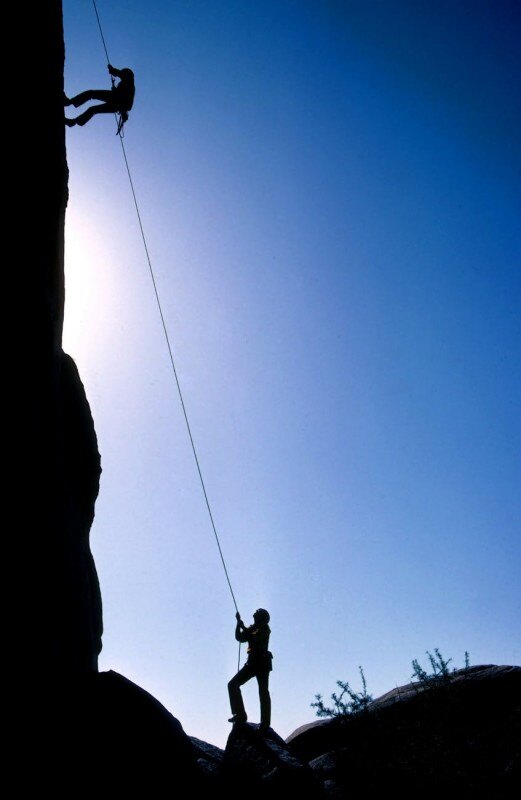

As I reflect back on my path leading into insurance, I should have known from the start that I was built for the industry. I grew up as a play-it-safe kid who loved to make plans that involved the least amount of risk possible (aka, don’t climb to the top of the jungle gym, don’t jump off the swing when it’s really high, and never jump off the high-dive!) While this may make for a boring childhood for some, it was all I knew… I come from generations of women who tend to worry and take measures to avoid risk as much as possible! When I graduated high school and headed off to college, I knew I wanted to help people, but that does not help narrow down the hundreds of majors that would “help people”. I hopped around from early childhood education, interior design, nursing, speech and hearing pathology, and sociology. I worked many part-time jobs in a variety of different fields during this time, but after five years and over 170 college credits (about 35% more than required for a bachelor’s) with no degree to show for it, I decided to take a break from college to work full-time in the “real world” to try to figure out what to do with my life.

I eagerly began applying for jobs; I basically applied for anything and everything that did not require a college degree or experience. I received an offer from an independent agent insurance association as an administrative assistant. Little did I know this “random” opportunity I took would lead me to where I am today. The association introduced me to the insurance world and helped me explore the many, many opportunities within this industry. I am so thankful to have haphazardly landed that job back in 2008!

I quickly learned that I wanted to work on the carrier side, and after a year and a half, I left the association to take an opportunity with an excess and surplus lines company as a policy services technician. This was an entry level, data-entry position typing bound policies and entering them into the rating system. This role helped me begin to become familiar with insurance terminology and coverages. I began working towards my AINS designation through the Institutes and moved into a policy services team lead role managing a team of underwriting technicians. I then took an opportunity within the same company to transition to a training and quality assurance specialist role in which I provided training for all new underwriting technicians and performed quality audits on completed work for the production teams. I had found myself “topped out” in my department; there often seems to be a tendency for those who start out in data-entry positions to get “stuck” there; we are dubbed processors and are often overlooked for mentoring, coaching or development opportunities. I took this challenge head-on by developing myself through pursuing an insurance designation and learning anything and everything I could about how commercial insurance works.

After three years, I left the excess and surplus lines world for an opportunity with a standard lines regional carrier. I started with my current carrier as an underwriting technician, in which I quoted and rated all new business for my assigned territories. I knew before accepting this position that I wanted to be an underwriter, but I was willing to start wherever I needed to and pursue further educational opportunities in order to work my way up. After eight months as an underwriting technician, I moved into an underwriting assistant position, where I prepped all commercial renewals and processed existing policy changes for the underwriters on my team. My year and a half in this role proved to be instrumental for me; I developed a mentor-mentee relationship with my lead underwriter. She spent so much time teaching me how to read and interpret coverages forms, when to add certain endorsements and exclusions, questions to ask for different types of risk, how to have difficult conversations with agents, answered my (millions) of questions and helped shape me into the underwriter I am today. In December of 2015, I was promoted to a commercial lines small business underwriter and was lucky enough to stay on the same team and continue developing under my mentor. I have recently transitioned to a new position within my company as a transformation small business underwriter on a pilot team for a new program we are kicking off in May

Continuing education has been a key component in my movement and success within the industry. I knew completing designations and my degree would be necessary in order for me to move from a data-entry based role into an underwriting role, so I made sure to extensively discuss career paths and education in the interview process with my current company. I didn’t want to get “stuck” in a data entry role again without the opportunity to grow within the same company. The day I was eligible for educational benefits, I ordered my first CPCU book; two months later I passed the exam, which successfully kicked off my road to CPCU and also served as the last exam for my AINS designation. During this same time, I enrolled full-time in Kent State University’s online Bachelor’s degree program for insurance, but I still wanted more. I couldn’t wait to learn as much as I could (proud insurance nerd here!) and also enrolled in coursework to concurrently obtain my Commercial Lines Coverage Specialist (CLCS) designation through the National Underwriter company. I completed that designation in May of 2015. I completed my CPCU in March of 2016 and celebrated by attending the CPCU Annual Meeting and Conferment ceremony in Honolulu this past September (aloha!). I will be graduating with my B.S. Insurance Studies with a concentration in Property & Casualty insurance in May of this year.

I’ve worked a lot of jobs in a variety of different fields including colleges, hospitals, libraries, and restaurants; I could not imagine going back to work in an industry outside of insurance. Our industry is so unique in that it’s not just for agents and underwriters; we need expertise in customer experience, IT, actuary, claims, management, security, accounting, finance, reporting, business analysts, and the list goes on. I have found so much flexibility and freedom in being able to carve out a career path within the industry withOUT limitations.

About Shana Hahn

Shana is a Small Business Underwriter at Motorists Insurance in Columbus, OH. She has been in the insurance industry since 2008 and holds a Bachelor of Science in Insurance Studies from Kent State University and her CPCU.

Shana is a Small Business Underwriter at Motorists Insurance in Columbus, OH. She has been in the insurance industry since 2008 and holds a Bachelor of Science in Insurance Studies from Kent State University and her CPCU.