The classic bricks and mortar business model for the 21st-century insurance agency is broken. It is too expensive, unnecessary and unwanted by consumers. That said, local agents are still important to everyone involved in the sales and service of insurance products.

So, what’s the problem?

Local SEO results for Google and other search engines are rooted in a business’s ‘physical address. This is fine assuming you’re selling pizza or other tangible products within your community. It’s not fine if you sell an intangible product like insurance. Before we go any further, let me explain where the agency distribution channel is headed, and what it’s starting to look like today.

The 21st Century Insurance Agency

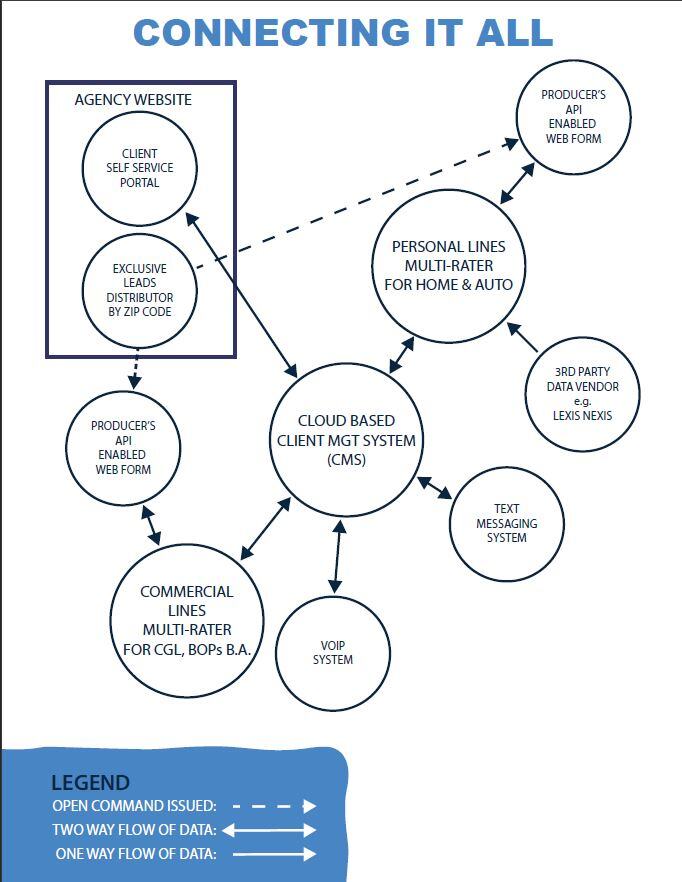

As stated above, the traditional local bricks and mortar insurance agency is too expensive, unnecessary and unwanted by most insurance consumers today. Thanks to cloud-based CMS/CRMs, VOIP phones, e-signatures, automated email marketing systems all combined with local producer web forms, and exclusive leads SaaS applications within an agency’s web site, agencies can effectively manage multiple producers from one centralized office within any state of operation. This frees up the local producer to work from home, focusing on their “natural markets” within their communities, utilizing referral networks, social media, even DMCO (Digital Marketing Co-Operative) participation to get found on-line. This type of business model allows for the agency to grow inexpensively and easily all while being fully compliant with their state’s regulators. That said, operational oversite can be maintained by the agency’s centralized office along with field management assigned to local producers as well.

At the end of the day, consumers want it all. They want both the speed and convenience of the web, i.e. the Amazon shopping experience, as well as be able to get help from a local knowledgeable agent without having to go to an office. Agencies of the 21st century that operate this way will continue to support their local economies much better than direct writing carriers like GEICO, Lemonade or Next-Insurance ever will. For all the right reasons, buying insurance from a local professional still matters, but face to face agency office visits do not. Face to face can still be done at the local coffee shop, or in the case of mid to large market commercial accounts, just like always, at the insured’s location of business.

Back to the Problem…

Thanks to the above-mentioned technological advances being applied to the agency distribution channel, not just to Insurtechs, it has now become easy to supported multiple producers, located in numerous communities, via one agency’s web site all while giving the consumer an Amazon shopping experience from a local insurance agent. The problem has to do with the inability to utilize SEO techniques beyond a limited number of communities where physical agency offices don’t exist, but available, local, knowledgeable, licensed producers are in fact residing within these same communities but are not being credited for SEO purposes.

This problem places the 21st-century insurance agency at a clear disadvantage to the big-budget, call center driven high tech D2C/D2B insurance companies when it comes to getting found online by local insurance consumers! After all, no one goes past page one for searches. These same carriers don’t rely on SEO. In fact, they mostly spend their digital marketing dollars on paid per click, banner ads and offline advertising. All to the tune in excess of 1 billion dollars a year in some cases, e.g. GEICO. While you might say so what, it’s all about competing online for the consumer’s insurance dollar, I say sure but at what cost?

If I was selling a true commodity then you definitely have a point, but we’re not selling a commodity. We are selling an important and sometimes complicated promise to people and businesses. We are essentially promising to show up with our checkbooks to take care of our clients in times of need when something bad (and insured) happens to the buyer of our promises. To remove the local agent from the equation in the sale and service of insurance (all to save a couple of bucks) is truly a disservice to the local insurance-buying public.

….. and a Possible Solution

I first want to say that I greatly appreciate and depend upon Google for so much of my daily life’s activities that Google now makes easy to do. So, what do I propose?

In a Word, Verification…

This is something Google does for every search, but instead of verifying bricks and mortar locations, they can just as easily verify both the state licensing and the residential address associated with the producer’s license, which if someone really wanted to know, is in the public domain anyway. To be clear, I’m not suggesting that human eye balls should be able to see on the agency web site the local producer’s residential address associated with their insurance license, but the web crawlers should.

For example, Sue sells and services insurance in Tampa, but her principal agency’s main office and service center is located in Orlando. Sue works from home in Tampa, and her insurance license confirms the same address. Her bio on the agency web site says she resides in Tampa. Google and for that matter, all other search engines should give SEO credit to her agency principal’s web site for Tampa for all the reasons stated above. Should the SEO juice received be at the same level as a brick and mortar satellite office for the agency? Probably not, but some juice should be given to the web site since Sue does live, sells and services insurance in Tampa.

In conclusion….

I learned long ago if you’re going to criticize someone you respect and admire, you better be able to offer up a viable solution. In other words, while the classic bricks and mortar business model for the 21st-century insurance agency is broken, the solution is already being implemented. Insurance agencies now need a little help from Google to recognize and give SEO credit for this solution, i.e. the agency distribution channel model best suited for the 21st century.

About Carl Moulton

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com. I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com.

I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.