Tackling the challenges of an industry that has historically been male, pale, and stale.

It does not come with much surprise that the insurance industry has a significant diversity hurdle. Unlike several of its financial service peers, our industry is late to the idea that diversity, in all forms, makes for good business.

The financial services field is among the least diverse in the country and little has been done in the past to change its status. Despite the progress that has been made for some previously underrepresented groups in this space, progress has been sluggish and the industry has a long way to go in reflecting the diversity of America.

However, the topic is higher on the agenda now more than ever.

Recently, I had an opportunity in Chicago to serve as a committee member for The Dive In Festival – an insurance industry initiative that took place in numerous cities throughout the world during the final week of September. The festival promotes engagement amongst peers around the globe in sharing practical ideas on how to move from awareness into action in order to increase diversity, foster inclusion, and drive positive change.

The Dive In Festival began in 2015 in London and has since grown to include over 109 events in 53 cities worldwide. It’s exciting to see the initiative gather global momentum and spread to countries where the issues around inclusion and equality can still be challenging. A survey conducted through Dive In of a group of 2,500 respondents from 150 companies throughout the world revealed that the vast majority (93%) of insurance professionals believe that leaders are now taking positive action on diversity. Through my involvement with Dive In Chicago, it was encouraging to see so many people in insurance around the world taking real action to bring about this positive change – but there’s still plenty of work to be done.

A History of Hierarchy & Homogeneity

Similar to other professional services, the insurance industry has always been hierarchical. By means of the apprenticeship model, insurance professionals have been shaped to spend years honing their craft before eventually moving into leadership positions as more tenured professionals leave the industry.

While this model has been successful in developing the knowledge base of many professional, it also presents challenges when it comes to diversity. One particular outcome of this structure is unidirectional communication: information flows from the top down. Absent a multidirectional flow of information and ideas, innovation is stymied. For innovation to flourish at any level there is a call for transparency of thought, opportunities to think outside of the box, and safety in challenging ideas.

Through an infusion of modern talent management practices, organizations of all types are gradually creating environments that facilitate open dialogue and the sharing of ideas. Through the recruitment of diverse individuals and the crowd sourcing of ideas, it will hopefully allow for the development and improvement of these best practices. As this hierarchical model gives way to flatter structures and more open management discussions, it is promising that everyone in an organization will have a voice in how business is conducted.

When we have all of the same type of people in the same environment acting in an echo chamber, it limits innovation from flexing its muscles and it restricts the challenging of traditional models. As the insurance industry looks to break free from the bondage of homogeneity, it will allow for the advantageous characteristics of diversity to shine more brightly.

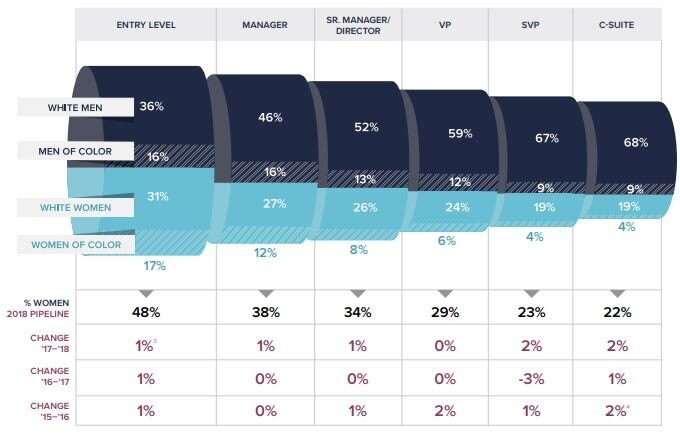

REPRESENTATION IN THE CORPORATE PIPELINE BY GENDER AND RACE % OF EMPLOYEES BY LEVEL IN 2018 – McKinsey & Company

Defying Discomfort

Where you find rich diversity and inclusion, you also find a certain level of discomfort. However, this discomfort is nothing to be afraid of – because it’s discomfort that brings about creative thinking and open dialogue.

The financial services industry traditionally evades discomfort through a high degree of cordiality and superficial respectfulness. However, by avoiding uncomfortable situations, we avoid disagreement and challenge. As a result, we fail to foster a space that enables the free flow of ideas that ultimately leads to innovation. We have proven to lack the ability to maintain conversations with different points of view.

As professionals within financial services, we all need to get better at being intentional and explicit in our actions. However, fostering intentionality can itself be a challenge. Moving forward, we need to focus on promoting dialogue and being specific with our objectives in this approach.

Developing talent pools in a way that encourages the challenging of assumptions — fostering uncomfortable conversations — can lead to extraordinary innovation and modernization within the industry. It can also create a more confident, engaged, and enthusiastic workforce.

It is important to understand that challenging the status quo while still maintaining a culture of empathy are not mutually exclusive. As we move towards open dialogue we must not lose sight of the dignity of the individual and we must work to foster a mutual respect that is grounded in empathy.

Doing Well to Do Good in Business

Over the past few years, many companies have reported that they are highly committed to diversity in the industry. However, that commitment has not necessarily translated into significant progress. The reason is that you can’t just “do diversity,” Rather, it is a culture thing. Diversity has to be built into the organization.

Companies need to do a better job of treating diversity like the business imperative that it is. Furthermore, we need to enhance our ability to articulate why a more diverse workforce is good for business.

According to a recent report published by Marsh, experts agree that clarifying a business case, setting goals and reporting on progress, and rewarding success are key to driving organizational change. When it comes to diversity, more companies need to put these practices in place. For example, when it comes to gender diversity, only 38% of companies set targets for gender representation, even though setting goals is the first step toward achieving any business priority. Only 12% share a majority of gender diversity metrics with their employees, even though transparency is a helpful way to signal a company’s commitment to change. Only 42% hold senior leaders accountable for making progress toward gender parity, and even fewer hold managers and directors accountable. Yet it’s hard to imagine a groundswell of change when leaders aren’t formally expected to drive it.

In all of this, there is a need for a great deal accountability. Companies need to be accountable for developing, mentoring, and sponsoring a diverse workplace. And they have to become accountable for enhancing the hiring process so that the pipeline is full. Without that kind of accountability, talk about diversity is just lip service.

Across organizations in the industry, we need to further encourage the conversation so that we can learn from one another and better understand what is working well. We need to open source our conversations and approaches to these vital issues. Only then can we cultivate creativity and begin to reflect the diversity of our neighborhoods and of our clients. Let us go beyond simply promoting diverse boardrooms as we look to weave diversity into the fabric of business.

When diversity has a seat at the table, innovation thrives, and we all grow stronger.

Sources:

https://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2016/june/WiFS/WomenInFinancialServices_2016.pdf

https://www.propertycasualty360.com/2017/04/04/4-diversity-challenges-stifling-insurance-innovati/

https://womenintheworkplace.com/

https://www.insurancebusinessmag.com/uk/news/breaking-news/senior-broker-my-career-journey-tech-and-being-a-woman-in-insurance-113758.aspx

https://www.investmentnews.com/article/20151214/FEATURE/151209979/a-diversity-problem

Corporate Pipeline Study:

1 In this study, women of color include Black, Latina, Asian, American Indian or Alaskan Native, Native Hawaiian, Pacific Islander, or mixed-race women. However, due to small sample sizes, reported findings on individual racial/ethnic groups are restricted to Black women, Latinas, and Asian women. 2 Due to rounding, representation by race and gender may sum to 101 percent or 99 percent within some levels. 3 This represents percentage point change. 4 The small numbers at the executive level, combined with this study’s methodology, which takes the average of companies, means that findings at the executive level are more sensitive to individual company variation.

About Cooper Cohen, CPCU

Cooper is an International Underwriter at CNA Financial in Chicago, Illinois providing tailored solutions to meet the foreign insurance needs of US-based clients doing business abroad. He graduated with honors from the University of Notre Dame where he studied the complexities of Finance & Entrepreneurship. He is a native of Colorado and joined the insurance industry in 2016. Cooper holds the following designations: Chartered Property Casualty Underwriter (CPCU), Commercial Lines Coverage Specialist (CLCS), and Construction Risk and Insurance Specialist (CRIS).

Cooper is an International Underwriter at CNA Financial in Chicago, Illinois providing tailored solutions to meet the foreign insurance needs of US-based clients doing business abroad. He graduated with honors from the University of Notre Dame where he studied the complexities of Finance & Entrepreneurship. He is a native of Colorado and joined the insurance industry in 2016. Cooper holds the following designations: Chartered Property Casualty Underwriter (CPCU), Commercial Lines Coverage Specialist (CLCS), and Construction Risk and Insurance Specialist (CRIS).