This article originally published on InsNerds.com

Or Why Brokers Won’t Be Disrupted

Middlemen (an example being brokers) add cost to a product without changing it. What’s not to hate about that? It’s an old insight: over history no economic agent is more loathed than the middleman (called an intermediary in the jargon).

In the 60s, we made a big word for the glorious annihilation of the middleman: disintermediation. Back then you (a consumer) couldn’t invest in securities, only in savings accounts, and banks did the investing for you, paying you an interest rate instead. Clearly ridiculous by today’s standards, but that system lasted until the US government capped the allowable interest rate paid by savings accounts, forcing people into the investment market directly and cutting out the middleman (banks).

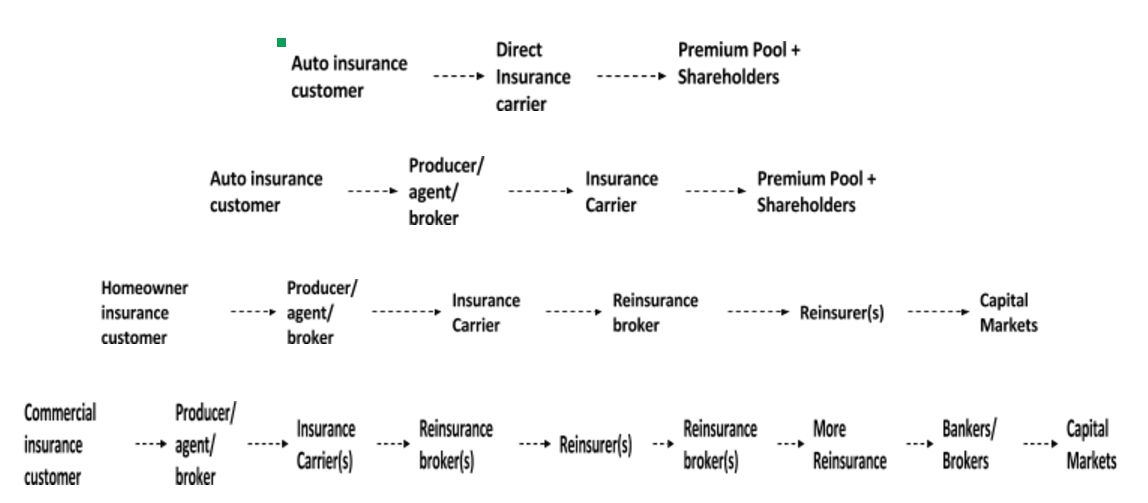

Well, the chain of middlemen in insurance is really weird. Here’s a normal situation: policyholders pay into a huge pool of collective premiums which funds losses. They’re literally paying each other’s’ claims. Here are some examples of value chains in insurance:

Don’t those chains feel long? Let’s make some money by cutting links! It clearly worked in personal auto… there’s just one link between the customer and the capital.

Auto insurance is special, though, and it’s worth a detour to explain. First, the risk is huge: I once calculated that about 60% of all the premium in the US is for auto insurance. Second, it’s politically sensitive: for most families, personal auto insurance is a meaningful cost. The reason for both of these features is simply that cars are really dangerous. And the cost of that danger is managed by insurers because auto insurance is compulsory.

Compulsory insurance yields huge volumes of data that makes the risk easy to understand. This simplicity makes the pricing of auto much more straightforward and mechanical than any other line of business. Regulators help this by enforcing adequate rates and slowing ‘innovation’ which all too often is just a mask for inadequate pricing.

In non-auto lines it’s way harder: you have to pay for a lot of expertise on the other end. Or pass it along to a specialist, adding intermediaries along the way. You see, insurance risk, when taken as a whole, is inconceivably complex. To manage that complexity insurers do three things: 1. study the risks they can understand; 2. sell risks to someone else who understands them; and, 3. come up with some (any!) kind of plan for the stuff nobody understands. We price category 1, call a reinsurance broker for category 2 and manage our portfolio and capital levels for category 3.

The more complicated the risk, the more links (mouths!) in the chain, more credit risk, more relationships and more trust needed in the system.

The problem is that the service sucks, the communication is slow and the products are complicated. If you look back at that chain, everyone is still an insurer so why can’t we have a one stop shop? The closer you are to the customer the more likely you are to think about what they want, so the system should improve.

In pitch meetings, I like to quote Jim Barksdale: “there are only two ways to make money: bundling and unbundling.” Unbundling is a great way to save money because specialists can outcompete generalists for certain kinds of risks. But assembling a hodgepodge of specialists to mimic general coverage takes a *lot* of work and is never perfect. You wind up with little gaps and, possibly, a big mess if something falls through those gaps. Bundling gives you awesome service because everything is sold together. But since you have to go to a generalist to get a bundle, you pay a premium!

This flies in the face of financial theory. The whole point of insurance is to diversify risks and adding coverages should do just that. Cute, but diversification assumes you’re not getting screwed by your client. When you wander into risks you don’t understand, we call that di-worse-ification. Companies can understand some risks, but, almost inevitably, there will be others that are such tiny parts of a policy that it pays to outsource that to specialists who can aggregate those tiny bits into a meaningful business.

So, I see the complexity of insurance products as a very finely tuned balance between price and coverage. Want it cheaper? Make it more complex. Want it simpler? Up the price. All against the backdrop of very slow change. Remember that the state is on the hook for the claims if insurers go insolvent, so anything that smells like underpricing, and all innovation does, meets a lot of skepticism.

What about the salesmen, can’t we at least pull them out? Let’s take one of the chains above:

And restate it:

Notice that the cultures of the links in the chain are alternating. The key idea in opposition to consolidation and disintermediation is that specialization matters. And service firms don’t specialize in products, they specialize in cultures. I started in the business in a sales culture, and there was always this presumption that people are “brokers” or “underwriters”*. Well, I reject entirely that salespeople and risk takers are born. They’re the product of their firm’s culture, and those cultures are so distinct it’s hard to tell sometimes that they are versions of the same thing.

At each chain link above, the risk changes, and you need a new negotiating collaboration. Even in integrated carriers, you’ll have a sales department and a risk department with dramatically different cultures**. In any negotiation, you are introducing a seriously high risk of human fallibility, and the shareholders of these organizations have very strong preferences for the kinds of errors they want their organizations to make. Risk taking organizations want fewer false positives (doing fewer bad deals), and sales organizations want fewer false negatives (ditching fewer good deals). They fight it out to correct for cognitive bias***.

The trick is: you can’t have fewer false positives and false negatives at the same time. Culturally, a firm can only lean in one direction, and if they don’t lean far enough, they are likely to get beaten in the marketplace by a firm that is at the optimal point.

There’s some underlying math to this idea of avoiding errors, and it has a solution: do more deals. As volume goes up, the chances of a meaningful error of any sort disappears. This works in two ways. First, any individual actor in the insurance chain needs higher volume to minimize the impact of its own biases and average out the effects of individual deals. Second, consumers need to engage in as many of these battles against bias as possible to make sure they get the best deal available.

Disintermediation destroys this ecosystem, which has a cost. I am not saying that it is impossible for the gains from disintermediation to outweigh the costs. But people have been attacking the middleman for centuries, and the structure persists everywhere, including after sustained assaults in insurance.

To me, that says the costs of destroying this system are very high. Any disintermediationaire needs to study that.

*as an unknowing future actuary in a junior broker role, I puzzled an early boss’ intuition: “I don’t know what you are”

**Witness the fading away of direct reinsurers as evidence of how well those generalist firms did at not specializing.

***We are assuming good intentions and strong relationships among all parties of course. In my experience, every good negotiation is a truth seeking exercise. Maybe this is unique to insurance!

Image unrelated to article, Tony just felt he needed a cool image :-D

About David Wright

David's entire career has been in the reinsurance industry and all with Beach & Associates, having first joined the Toronto office as a summer intern trainee broker in 2003. David is an Associate of the Casualty Actuarial Society and CFA Charterholder, with extensive experience in both sales and analytics. He has worked with global and regional clients across casualty, property and specialty lines of business. David now manages the New York office as well as all of Beach's North America Analytics teams. You can listen to his podcast at notunreasonablepodcast.com, follow him on twitter: @davecwright, and sign up for his newsletter at https://webtrough.com/signup/

David's entire career has been in the reinsurance industry and all with Beach & Associates, having first joined the Toronto office as a summer intern trainee broker in 2003.

David is an Associate of the Casualty Actuarial Society and CFA Charterholder, with extensive experience in both sales and analytics. He has worked with global and regional clients across casualty, property and specialty lines of business. David now manages the New York office as well as all of Beach's North America Analytics teams.

You can listen to his podcast at notunreasonablepodcast.com, follow him on twitter: @davecwright, and sign up for his newsletter at https://webtrough.com/signup/