As Elizabeth Rush Kruger reminds us in her book “The Top Market Strategy – Applying the 80/20 Rule,” the Pareto distribution rule is both universal and alive and well, impacting every legacy insurance carrier’s bottom line. In other words, 80% of every carrier’s positive results are coming from 20% of their agents. On the other hand, 80% of the carrier’s negative results are coming from a different 20% of their agents. What makes this truth so profound in the property and casualty insurance business is the added requirement of profitability to the goal of market share growth. As most of us in the industry know if management doesn’t know which agencies fall into which 20%, any marketing campaign is destined to fail. Since insurance is an intangible product; one which can easily cost the seller far more than what it’s sold for, profitable growth in the P&C business requires a team effort between sales, underwriting, claims, and actuarial departments in order to identify and manage each group of agents. Without receiving balanced input from each of these disciplines, as the carrier’s digital marketing programs are being developed, the goal of achieving profitable growth becomes more like an exercise of trying to nail a cube of Jell-O to a tree! So then how can DMCOs (Digital Marketing Co-Operatives) be used to leverage the 80/20 rule in favor of those carriers that utilize the agency distribution channel?

First some Required Assumptions

These carrier assumptions are:

- The insurance carrier has a good handle on which desired market’s they’re profitable and competitive in (i.e. by line, by demographics and by rating territory).

- The carrier also knows which of their producers are doing the job of writing profitable business within these targeted markets.

- The carrier maintains good monitoring activities with regular feedback and input from the four above mentioned departments in order to make intelligent adjustments to their digital marketing efforts.

Assuming all of the above is true and the legacy carrier’s digital marketing team has established an open line of communication with its agency operations management team, that’s when the implementation of a DMCO will yield its best ROI.

So, what exactly is a DMCO again?

A Digital Marketing Co-Operative is nothing more than an online version of a traditional cooperative. Co-Ops have been utilized by almost every single industry in the USA, everything from local farmers to attorneys. Traditional insurance agency co-operatives usually consist of co-branded direct mail, newspaper, radio, and cable TV ads with both the agent and the insurance company financially contributing to co-op ad campaigns.

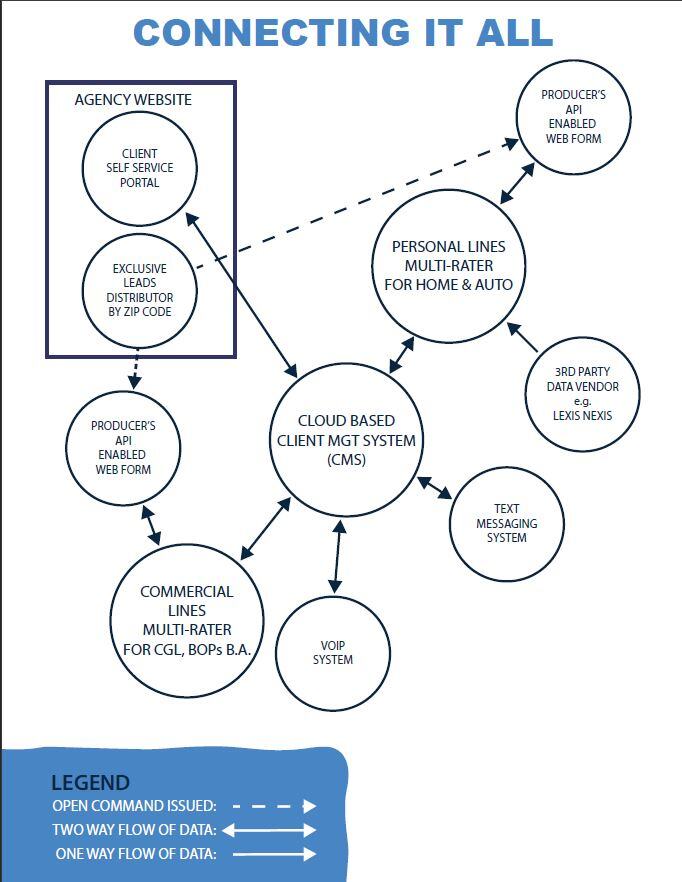

An insurance agents’ DMCO allows otherwise competing agents to each own a zip code(s) and type of insurance to be quoted. That way when consumer land on the DMCO’s consumer portal looking for a quote, each participating agent will receive an exclusive lead delivered into the technology (i.e. web form) of their choosing for the zip code they own. What makes a DMCO significantly better than a so-called exclusive leads vendor is the ability to control the lead data. If the producer is provided a personalized carrier web form that is tied into the company’s rating engine the control of the lead data lies exclusively within that appointed agent’s account with the insurance carrier. For truly captive agents this decision is a no brainer. For independent agents, the choice to use a carrier provided producer level web form (versus using a multi-rater web form) must be financially incentivized by the insurance company’s co-op funds. So, what’s in it for the insurance carrier? In a word, leverage, specifically the ability to leverage the 80/20 rule to their mutual advantage. Through DMCO participation carriers can sponsor their very best producers within each specific target market.

How does a legacy carrier best utilize a DMCO?

As previously stated, what makes a DMCO unique and better than any so-called exclusive leads vendor is the ability to own and control the lead data through the use of the technology of choice, i.e. producer level web form, for each DMCO participant. Carrier provided producer level web forms combined with a DMCO engine such as 1Lead1Buyer are the key components of any successful DMCO.

Why Producer Level Web Forms are Critical

Within almost all successful insurance agencies, you will find more than one licensed insurance producer. Additionally, agency principals usually assign product line specialists within their agencies. That said most of these same agencies only have one web form for each line of insurance they sell. Leads that come in from agency web sites are usually distributed to a group of people, with inbound leads being addressed only during regular business hours. Unfortunately, with today’s instant gratification insurance consumer, this is unacceptable, especially when the direct writing Insurtechs are offering consumer portals equipped with quote & bind web forms supported by call centers with extended hours. At the end of the day, until the local producer is armed with the same technology, the agency distribution channel is at great risk of going away, especially for the sales of personal lines and small commercial accounts. That said, the opposite is true if and when the local producer becomes equipped with quote & bind web forms of their own.

In Conclusion

While it is true that some legacy carriers have added or switched distribution channels in order to market directly to consumers, the idea that they will ultimately cut expenses and earn a better ROI by going direct simply hasn’t materialized. By offering each licensed and appointed producer their own quote & bind web forms a much better opportunity exists, especially when coupled with DMCO participation and support. To learn more about what makes for a good producer level web form visit 1Lead1Buyer.com.

In conclusion, the best way legacy carriers can leverage the 80/20 rule in their favor within the landscape of digital marketing is by offering the local producer (not just agency principals) their own mobile responsive web forms at the same time participate and promote the use of DMCOs within their target markets. This needs to be done by financially supporting their best producers, paying either all of some of the producer’s DMCO monthly subscription dues.

As always, your feedback by way of comments and/or criticisms is greatly appreciated. Please do so by sending me an email at carlm@floridainsurance.com.

About Carl Moulton

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com. I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com.

I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.