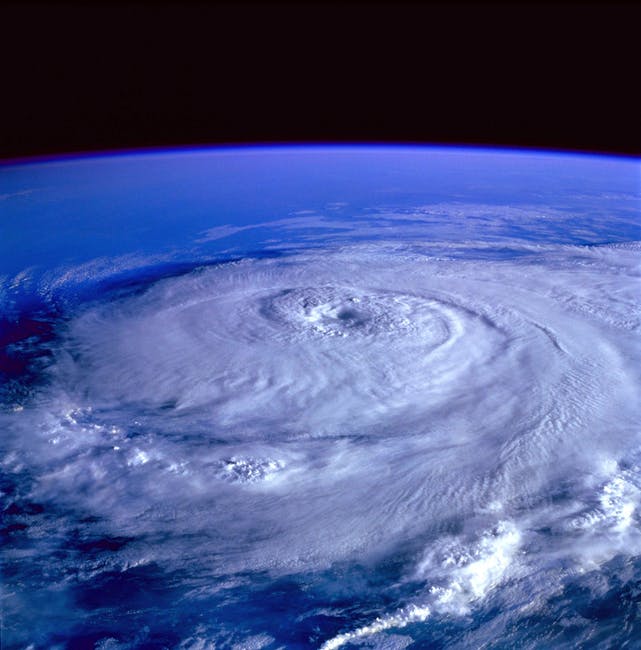

With NOAA predicting four to seven major hurricanes, the 2024 Atlantic hurricane season has yet to reach peak ferocity and insurers are watching the skies in anticipation of the next significant catastrophic (CAT) event.

Managing CAT events is a top priority for property and casualty (P&C) insurance companies, and moratoriums play a vital role in doing this effectively. These temporary suspensions of new insurance policies or modifications to existing ones are typically implemented when a significant threat, such as a hurricane, is imminent.

Managing CAT events is a top priority for property and casualty (P&C) insurance companies, and moratoriums play a vital role in doing this effectively. These temporary suspensions of new insurance policies or modifications to existing ones are typically implemented when a significant threat, such as a hurricane, is imminent.

While the primary goal is to prevent last-minute exposure binding, which could lead to substantial financial losses, moratoriums ensure policyholders cannot “buy a claim” by increasing coverage or reducing deductibles just before a disaster strikes.

However, the process of establishing and administering moratoriums is complex and prone to human errors which often cause irritation and conflict between insurers and distribution sources. And, perhaps even worse, human errors could expose your E&O policies and make insurers liable for losses.

By exploring best practices for CAT moratoriums and how technology can streamline the process, it is possible to make it more efficient and effective.

Best Practices for Implementing CAT Moratoriums

- Early Detection and Communication:

-

- Utilize advanced weather forecasting tools to detect potential CAT events early.

- Communicate impending moratoriums promptly to agents, brokers, and policyholders through multiple channels, including email, SMS, and company portals.

- Clear and Consistent Guidelines:

-

- Establish clear guidelines on when and how moratoriums will be implemented.

- Ensure consistency in applying these guidelines across all regions and types of policies.

- Training and Preparedness:

-

- Regularly train underwriters and claims personnel on the procedures and protocols related to moratoriums. Conduct periodic drills to ensure readiness during actual CAT events.

- Data-Driven Decision Making:

-

- Leverage historical data and predictive analytics to determine the optimal timing and scope of moratoriums. Continuously monitor real-time data to make informed adjustments as conditions evolve.

Leveraging Technology to Enhance Moratorium Processes

Technology can significantly enhance the efficiency and accuracy of implementing CAT moratoriums. Here are some ways technology can be utilized:

- Automated Systems:

-

- Implement automated systems that can trigger moratoriums based on predefined criteria, such as weather alerts or risk thresholds. Your system should NOT rely on the honor system. Your systems should physically (should be embedded into the code base) block new business based on rules and criteria. Systems like these can reduce the manual workload and minimize the risk of human error.

- Geospatial Analytics:

-

- Use geospatial analytics to identify areas at risk and apply moratoriums more selectively and precisely. This approach ensures that only the necessary regions are affected, reducing disruption for unaffected policyholders. If a storm is not expected to hit an entire state, then there is NO REASON to block the entire state. In fact, you are losing an opportunity for new business to property owners in unaffected areas.

- Integrated Communication Platforms:

-

- Deploy integrated communication platforms that allow for rapid dissemination of moratorium notices. These platforms can ensure that all stakeholders receive timely and accurate information.

- Blockchain Technology:

-

- Explore the use of blockchain technology to secure and transparently record moratorium decisions. Blockchain can provide an immutable audit trail, enhancing accountability and trust.

- Artificial Intelligence (AI) and Machine Learning (ML):

-

- Utilize AI and ML algorithms to analyze patterns and predict future CAT events with greater accuracy. These technologies can also optimize the timing and scope of moratoriums, improving overall effectiveness.

Conclusion

CAT moratoriums are essential tools for managing risk for P&C insurance carriers. By adhering to best practices and leveraging advanced technologies, insurers can enhance the efficiency, effectiveness, and accuracy of their moratorium processes. This not only protects insurance companies’ financial stability but also ensures fair treatment for policyholders.

About Peter Crowe

Peter Crowe began his career in technology consulting, which led him to many cities, companies, and even a few countries doing system implementations, upgrades, and conversions. A tech project he worked on led to an opportunity at RE/MAX, a real estate franchise company. Pete joined RE/MAX in 2013 and while there, served in various capacities including Vice President of Investor and Public Relations, Sr. Vice President of Marketing, Communications, and Investor Relations, and Executive Vice President of Business and Product Strategy. Pete joined We Insure, a PEAK6 InsurTech company, in September 2019, where he served in the roles of Chief Revenue Officer and Service Operations lead. In these roles, Pete partnered with leadership and the We Insure team to help make We Insure an unstoppable force in the insurance industry. Through strong strategies and partnerships, Pete was able to assist in the expansion of We Insure into 25 new states, growing the agency footprint from 90 to 190 offices in just over two years. In 2021, Pete shifted to the role of Executive Vice President of Team Focus Insurance Group, another PEAK6 InsurTech company, and has served as President of Team Focus for two years. Pete holds a Bachelor of Business Administration from Indiana University, and an MBA from the University of Denver – Daniels College of Business.

Peter Crowe began his career in technology consulting, which led him to many cities, companies, and even a few countries doing system implementations, upgrades, and conversions. A tech project he worked on led to an opportunity at RE/MAX, a real estate franchise company. Pete joined RE/MAX in 2013 and while there, served in various capacities including Vice President of Investor and Public Relations, Sr. Vice President of Marketing, Communications, and Investor Relations, and Executive Vice President of Business and Product Strategy.

Pete joined We Insure, a PEAK6 InsurTech company, in September 2019, where he served in the roles of Chief Revenue Officer and Service Operations lead. In these roles, Pete partnered with leadership and the We Insure team to help make We Insure an unstoppable force in the insurance industry. Through strong strategies and partnerships, Pete was able to assist in the expansion of We Insure into 25 new states, growing the agency footprint from 90 to 190 offices in just over two years.

In 2021, Pete shifted to the role of Executive Vice President of Team Focus Insurance Group, another PEAK6 InsurTech company, and has served as President of Team Focus for two years.

Pete holds a Bachelor of Business Administration from Indiana University, and an MBA from the University of Denver – Daniels College of Business.