This article originally published by the author on LinkedIn. Republished here with his permission. Normally we don’t publish customer facing articles, we are publishing this one because we thought it be helpful for other agents.

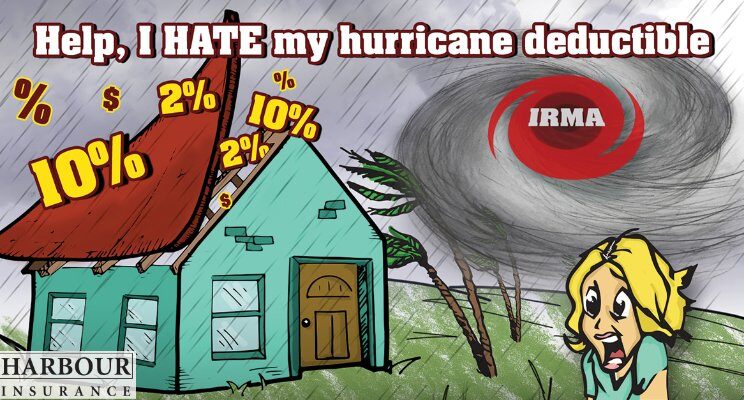

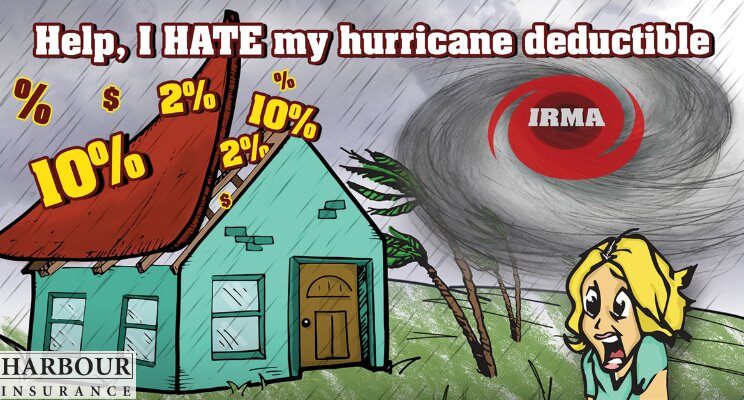

As we help our clients close their claims after hurricane Irma, we encounter one consistent frustration: “I hate my hurricane deductible.” In this article, I’ll provide a few options to work around your homeowner’s deductible, and make it helpful, rather than hateful.

Irma is a Four-Letter Word

Irma made landfall in Florida on September 10, 2017. It was the strongest hurricane recorded in the open Atlantic, hitting as a category 4 storm, and resulting in the state’s largest evacuation ever: 6.5 million Floridians fled their homes. Ultimately, 91 people died from storm-related incidents, and Irma’s strength and reach exceeded that of even Hurricane Andrew.

I myself witnessed Irma’s devastation, just 18 hours after the storm hit Marco Island, as I drove from Charlotte, NC to Naples, FL. Most of the state’s services were cut, putting it literally off the grid. The losses began to mount, and Irma became the “big one” we all knew had been coming.

No One Wants to be a Squirrel and Store Away Nuts

Fortunately, most losses were not deemed “total losses.” But the cost of the damage was significant. Many Floridians with higher hurricane deductibles were forced to pay out-of-pocket to restore their homes. Most Floridians don’t have a hurricane fund stored up.

With claims still rolling in, it’s difficult to pinpoint the average homeowner’s actual loss. Harbour’s client average hovers around 10% of the cost to replace their home. As of January 5, 2018, 877,843 damage and loss claims from Irma have been filed across the State. So far, 83% of those claims have been closed. You can view updated state claim information online.

Because Florida is the only state with a unified building code for hurricane protection, most homes built after 2002 withstood the storm rather well. Common damage included lost roof tiles, fallen trees and debris, some interior water damage, and food spoilage. More extensive damage included roofs that lost more than 25% of their tiles, and so needed to be replaced entirely or instances of buckled lanais (pool cages).

Overall, Floridians largely avoided total or near-total losses. But this did not save homeowners with high hurricane deductibles from bearing a significant portion of the cost of repairs.

The Ante to Live in Florida: Your Hurricane Deductible

In Florida, we enjoy zero income tax, never shovel snow, play year-round golf, meet exciting new people from all over the world, swim in crystal-clear Florida springs, and barely have to touch the water before hauling in tarpon, bonefish, grouper, or sailfish. But, living in this paradise is also like playing poker with your friends: yes, it’s a blast, but you still have to ante up if you want to be in the game. Often, the cost of living in Florida includes paying higher insurance premiums than you would in other states. And that includes paying your hurricane deductible.

For readers who are new to Florida, or unfamiliar with hurricane insurance: you pay a percentage of the replacement cost (RC) of your house as your deductible when you file your hurricane claims. For example, if your home’s total RC is $1 million, and you have a standard 2% hurricane deductible, then you must pay, out of pocket, the first $20,000 of your claim. We cover a lot of high-value homes at Harbour Insurance, and clients commonly carry a $100,000 deductible on a $5 million home.

Back in 1992, just when Hurricane Andrew crushed Florida’s east coast, all hurricane deductibles were $500, and insurance companies covered nearly all damages. As you can imagine, these high payouts resulted in many insurance companies filing for bankruptcy, with some driven out of the state entirely. Since then, hurricane deductibles have become standard practice for insurance companies, and a standard cost for homeowners to bear.

How to Hate Your Hurricane Deductible Less

Buy Deductible Insurance:

This is exactly what it sounds like; insurance for your hurricane deductible. Sounds odd, right? You’re asking, “I have a homeowner’s policy, and now you want me to buy another policy just to cover my hurricane deductible?” Yup basically.

Cat4Home is a hurricane deductible buyback product that offers coverage for 100% of your hurricane deductible from the first dollar of loss up to a maximum deductible of $20,000. This policy covers your hurricane deductible from the primary policy, so if there is hurricane damage to your home and it is covered by your primary policy, Cat4Home will cover the deductible loss. Additional coverages are also provided for some other non-covered out of pocket expenses.

Cat4Home is a Lloyds of London product and has an AM Best A+ rating. On average across the state, the premium is approximately $400. Prices vary based on location, age of home, age of roof, wind mitigation plus a few additional factors.

Vanishing Homeowner’s Hurricane Deductible:

One company that offers a vanishing deductible (much like you see with car insurance) is Frontline Insurance, whose rider to their homeowner’s policy is the Stepdown Deductible Credit. The vanishing deductible is an innovative idea that assists homeowners with a sliding scale. Every year, over a 6-year period, your hurricane deductible is reduced, until you no longer have a hurricane deductible at all. This is a great way to make your hurricane deductible disappear while insuring your home with a customer-centric insurance carrier.

Parametric Hurricane Insurance:

Parametric insurance pays you a pre-determined amount when one or more parameters are met. Parametric Hurricane Insurance pays you when a storm is declared a hurricane and it lands in a certain proximity to your home. It automatically triggers a claim and you get paid immediately.

StormPeace is a parametric Insurance Company that pays for gaps in your traditional insurance policy for things like tree removal, evacuation expenses, and other hurricane out of pocket expenses that may not be covered by your traditional insurance policy.

Value your agent

My final piece of advice is to make sure you have a qualified, independent insurance agent. There’s far more to insurance than the premium. A great independent agent will only conduct business with solid insurance companies, and we know their management, claims, and marketing representatives, so we always know who to call if an issue arises with your claim.

A good agent always gives good advice. Harbour is proud to say that, since hurricane Irma, we have not lost client due to poor coverage or claims. In fact, we have seen huge growth in our Florida clientele who are seeking advice on one of their biggest investments—their home.

All in all, hurricane deductibles can be a pain, but hopefully, this article will help you make yours a little more manageable. Living in this Florida paradise is not cheap, but it sure is fun.

About the Author: Will Kastroll owns and actively purchases independent insurance agencies. He is passionate about educating his clients and customizing their policies, and he is committed to bringing responsible clients to his valued insurance carriers. Will lives in Naples, FL.

About Will Kastroll

Will Kastroll is a passionate believer in the personal advice of the local and independent insurance agent. Will is devoted to educating and customizing policies for his clients. And committed to presenting responsible clients to his valued insurance carriers. His company’s mission is the help people insure their goals and dreams. He owns multiple independent insurance agencies and actively purchases quality independent agencies. He lives in Naples, FL.

Will Kastroll is a passionate believer in the personal advice of the local and independent insurance agent. Will is devoted to educating and customizing policies for his clients. And committed to presenting responsible clients to his valued insurance carriers. His company’s mission is the help people insure their goals and dreams. He owns multiple independent insurance agencies and actively purchases quality independent agencies. He lives in Naples, FL.