Editor’s Note: Normally we only run articles meant for insurance professionals, but since we haven’t ran any articles on Parametric Insurance in the past we thought this one was a good intro, even though it’s written for the insurance buying public.

What’s the one thing you can’t live without?

It probably took you .07 of a second to answer: “My phone, of course!”

Yeah, our phones are indispensable. You can’t look anything up, listen to music, communicate or buy anything without your phone. It’s your lifeline and your constant companion.

So let me ask a question, then:

Why are we still asked to put down our phones when transacting business?

I still drive five miles to my bank, park the car, get out of the car and walk inside to deposit a check because my bank has made it darn near impossible to activate mobile banking for my business account. My dad opened a bank in 1966 and if he were alive today even he would be rolling his eyes.

But before we beat ourselves up too much, let’s admit we are getting better at putting the customer experience in the smartphone. There are some great examples in the world of insurance and risk, like Lemonade, Metromile, and GEICO.

But – and here’s the big “but!” – there’s still too much friction when the you-know-what hits the fan and a policyholder tries to file a claim. They have to look up a phone number, call the number, sit on hold, speak to three different people, give their policyholder number (who knows where to find their policyholder number anyway?) and wait another 15 minutes until they get some kind of assurance that they are being taken seriously and someone will look into their claim.

Or they go to a website and open up one of those dreaded chat windows. Helllooo? Is anyone there? You can bet the uncertainty and delays are only worse when hundreds of people are trying to get online after a major disaster.

As J.D. Power notes, “most insurers’ digital offerings are lacking in insurance-specific capabilities such as processing claims, effective shopping and servicing of policies.”

It shouldn’t be this difficult for the consumer.

Fortunately, two breakthroughs have converged that will ease the pain of the interminable claims process:

- Parametric insurance has shortened the time to payment.

- Mobile technology has made it immediate.

You can now have a claims payment hitting your bank account within hours with no hassle or human interaction.

The problem has been around forever: too many things happen during a disaster that aren’t covered by a typical homeowners policy. With the exception of the dwelling and contents, anything damaged or destroyed isn’t covered. That’s historically put consumers in a bind, until advanced data science and computing came along and made it possible to insure all these additional risks. In fact, if it doesn’t appear in your homeowners policy, a supplemental hurricane policy will cover it.

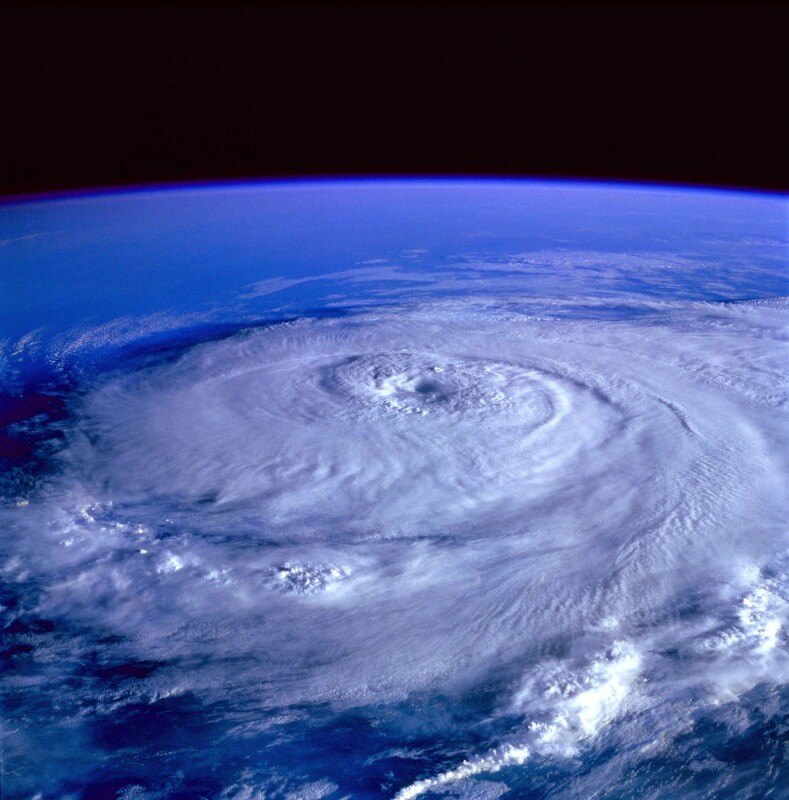

Here’s an example of how parametric and mobile are teaming up to help people recover faster. Let’s say you live in Florida and a hurricane passes through your town and topples a huge tree in your driveway. Now you’re stranded because your car is stuck in the garage. To make matters worse, you lost power, your food is spoiling and you’ve been ordered to evacuate.

Few of us would have the cash sitting around to take care of these urgent matters quickly. If you’ve been through a hurricane, tornado or similar disaster, you know the first 24 to 48 hours can be paralyzing. Your world is turned upside down.

However, if you had purchased a parametric insurance policy, you can get the money you need almost instantly. There’s no claims process because the computer instantly calculates how much dough you’re eligible to collect. The amount is based on the strength of the storm and its distance from where you live.

So, you’re sitting on your front step lamenting your situation when all of a sudden you get a text from your insurer saying you’re eligible for a claims payment. All you have to do is click “accept” and the money is wired to your bank. It’s like “found money” because you even forgot you purchased that parametric policy! And it’s a good thing your insurer notified you by text because your phone is about the only thing you own that’s working at the moment.

A typical parametric policy works this way:

- Submit your name and address

- Select a limit

- Click Buy

There’s no underwriting in a parametric policy; the machine already has the information it needs (your name and address) to distribute the correct amount to you if or when there’s a hurricane and you’re affected. Remember, payments are based on the strength of the storm and the distance of the insured from the center of the storm.

Parametric insurance is pretty common in business, especially in developing nations and areas that are especially vulnerable to extreme CATs. (See MICRO’s entry into El Salvador with business interruption coverage.). Only recently are insurers recognizing the value it holds for consumers.

That’s because it gives people the assurance that they’ll have money in their pocket to handle those surprise expenses that pop up, like needing to buy a generator, repair a pool cage or boat dock, or replant landscaping. Folks like the idea of supplemental parametric insurance because they can use the funds to meet their homeowners deductible, which can run into the thousands. Without the deductible, repair work on your house will be delayed even longer.

Thanks to the Insurtech wizards, it’s getting easier to review coverages, match them to your needs and purchase a policy. But the claims piece is more complex and challenging. While the wizards can’t close your homeowners claim with a simple click (yet), they’ve found a way to get you the instant funds you need to get back on your feet. Parametric insurance and mobile technology are pairing to make this possible.

Reinsurers like Swiss Re are doing some amazing things with parametric insurance – everything from compensation for delayed flights to pre-disaster infrastructure funding to protecting the finances of African farmers from the vagaries of the weather.

About John Novaria

John Novaria is Communications Director at Assured Risk Cover, a Silicon Valley-based company that sells supplemental hurricane insurance in Florida under the StormPeace brand.

John Novaria is Communications Director at Assured Risk Cover, a Silicon Valley-based company that sells supplemental hurricane insurance in Florida under the StormPeace brand.