This is the eighth in a multi-part series on the effects of the ongoing legalization of marijuana in the worker’s compensation insurance ecosystem. In case you missed them here’s part one, part two, part three, part four, part five, part six and part seven. This series is being ran in preparation for a panel on “Legalization of Marijuana and the Impaired Workforce” that the author is moderating at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp. Insurance Nerds readers can save 0 on registering for AmComp with discount code AMCOMPNERDS.

Medicare is a US federal program administered by a federal agency, the Center for Medicaid and Medicare Services (CMS). The federal government still recognizes marijuana as illegal regardless of state laws. The question commonly raised is whether a claimant who requires medical marijuana as a lifetime medication, and desires he settle his or her case in a full-and-final settlement subject to Medicare Secondary Payor Act guidelines, how or can you incorporate this future medical need into a Medical Savings Account (MSA)? As of right now, marijuana would be excluded as a factor in calculating the MSA, but it is still necessary in the overall evaluation of projected future medical costs. Some MSA providers are starting to include the costs in their calculations, but CMS still considers it as a non-Medicare payment.

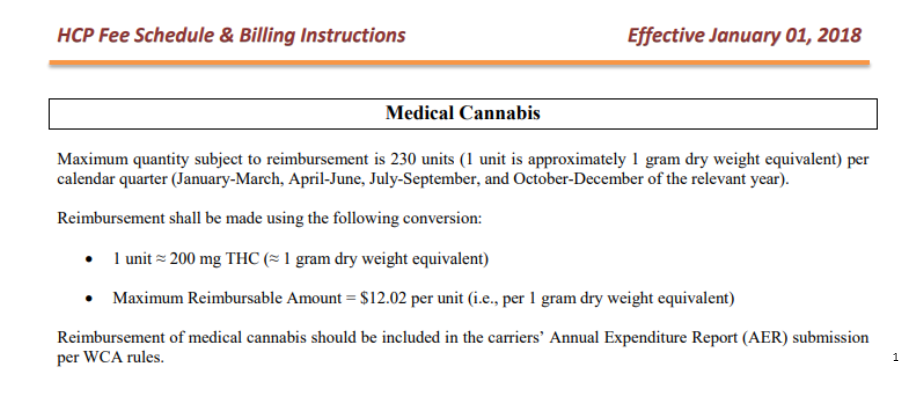

The guidelines used for these calculations are still in their early stages and continues to be developed. It is likely that the factors used in these estimates will change over the next few years as price and coverage change. Unless the federal government removes marijuana from the list of controlled substances, it is improbable that CMS would include dollars in its assessment for a claimant’s potential pounds of pot over the next few decades. However, a change in marijuana’s legal status at the federal level could lead to a future allocation that covers this. In the meantime, it is up to carriers and claimants and/or their attorneys to compromise on a reasonable settlement amount for these future medical marijuana costs.

Many times, carriers have decided not to settle a claimant’s medical portion of a claim because the MSA was too high (we have all seen the $700,000 MSA for opioid users). If the claimant’s future medical costs are attributed to medical marijuana, a non-covered item, the insurer’s protection of CMS’s interests may become minimal as the cost are “non-covered”. Perhaps CMS’s guidelines to ignore marijuana will beneficial to claimant and carriers and allow for greater flexibility when discussing settlement. Conversely, as the number of entrants, and users, into the medical marijuana space grows, questions remain about how supply and demand will affect future pricing. It may difficult for insurers, and claimants, to assess the value of future costs. This could has a negative effect on resolving the medical portion of a claim with insurers fearing they have overpaid, and claimant’s worried they are not receiving enough.

Truly, no one knows what the value of marijuana will be in 10, 20 or 50 years. Not only are there uncertainties over pricing based on supply and demand, there are also taxation issues. Many consumers have seen tobacco prices rise substantially in some states due to a mere increase in taxation alone. Prices may fall into a slightly different category if one considers marijuana medicinal, not recreational. Typically, medical patients are often excluded from these taxes and fees. Ultimately, impacts to MSAs will remain unaffected until some type of federal ban on marijuana is lifted. However, carriers still have the opportunity to decide how to settle files with claimants who use medicinal marijuana.

Brian Reardon is a Board Member of AmComp and AVP, WC Claims for Maiden Reinsurance. He will be moderating the upcoming panel session on “Legalization of Marijuana and the Impaired Workforce” at the AmComp Fall Conference in NYC on November 8, 2018. Opinions expressed are those of the author and are not necessarily held by the author’s employer or AmComp.

About Brian Reardon MBA,ARM,AIS

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.

Brian Reardon, AVP of Worker's Compensation Claims at Maiden Holdings in Bermuda and NYC. He has over 14 years of P&C experience working on all sides of the industry including carrier, reinsurer, TPA, broker and employer. He holds multiple industry designations and a MBA in Insurance and Risk Management from St. John's University. He's a Board Member at AmComp (American Society of Workers Comp Professionals) and a Fellow at the Claims & Litigation Management Alliance.