mentoring and effectively coaching others to help reach their career goals, and she shares her experiences along the way. Ashlea has a strong reputation for utilizing different strategies to achieve individualized goals for employees of all backgrounds and tenures.

She is proactive in identifying gaps in workflows and processes, and she communicates effectively with business partners to find resolutions. Ashlea has a positive attitude, and influences others to do the same.