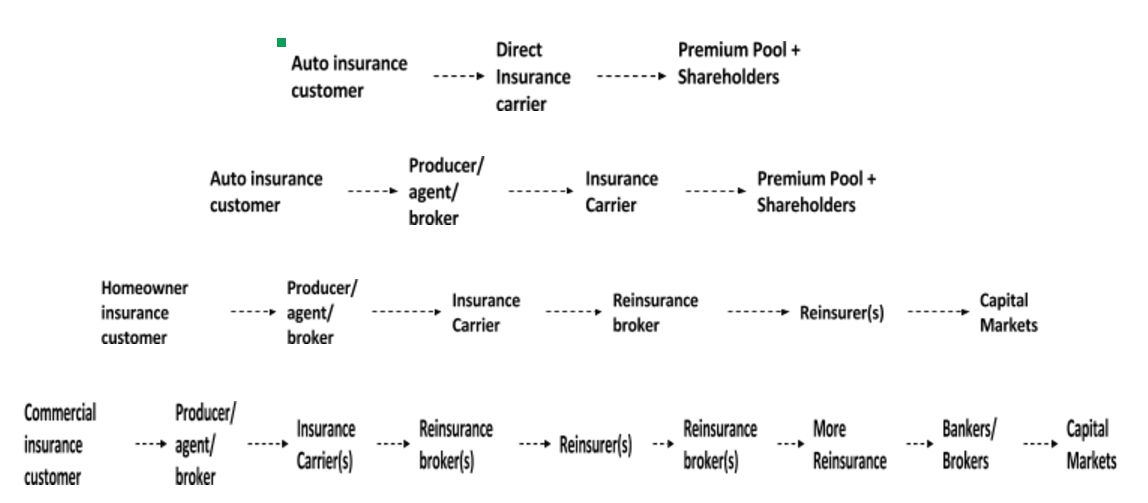

No man is an island – There are many advantages to being an InsurTech intermediary. It’s probably the business structure that has the least amount of regulatory friction, while allowing you to control a book of business. However, a key challenge you’ll face as an intermediary is forging partnerships with partners that will permit your program to thrive. Although we’re classified as a B2B2C structure, you’d technically have to add a few more Bs in there to count all the partners we have to make our business function.

First and foremost, you need to find the right insurance carrier for your program. It’s critical that you find the right cultural fit for your organization. Insurance carriers can vary widely on risk appetite and agent management. Insurance programs have a high initial startup cost for carriers, as they need to allocate scarce underwriting, actuarial, and compliance sources to get a program up and running. Furthermore, they have real dollars at stake for the policies they write. Don’t be surprised if a carrier wants to do more hand-holding for your startup, but know what your boundaries are when it comes to control over your book of business. Pro tip: a reinsurance broker may be able to help you with introductions to the right insurance carriers.

You’ll likely need some other partners along the way to get from concept through the complete policy lifecycle. Unless you want to manually price, underwrite, and issue documents, you’re likely going to need a policy administration system. These are plug-and-play partners that can handle all those functions in addition to the day-to-day policy management of endorsing and cancelling policies. If you’ve decided to focus solely on underwriting, you may decide to assign claims to a third party administrator. This firm would handle the negotiation and payment of claims on behalf of your carrier. If you decide to go this route, you’ll want to hire a firm with a sterling reputation and deep experience with your line of business. Your customers will be interacting with your TPA partner in their time of need, and their experience with a claims TPA will undoubtedly be tied with your business.

At BriteCo, we’ve forged relationships with our partners that will extend years into the future. We were connected to our primary insurance and reinsurance carriers through a knowledgeable and well-connected broker. Our primary and reinsurance partners are strong advocates for our long-term vision, lending us a wealth of experience and resources to propel BriteCo’s success. On the policy administration side, we talked to nearly 20 (yes, 20!) companies before we found the right policy admin company. They’ve been a fantastic partner and have taken time to understand our program backwards and forwards.

Remember, choose partners who are invested in your long-term success. You want business relationships that last years, not months.

A regulatory labyrinth – Perhaps the most difficult challenge to navigate as an insurance intermediary is the myriad of regulations. Insurance is likely the most regulated financial product in the entire country. This is compounded by the fact that insurance is regulated on a state-by-state basis. Yes, you read that right. You have 50 different regulators you’ll be dealing with if you plan to write countrywide. Luckily, these regulators work together to bring some semblance of conformity around licensing, filings, and financial reporting. However, there are lots of exceptions to those general rules and regulations that can make regulatory approval extremely challenging.

You’ll want to thoroughly consider the regulatory hurdles of implementing your program. Is your line of business admitted, meaning you’ll have to submit rate/rule/form filings to nearly every DOI, or can you sell your product through the non-admitted market? If you are looking to start a personal lines program, be prepared for extra regulatory scrutiny, especially if that insurance is compulsory or required by a mortgage lender. You may want to consider partnering with a carrier who has the filings and licenses in place to write your program upfront versus building a proprietary product. You may also consider hiring a compliance or actuarial services firm to help with some of this research or filing legwork.

You’ll also need to get licenses to sell insurance in every state. This typically requires you to attend an agent pre-licensing class, then pass an exam particular to your home state. Once that’s complete, you’ll need to apply for a license through the NAIC’s National Insurance Producer Registry. You can use the same registry to apply for congruent individual licenses in other states and for your business entity licenses. Note that there are special requirements in certain states that you should consider:

- Some states require fingerprints for you and for the officers of your business

- Some states require the name approval of your business entity

- Some states require you to submit proof of a professional liability insurance policy or surety bond

- Some states require you to register your business entity with the Secretary of State before applying for a business entity license

This is an area where recruiting an insurance insider and fully credentialed actuary has benefited BriteCo. Actuaries are highly knowledgeable insurance professionals who touch multiple facets of an insurance organization. I brought years of experience working in licensing, filings, and product management to the team. As a result, BriteCo was able to gain regulatory approval for the lion’s share of filings and business entity licenses in one quarter as opposed to three or four quarters. The key to BriteCo’s compliance approach is to provide regulators with sufficient information and clarity so that their comfort with the product and program is established upfront.

Like it or not, you’ll need to work closely with regulators to get an insurance program up and running. The best approach is to foster positive touchpoints with your regulators on a frequent basis. It’s especially important to establish a relationship with your domiciliary state, as they can provide indispensible insights and prove a strong advocate for your business in dealing with other regulators.

About Conor Redmond

Conor Redmond is co-founder and Chief Insurance Officer for BriteCo, an innovative jewelry and watch insurance company that is transforming the retail jewelry appraisal and insurance experience for the digital age. Prior to joining BriteCo, Conor served as an actuarial analyst in the property & casualty insurance industry. He served in several technical pricing roles spanning commercial and personal lines and brings an extensive knowledge of insurance program business to the table. Conor is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. He has a BA in mathematics and minor in actuarial science from The College of New Jersey.

Conor Redmond is co-founder and Chief Insurance Officer for BriteCo, an innovative jewelry and watch insurance company that is transforming the retail jewelry appraisal and insurance experience for the digital age.

Prior to joining BriteCo, Conor served as an actuarial analyst in the property & casualty insurance industry. He served in several technical pricing roles spanning commercial and personal lines and brings an extensive knowledge of insurance program business to the table.

Conor is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. He has a BA in mathematics and minor in actuarial science from The College of New Jersey.