Today the role of the local agent is being marginalized. Most start-up insurtechs, even some legacy insurance carriers, no longer see the value of the local agent. Part of this marginalization is also self-inflicted by us agents. The guiltiest of which are old-school agents such as myself who have refused to change. The truth is many of us don’t have the know-how. Until now.

The purpose of this paper is to show you how to change and to grow your agency again in ways previously thought impossible, all while keeping the local agent front and center for everyone’s benefit.

My father was the first independent insurance agent in Cocoa Beach FL. A proud member of the Big I, mostly selling for the Travelers Insurance Company. The year was 1967, and my community was ground zero for the space race between the Soviet Union and the United States. We were surrounded by brilliant people, literally rocket scientists, working with the best technology of the time. But insurance was still being conducted on carbon paper and rating textbooks with the role of the agent being one of sales, field underwriting, and sometimes claims adjusting. In other words, the role of the local agent was indispensable and critical to the success or failure of the insurance carriers they represented.

Simply stated, it is an independent insurance agency that has multiple licensed producers located in every community and state in which the agency principal is also licensed. These producers are supported by the agency principal’s home office and website without the need or expense of having their own brick and mortar office locations.

HOW TO BUILD IT

Start by assembling and integrating your agency’s four digital pillars.

Before you assemble these digital pillars, you must first know what they are and what they entail. They are a fully integrated Client Management System (CMS), a VoIP phone system, an exclusive leads distribution application for all 42,000 zip codes embedded in the agency principal’s website, and producer-level API-enabled web forms that are best in class for the line of insurance being sold.

Now let’s take a closer look at each one of these four digital pillars.

Fully-Integrated Cloud-based Client Management System (CMS)

While we all know a chain is only as strong as its weakest link, a fully integrated cloud-based CMS is arguably the most important of the four digital pillars. That said, let’s dive into what I mean by “cloud-based” and “fully integrated.”

CMS that are supported on the cloud, are required for ease of access by all of your agency producers and CSRs regardless of where they are located throughout the country. While you can argue that you can support producers by offering a more secure VPN connection, you are limited by the server itself as to how many connections you can have. Additionally, your VPN connection cannot support mobile applications. Having a truly cloud-based CMS allows for both rapid growth and mobile-first capabilities.

Being fully integrated simply means that data can be accurately received and transferred from your CMS from various plug-in sources. These data sources can be those that are provided by your CMS vendor and those that are not. Working together, these plug-in systems must support the customer experience for every part of the client’s policy life cycle. Start with organic new business acquisition, then retention, cross-selling, and lastly recapturing lost clients.

If you are considering changing CMS vendors, besides being a cloud-based platform, here are some of the critical features your new CMS must have:

- If the CMS vendor doesn’t already have its own plug-in solution for rating new business, retention, and cross-selling, then it must be able to integrate with those vendors that do. Examples include multi-raters, e-signature services, automated email marketing

systems and text messaging services.

- Within your CMS you must be able to manage your data for prospects, existing clients, and x-clients, down to the local producer level. Most CMS systems allow you to identify the agency, the office location and the specific producer assigned to the account and or policy. This feature is critical for any successfully dispersed digital insurance agency. Reporting capabilities of your CMS must be flexible and robust enough to give you, the agency principal, accurate insight as to the day-to-day activities of your producers and CSRs alike.

- A self-service agency website plug-in that allows clients to log into their account 24/7 in order to obtain policy information like ID cards, declaration pages as well as requesting unbound policy changes.

- The CMS must be able to manage files for vendors, employees and/or 1099 associates, insurance carriers, and MGAs, not just for clients and prospects. Your CMS must be able to manage producer commissions easily. It must maintain up-to-date non-client files, keeping all your agency’s critical operational information up to date and at your fingertips. This will facilitate training for new producers and CSRs, easily standardizing and implementing processes and procedures throughout the agency. Lastly, your CMS must have at least three levels of access to the above-mentioned files and report data. For example, your 1099 producers should not be able to access each other’s client files, while your home office CSRs should be able to access them all.

While not necessarily a feature, your CMS provider must have strong customer support. One that allows you to call in, offers screen sharing services for problem-solving, or if you prefer, gives you the ability to email in your questions and offers a chat window for support as well. Lastly, your CMS provider should have step-by-step training videos for managing every part of a client’s policy life cycle mentioned above. An example would be a video showing you how to set up a prospect file inside the CMS, then properly assigning it to the producer who owns it.

A VoIP Phone System

Today, VoIP phone systems are very common. If your agency is not already using one, be sure to do your homework.

Some of the top providers of VoIP are Vonage, dialpad, RingCentral, Ooma, Zoom, and GotoConnect. By design, VoIP systems are perfect for supporting your geographically dispersed mobile producers as well as your home office CSRs.

Before deciding on the vendor, compare them based upon their call-in support, the user dashboard and their flexibility for in-bound call routing configurations, call recording features, and their associated reports.

An Exclusive Leads Distribution Application (by Zip Code)

Often referred to as a plug-in SaaS to the agency principal’s website, this application must allow each subscriber to create and manage any combination of request types, i.e. line of insurance. Additionally, subscribers must be able to assign and change any URL address within any of the assigned 42,000 zip codes within the United States.

I understand that many of my readers are asking “so what?” as to why this type of SaaS is considered an essential digital pillar. Here’s why: because traditional SEO hardly works anymore, especially within large metropolitan areas. Every agency principal needs buy-in and support from their geographically dispersed 1099 producers. Keep in mind that most producers have their own social media accounts, emails and other network marketing strategies, independent of the agency itself. In turn, the agency principal needs these same producers to spend their own time and money in driving traffic to the website. That’s not going to happen unless each of these producers essentially owns the zip code(s) in their communities for the type of insurance they’re selling on behalf of the agency. Unless these producers are guaranteed an exclusive lead delivered into their web form, they’re not going to help, and you can’t make them! As most managers know, you can’t push a string, but you can always pull one.

Until recently the above-mentioned SaaS did not exist. Thanks to All-in-Digital Marketing, now it does. To learn more about this software, go to DMCObuilder.com. You’ll see how easy and inexpensive it is to utilize this critical digital pillar for growing your agency. No need for adding brick and mortar locations, or making radical changes to your existing website.

Producer-Level, API-Enabled Web Forms

Let’s first define what I mean by “producer -level API-enabled” web forms, starting with what is an API? An application programming interface (API) is a computing interface that defines interactions between multiple software intermediaries. This is a fancy way of saying it’s an interactive web form. The best ones within the insurance industry allow for prospects to get quotes and even buy from you online.

Examples of such APIs are Thimble and Briza Insurance, both of which sell business insurance through the agency distribution channel. Some examples of none “quote & bind” APIs can be found in personal lines multi-rater providers. ITC, Vertafore, EZ Lynx, and Applied Rating are just a few vendors that offer agency-level API web forms to their clients. While these vendors are not yet offering the “buy now” button, most will return and display online quotes to your prospects and notify the agency as well. Most offer data prefill for an additional cost, with the ability to export your prospects’ lead data into your CMS (Client Management System) for remarketing purposes. Considering the fact that most agencies don’t close the sale on the first attempt, clean data is good data and subsequently valuable in and of itself if properly managed. I will provide more details about managing your lead data in the implementation part of this paper.

While we all agree that there are many vendors that offer agency-level API enabled web forms, the issue now is what about the local producer? Even if your agency has a SaaS that will deliver exclusive leads into your API-enabled web forms by zip code, i.e. #3 above, what good is that to the local producer? How are they going to be able to claim and work with that lead? How are they even going to know that a lead came into the agency in the first place? Currently, there are no vendors offering producer-level, API-enabled web forms. Fortunately, we at All-in-Digital Marketing have resolved that problem too.

Introducing Wrap My API.com. the solution to this specific problem. The purpose of WrapMyAPI.com (WMAPI) is to maximize the online presence of the local producer, allowing prospective customers to interact with that producer’s agency principal’s API enabled web form without giving up credit for any lead information provided by the prospect within the applicable web form.

Your fourth digital pillar is now complete.

Once the agency principal’s API web forms are wrapped by WMAPI for every outside producer, your fourth digital pillar is now complete. Each producer can freely use their wrapped web forms within their own social media accounts, emails, and any digital marketing co-op they choose to join. They can be confident in knowing that each of their wrapped agency webforms identifies them personally as the agent of record, displaying their name, their photo all while offering the prospect the ability to click to call, text, or email them with any questions while interacting with the agency’s web form.

Additionally, you, the agency principal, can now give these same 1099 producers the incentive they need to spend their own time and money driving traffic to your website if you subscribe to DMCObuilder.com. How? By assigning your producer’s web forms to the zip codes within their communities, selling on behalf of the agency online. This can be done without the need for adding any brick-and-mortar office locations for the agency. While WMAPI was designed to work with a DMCO builder account, it works perfectly fine by itself as well.

Please visit WrapMyAPI.com today to learn how inexpensive and easy it is to subscribe. As a local independent producer, you have nothing to lose and much to gain for you and your agency principal. Try it out for free for 30 days without submitting credit card information. Any agency principal, can subscribe to WMAPI for themselves, and on behalf of their 1099 producers as well, managing multiple web forms within one account.

A Final Word on Integrating Your Four Digital Pillars

Before moving on to the topic of implementation, you must first be sure that your data flows accurately and easily between the data and technology vendors that are providing the components and plug-ins of your business’ four digital pillars. If your CMS vendor is the same company that offers your agency multi-rater web forms, moving your data around will most likely not be an issue. The same would apply if your CMS vendor is also providing your automated email marketing system, your CMS text messaging, and/or your website consumer portal plug-in.

Regarding integrating your VoIP with your CMS, many CMS vendors offer an option within your CMS that automatically opens up a client’s file once a phone number is recognized from an inbound call. This feature is best suited for use by your customer service staff.

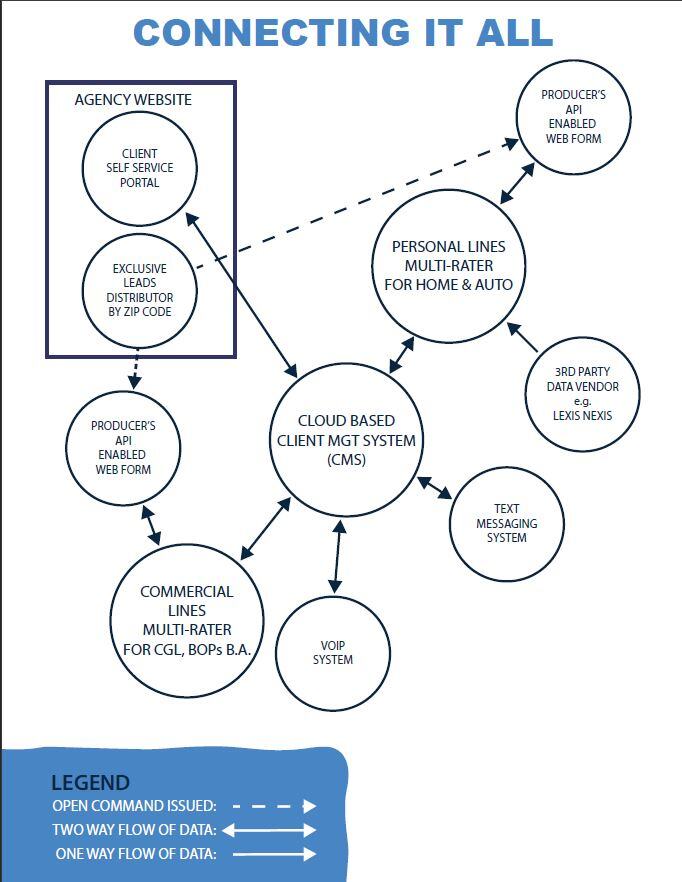

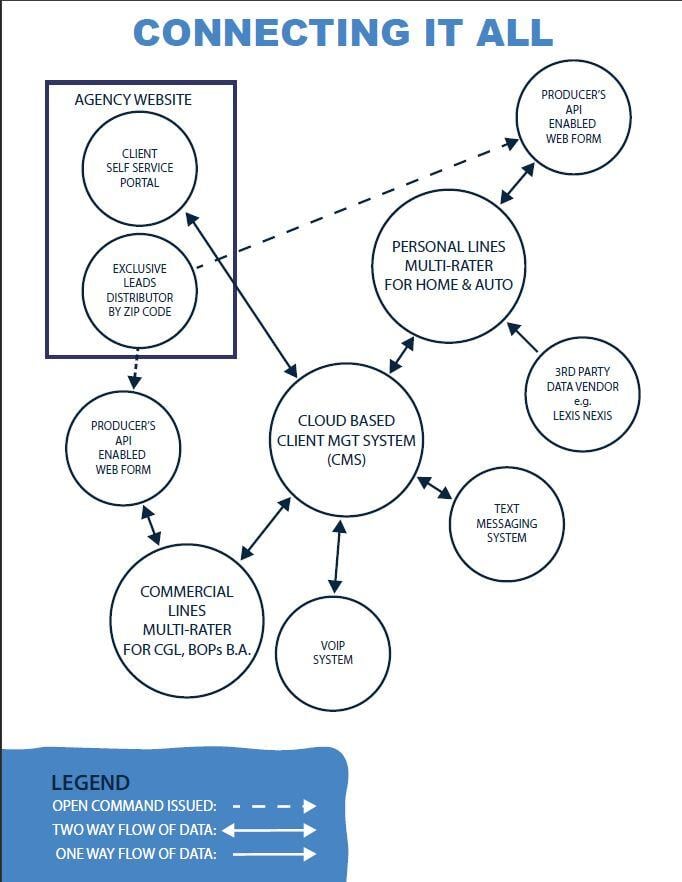

Below is a diagram that illustrates the flow of data within the 4 digital pillars, 3rd party data vendors, and the available integrated data touchpoints. Note that data is illustrated with solid lines with arrows on both ends for a two-way flow, a solid line with one arrow for a one-way flow, and lastly a broken line with one arrow indicating a command to open the producer-level API web form.

For a simpler diagram, I have omitted the flow of data between the multi-raters and insurance carriers. Additionally, omitted is the data flow, by way of IVANS downloads, between the carriers and the illustrated CMS.

Implement

Now that you’ve assembled the four digital pillars, the first step in implementation is to establish the workflows for organic new business, customer service, cross-selling, and retention. At the same time, you need to determine if your current organizational structure and agency job descriptions support your new business model. Examining successful independent agency business models is a good place to find areas of change within your own.

Agencies that operate a geographically dispersed sales force, supported by a centralized call center (i.e. home office) for customer service have proven to be the most successful. Unfortunately, these franchise agencies usually come with a high price tag and a high overhead since most require the franchisee to open a physical office location within the communities they serve. This is something that is no longer necessary if you utilize all four of the digital pillars mentioned above. Still, for heavily populated urban areas with multiple zip codes, you may want your 1099 producers to share in the cost of an executive office space. This will help your agency’s website by improved SEO results. I recommend going to Regus.com or EasyOffices.com to learn more about flexible executive office leasing options.

Assuming you’ve decided to support your geographically dispersed 1099 agency force with a centralized customer service office, and have already set up and integrated the four digital pillars, here are the next sequential steps to take in order to implement your plan:

- Write job descriptions for outside 1099 producers, internal sales, and internal customer service representatives (CSRs). I strongly recommend keeping customer service functions separate, centralized, and not mixing your internal sales representative’s job descriptions with your CSRs. Internal sales reps. should also be responsible for cross-selling and account completion campaigns for those clients that don’t already belong to an outside 1099 producer.

- All inbound sales calls should be entered directly into your website’s API-enabled web forms for correct routing of leads for producers assigned to the zip code and policy type in question. Keep in mind your VoIP should also be configured to allow prospects to choose an agent from your directory in order to minimize the need for internal salespeople entering in prospect information on behalf of your outside producers. Having producer-level webforms assigned to zip codes will also reduce the number of inbound sales calls too. Inside sales agents will of course have their own assigned zip codes and policy types as well.

- The use of paper within each step of managing a prospect’s file is to be avoided. You simply cannot standardize your workflows, grow your agency, and reduce your E&O exposure if you’re still including paper documents within your agency’s operations. With the advent of fillable PDFs and e-signature services, paper documents are no longer needed.

- Have an internal underwriting & marketing department or at least assign designated employee(s) for these functions. This will be necessary to assure that new business quotes and submissions are properly done along with correctly built prospect and/or client files inside your CMS. Remember that over 75% of all prospects do not buy from you the first go around, and you’ll need to get them into your automated email marketing system asap. Additionally, new clients need to be thanked and entered into your email marketing system for cross-selling and retention emails.

- Write training modules for every step of your client’s life cycle for each line of insurance your agency provides. Tailor each step to reflect your agency’s technologies that are being utilized, taking advantage of vendor-provided training videos and documents. Make a master copy of your agency’s training manual to be included with each training module. Training reference documents should include applicable website addresses for training videos, carrier and MGA contacts, and a quick reference matrix for underwriting guidelines and appetites. Be sure to update your training modules as either your workflow and/or technology changes. Utilize a numbering system to identify the most current edition of your training modules. Below is an example of a training module for quoting a personal auto policy prospect.

- Train your trainers. Start with the person who puts together the training modules and their associated training documents. That person(s) should be able to demonstrate how each of the training requirements is done to you the agency principal, before training of others begins. This is consistent with the training acronym PESOS. Prepare, Explain, Show, Observe and Supervise. Once a training session is finished, a copy of the employee’s and/or agent’s training modules should be scanned into their employment file, adding to it as changes occur to your training program.

Grow

Now that your new digital agency has been built and your processes and procedures have been standardized with training modules in place, you are now ready to start recruiting. That said, here are a couple of administrative actions that need to be done or confirmed first.

- Before moving into a new state of operation, the agency principal needs to hold an out-of-state license for those lines of insurance she wishes to sell. This also assumes that she is recruiting only licensed producers within that same state.

- Carrier appointments need to be confirmed.

Like any sales source you have, referrals by networking will always yield the best results for highly qualified recruits. Having a “Become an Agent” page on your agency website for candidates to review and reach out to you is critical. This page needs to give candidates compelling reasons as to why they should join your team. Showcasing your agency’s four digital pillars is a start. Tell your candidates how they will be provided exclusive leads from the community where they live, along with the necessary customer service support, so they can focus on acquiring new business. Remind them that your technology allows them to work from anywhere without the need for a brick-and-mortar office. If applicable, remind them that you offer producer-level quote & bind web forms for the types of insurance they’re licensed to sell, and they can use these same web forms in their social media accounts, emails and within any co-op they choose to join. This is all in addition to their forms being used exclusively within your website within their assigned zip codes.

Promote a low out-of-pocket cost for becoming a 1099 producer, and the fact that you pay competitive new and renewal commissions. Lastly, I recommend offering extended earnings and/or a book of business succession program for their retirement as well.

Vendor Provided Recruiting Tools

If you don’t have a strong network for generating new agent referrals here are a couple of suggestions to consider.

- Purchase licensed agent lead data. An example is bookyourdata.com, they offer both name and personal email addresses for licensed agents in all states. You may also want to check with your state’s department of insurance to see if they offer an exportable data base for email marketing purposes.

- Once you have an exportable data base of licensed agents, you need to subscribe to a B2B lead generating email service. These are not to be confused with any opted in email marketing service like Mail Chimp, Constant Contact or your agency’s automated email mail marketing system previously discussed. These vendors specialize in cold call emails, that are still compliant with email regulatory requirements. Nor do they use your websites email address, in marketing campaigns. This practice helps keep your domain from being black listed, i.e. labeled as a spammer. An example of such a vendor is ClickBack.com.

- Advertise in your agency’s social media accounts.

- Advertise in industry trade journals, both for and not for profit organizations that cater to the independent agency distribution channel.

- Trade fairs, both local business franchise related, and insurance industry specific within the states you wish to add 1099 producers.

I sincerely hope you’ve found this white paper of some help as you move forward in making changes to your agency, so you can succeed and grow well into the future. Remember the way you win against the direct writing insurtechs is to match their strengths, while offering your clients something they will never be able to offer. That is to say, by giving your clients both the online 24/7 availability they want, along with a local agent. The complexities and constant changes within our industry still requires the services of a caring and knowledgeable local professional. Being known by, and available to your clients is still important.

You now have at your disposal, the tools and knowledge required to make this happen. The question is do you have the desire and will to do so? I hope so for all our sakes, least our noble profession goes the same way as the local travel agent. It’s time to change, it’s time to prove the Nay Sayers wrong. Not on our watch will the agency distribution channel fail to serve our communities. Thank you for taking the time to read this paper. I wish you the best of success as you do your part in securing the future of the local insurance agent.

About Carl Moulton

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com. I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com.

I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.