This is the first in a multi-part series on the effects of the ongoing legalization of marijuana in the worker’s compensation insurance ecosystem. This series is being ran in preparation for a panel on “Legalization of Marijuana and the Impaired Workforce” that the author is moderating at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp. Insurance Nerds readers can save 0 on registering for AmComp with discount code AMCOMPNERDS.

Medical marijuana has long been a hotly debated topic for the past two decades. Until recently, the discussion focused broadly on states’ rights, legal versus recreational uses, and patient advocacy. Rarely, were marijuana and workers’ compensation uttered in the same sentence. As several states moved from medical to recreational cannabis, and legislators at both the state and federal level have shifted favorably towards legalization, a new wave of discussions has begun. Given the potential impact to the industry, there is much to discuss. Considering some of the pivotal decisions made, by both statutory enactments and judicial opinion, and the potential impact to all stakeholders, the dialogue and review of medical marijuana must not escape the conversation.

As a nation, more than half of states have legislatively approved marijuana for medical purposes. Increasingly, marijuana is becoming an acceptable alternative for pain management while negative opioid related issues continue to make headlines. On another front, there is fear and apprehension on the effects that legalization may have on the general workforce. There is a systemic fear that workers with access to legal cannabis may lead to an increase workforce impairment and ultimately increased loss frequency. While the integration of marijuana into the workers’ compensation system is still in its infancy, all stakeholders need to create a more open dialogue in order to foster, develop and implement the most appropriate solutions. At a minimum, clear statutes that address compensability of medical marijuana, and if approved, what balance best serves the needs of injured workers and employers. An examination of several key issues require further discourse as the momentum pushing these issues forward does not seem to be slowing.

1. Should injured workers be afforded the same medical marijuana benefits offered under legalized state programs?

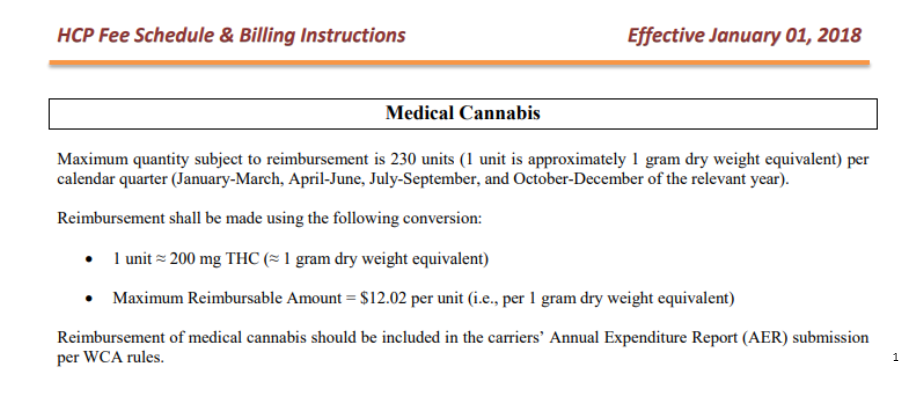

Though many states adopted medical marijuana laws years ago, only now has the conversation grown to a national debate, and a ‘hot topic’ for employers and insurers. Patient advocacy, and the rights associated with using medical marijuana as a treatment alternative, has always been at the forefront. Now, even more so as legalized medical use has been adopted in over 60% of states. Qualifying based patients with approved conditions, which the law intends to protect, may include those who may have been injured at work and have filed a workers’ compensation claim. Furthermore, nine states have legalized recreational marijuana, which increases access to the greater populace. This legalization has provoked trepidation amongst employers and insurers as they fear there could potentially be a detrimental effect on workplace safety. Not only could claim frequency increase for those workers who may be impaired, but also their unsuspecting coworkers whose job duties cross paths. Interest among the workers’ compensation community, including carriers, attorneys, and medical providers, has gained traction as recent court decisions have found marijuana to be an approved medical treatment for claimants for which the insurance carrier was responsible for payment. Some state labor boards are beginning to address marijuana in workers’ compensation. A key question in states with approved use is whether workers’ compensation claimants are entitled to payment of benefits for marijuana use, and if so, for which qualifying conditions. Of course, there is apprehension that any signal of approval will open Pandora’s Box, but whether for or against the industry cannot lay idle.

Map from the excellent non-partisan ProCon.org

States that have established state sanctioned medical marijuana programs have developed qualifying conditions for patients and caregivers. Many of these conditions would not meet the definition of a compensable injury. Approved conditions often include severe medical diagnoses such as AIDS, cancer, or Parkinson’s disease. However, many have approved injuries or diseases that are typically covered such as chronic pain, anxiety, migraines, or post-traumatic stress disorder. Some lists even include medical marijuana as an alternative to opioid treatment, an approved use, a crisis that has plagued the industry for the past decade. With these laws in place, states must clearly define their intentions as to whether insurers are required to cover medical marijuana. Few have, such as Oregon, which states, “Nothing in the Medical Marijuana Act shall be construed to require a government medical assistance program or private health insurer to reimburse a person for costs associated with the medical use of marijuana.” However, in states that require or left discretion up to health insurers, additional consideration must be given to what conditions or other attributes would qualify an injured worker for this medical benefit.

In addition, medical marijuana programs include the type of marijuana product that can and cannot be consumed for treatment. New York’s Compassionate Care Act does not include the traditional flower form of marijuana that is most often associated with cannabis whereas Pennsylvania allows it, if vaporized or nebulized. The uniqueness of each program may affect how and if patients decide to treat with medical marijuana. Workers’ compensation could decide to adhere to the same guidelines or restrict marijuana use to fewer forms. For example, Louisiana allows for a long list of acceptable varieties (oils, extracts, tinctures, sprays, capsules, pills, solutions, suspension, gelatin-based chewable, lotions, transdermal patches, and suppositories), but could limit compensable forms for workers’ compensation to just one or two based on various factors. Those factors may include treatment guidelines subject to evidence-based medicine.

The final question, and potentially most impactful, is how will states, without state-approved medical marijuana programs, respond to any form of federal legalization. Legislators in the Capitol have continually progressed toward easing prohibition. The number of congressional representatives supporting the Rohrabacher-Farr Amendment has nearly doubled in the past fourteen years. In addition, a handful of bills have been presented to the House to consider in the past two years with support from the Congressional Cannabis Caucus. Any federal policy changes could affect all states regardless of what programs are in place.

Brian Reardon is a Board Member of AmComp and AVP, WC Claims for Maiden Reinsurance. He will be moderating the upcoming panel session on “Legalization of Marijuana and the Impaired Workforce” at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp. Insurance Nerds readers can save 0 on registering for AmComp with discount code AMCOMPNERDS.

About Brian Reardon MBA,ARM,AIS

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.