This article was originally published on InsNerds.com

The title of this article comes from a post, on LinkedIn from Matteo Carbone who is undoubtedly an insurtech thought leader. The question being asked is are we at a point where insurance can be “turned-on” when needed and “turned-off” when not needed? Why do policyholders need to have coverage 24/7 and more importantly, why do they need to pay for that coverage? It’s a good point, which characteristically for posts made by Matteo, got a lot of responses, most of which were supportive of this movement.

I also made a few comments within that post and probably not so surprisingly to you all, I have a much different take on it. I wrote a piece in Coverager late last year where I gave my opinion on why on-demand insurance is such a bad idea. For this article, I’d like to focus on something I think raving fans are forgetting about when considering on-demand coverage: if the technology is good enough for us to offer on-demand coverage, then the technology would also be good enough to allow that same coverage to be turned-on all the time, but to only be charged when the exposure actually manifests. Allow me to explain.

Wind insurance can be very expensive in Florida. That is almost entirely due to hurricanes. No shocker there. In an on-demand world, property owners would buy wind coverage on June 1 and then cancel their policy on November 30 each year. Makes sense right? Why should the property owner pay for wind coverage year round, when nearly all the risk is the 6 months from June to November? The problems with on-demand insurance lie in these facts:

- Insurance buyers are woefully clueless when it comes to low probability risks. They will turn off coverage because they believe their risk is nil. But risk is almost never nil. There is always some residual risk. In my Florida property example above the risk of wind loss from hurricanes, outside of hurricane season is NOT nil! There is risk from rogue hurricanes that form outside of hurricane season AND wind exposure that is NOT tropical. I can imagine the conversation with your significant other now; “hey honey I have good news and bad news. The good news is I saved us a ton on insurance because I cancelled wind coverage outside of hurricane season. The bad news as you can see, is we got hit by a tornado”

- Somehow we are lacking the ability to extrapolate what technology can do, how it can do it and what we as consumer get from it. I think it’s wonderful that we are at a state of technology where new firms like Trov are emerging that will offer (in their words) “Protect just the things you want – exactly when you want – entirely from your phone”. I really like parts 1 & 3 of that statement. I really dislike part 2! My dislike comes from the implied value proposition that there is power in being able to decide for yourself when you insure something. From decades of experience in insurance, trading and just being a people watcher, I feel confident in saying that people will make really bad decisions when it comes to how they handle risk. As an insurance professional with I hope some degree of sophistication in how things should be insured, I just feel like allowing the insured to time their purchases is more burden than power. Besides, if the technology is that awesome that we can turn coverage on or off when the insured feels like the exposure has increased or decreased, then couldn’t the same technology also be used to predictably price the same risk in the same way in a traditional bundled product? In other words, why can’t we just keep the coverage turned on, always, and use this new technology to price the exposure when the risk exists and charge nothing when the risk doesn’t.

Going back to my Florida property example, by buying coverage only during hurricane season, a property owner may think they are smartly timing the coverage for maximum savings, but in fact the premium for a 6-month policy running the hurricane season in Florida would only provide a modicum of savings. Why? Because the modeling that generates the rates is smart enough to distinguish dates and charge a different rate for wind coverage whether the 6-month period is hurricane season or if it is the off-season. This is being penny wise and pound foolish. You may get some savings, but it’s tiny compared to all of the residual risk you just took on. And this goes for not only Florida hurricane insurance but many of these on-demand insuretech companies such as Trov. This is not a criticism but a critique. The technology is fantastic but the solution they are providing is an over-engineered product that is likely to cause more problems than it solves.

My advice is to empower consumers of insurance, protect them better. We can do that by being better product producers. Use technology to make insurance buyers lives easier. Give them more coverage and use technology to make it more economical.

So to answer the question posed by Matteo, should we say goodbye to “time”…yes we should. It just should be done in a simpler and more valuable way.

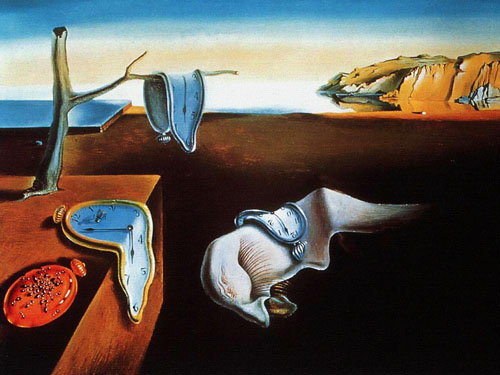

Note from Tony: Melting clocks above are by my very favorite painter (and nutcase) of all time, Salvador Dalí. Fun fact his full name was Salvador Domingo Felipe Jacinto Dalí i Domènech, Marqués de Dalí de Púbol.

About Nicholas Lamparelli

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

.jpg) Nicholas Lamparelli

Nicholas Lamparelli