Workers Compensation Insurance is a unique niche within the insurance industry. It is a niche that, for those within the industry, can be very interesting and offer immense opportunity. The uniqueness of each business is one aspect that makes workers’ compensation different from other areas within the insurance industry. Each business has its own unique risks and its own unique history that all goes into what a carrier will charge for premium on their policy. When you add in the appetites carriers have for different industries and areas of the country, workers’ compensation can become extremely complex very quickly. Here are some examples of the different variables that go into quoting a workers’ compensation policy’s premium.

The uniqueness of each individual policy

First, each workers’ comp policy is unique in that every business has its own unique risks. With those risks brings the possibility of causing a major financial loss for the agency, the carrier, and the small business itself. At any given time, each carrier has a different appetite for many different types of risk. While some insurers would claim a policy is far too dangerous and would run from it, other carriers will gladly write the risk. Assessing a potential insured involves accurately gauging the riskiness of the policy, and seeing if it fits within your insurance company’s appetite for risk.

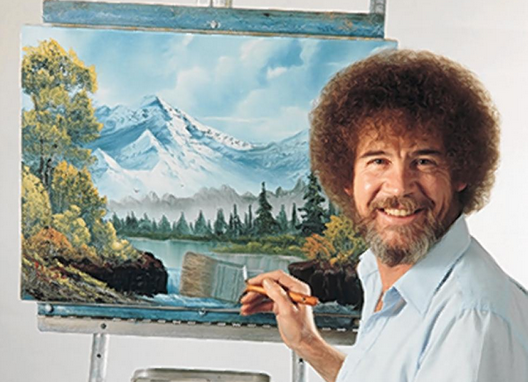

Paint a picture of how the business operates

As many in the industry know, when analyzing a workers’ compensation risk, an insurance professional is attempting to paint a picture of how the business operates and where claims could arise. The terms “light” and “heavy” are used to define the risk of a specific policy. ”Light” means the business seems like it will suffer less losses than the average and ”heavy” means the firm seems like it will experience more losses than the average business within the particular industry. “Class” refers to the individual workers’ compensation class code. Depending upon the risks the employees of a particular business face, the businesses are grouped together among similar operations for insurance pricing purposes. Each workers’ comp class code has a rate that is multiplied by the payroll of employees. This ratio creates the premium that is charged for the policy. If a company is light for its class, its premium will outweigh the amount of claims paid out, producing a profit for the insurer. If an insurer believes a policy is going to be heavy for its class, they may choose to price the policy higher to compensate for the potential increase in claims. Likewise, if an insurer thinks a risk is light for its class, it may price the policy cheaper to gain a competitive edge against other insurance companies. When an underwriter is investigating a risk, there are a wide variety of variables that can make it heavy or light for its class.

How big of a role are the loss runs?

One obvious indicator that a business is riskier than average is found in the “loss runs” of that particular business. The loss run report is a document generated by the insurance carrier to record the claims history of an insured. An insured that experiences frequent and severe claims is considered riskier, whereas an insured that has experienced little to no claims is considered a less risky policy. The idea is that a business’s past loss experience reflects the losses they might experience in the future. The claims history is also reflected by the experience modifier, or “experience mod.” An insured with an experience mod that is greater than 1 is expected to experience more losses in the future,and since the mod is greater than 1, the insured will be charged a higher premium. If the business had an experience mod less than 1, it would be charged a lower premium. A high experience mod may charge a higher premium, but it doesn’t always cover the extra cost of claims, especially if a very severe claim occurs or the premium is very small. Also, since frequency leads to severity, the more claims you have, the higher the chance that one will result in a massive loss. However, sometimes an experience mod can be misleading. A good underwriter will investigate the loss runs further to discover what is driving an experience mod to be so high. A high experience mod could be a reflection of poor safety and management practices, but it could also represent a freak accident or a very severe claim that is unlikely to ever occur again. If you can be certain that this claim is highly unlikely to occur again, or that the insured has taken measures to prevent this claim from ever happening again, then an overly high experience mod can be overlooked when analyzing a risk.

Is the risk light or heavy?

The specific attributes of a risk can also determine whether it is light or heavy for the workers compensation class. For instance, depending on where the operation is physically located, it may have a higher risk of a crime- related claim. The characteristics of the building, factory, or office space where work is conducted can also illustrate how risky a policy is. Things like handrails, non-slip mats, safety and exit signs, bright lighting, and other safety precautions can make an operation less risky. However, things like dim lighting, slick floors, tight spaces, clutter, unstable/unlevel floors, and unsafe height exposures create a greater likelihood that claims will occur and make the risk heavy for its class. Insurance companies know that some exposures are unavoidable, so they compensate by pricing policies higher or insisting that the insured find a way to control this exposure (for example, having a lock-in/lock-out procedure and/or hand guards for dangerous equipment). Other controls could be in the form of safety procedures, such as requiring gloves to be worn when handling sharp wood and metal, or requiring kitchen employees to wear non-slip shoes. Implementing controls creates a win-win situation for the insured, insurer, and employee. The insurance company benefits due to the lowered amount of losses paid to the insured. When the insured experiences less losses, they will be charged a lower premium and therefore save money on insurance costs. Lastly, the employee wins because they are provided with a safer work environment. The particular services and operations of a business can also make it light or heavy for its class. Many workers’ compensation class codes for employees include a very broad variety of job descriptions, some of which can be riskier than others. For example, imagine two car dealerships: a luxury sports car dealership and a small used car dealership. While their businesses may be in the same class, they experience different exposures. The luxury car dealership would operate mostly indoors and the employees would be highly trained and probably paid better, whereas a used car lot would be outside, exposed to the elements, with less trained employees that are probably paid less. This makes the used car lot more likely to incur losses, and makes the luxury car dealership a more appealing risk.

Analyzing a workers’ compensation risk can have many variables, and it takes a bright mind to organize all these variables in order to see the full picture and make a decision about a risk. Underwriters understand that there are always going to be losses, and there is always going to be risk, so it’s their job to decipher which employers are going to experience less losses than the average of their class. While there are a lot of numbers and data to (pull from?), sometimes analyzing the riskiness of a business can require the use of experience and gut instinct to make a decision. Being experienced, thorough, creative, and confident are all key to properly analyzing a workers’ compensation risk.

Bio

Chris Travis is a Marketing Specialist at General Liability Shop. Chris has extensive training and experience with underwriting and workers’ compensation insurance. Chris’s passion is to utilize his knowledge and experience in insurance to benefit the small business community.