On February 28th, the inaugural event held by InsurTech New England brought together 80 insurance professionals in Boston to delve into the intricacies of modernizing brands entrenched in legacy systems.

On February 28th, the inaugural event held by InsurTech New England brought together 80 insurance professionals in Boston to delve into the intricacies of modernizing brands entrenched in legacy systems.

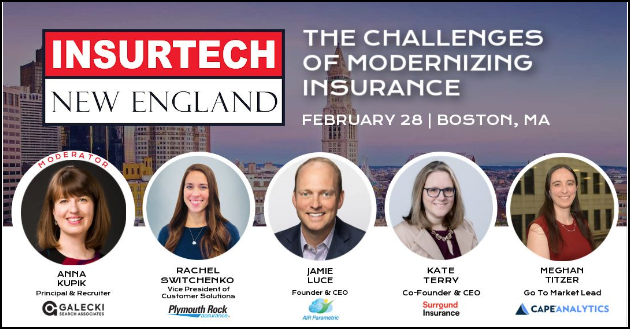

One highlight of the evening was the panel discussion “The Challenges of Modernizing Insurance Startup & Incumbent Views,” a timely and interactive conversation particularly as the insurance industry grapples with rapid technological advancements amidst aging legacy frameworks.

Moderated by Anna Kupik—Principal and Recruiter, Galecki Search Associates—the panel included distinguished guests from across P&C insurance segments: Jamie Luce (Founder & CEO, AIR Parametric), Meghan Titzer (Go-to-Market Lead, Cape Analytics), Rachel Switchenko (VP of Customer Solutions, Plymouth Rock Home Assurance), and Kate Terry (CEO and Co-founder of Surround Insurance).

The conversation covered a spectrum of front-of-mind topics, from adapting to evolving consumer needs to navigating challenges in different market segments, as well as using data efficiently, implementing AI, and managing industry-wide profitability issues.

“What emerged from the discussion was a sense that our community—legacy and tech-enabled carriers alike—face similar challenges, even if approaching them from different perspectives,” said Kupik. “At the heart of the need to modernize is the more digitally-aware and evolved insurance customer. This dialogue was a great kick-off for the growing, engaged InsurTech New England community.”

The Responsibility to an Evolving Insurance Customer

The Responsibility to an Evolving Insurance Customer

Terry emphasized that insurance tends to overlook younger customers at its own peril, and that industry perception of customer lifecycles may be as outdated as legacy systems are. “Of course we’re there for your first auto insurance policy,” she said. “But that assumes that if you’re a younger person, you’re playing the cookie cutter game of life, right? You spin the wheel, you get your first apartment, and then you buy a car, and then you get a condo, and then you get married, then you have a pet, then you have 2.5 children… but nobody lives that way anymore.” Add in the precariousness of higher prices, inflation, layoffs, difficulty finding gainful employment, she sees that “a lot of that stress falls on younger adults.”

She reminded the audience, “it’s been our job throughout all the generations that insurance people have been insurance people to take care of people who are exposed to risk. And our industry doesn’t adapt fast enough for those younger consumers.”

She underscored that it is the responsibility of insurers of all shapes and sizes to combine great advice with an easy, tech-enabled experience so that policyholders “can feel safe in this modern world.”

Balancing Profitability with a Shifting Risk Landscape

Part of feeling safe in that world is knowing insurance companies have their fingers on the pulse of a shifting risk landscape while maintaining profitability. “Loss for multi-line carriers is, particularly in the US, is incredibly hard to manage,” Luce said. “Not only do you have property values at exorbitant rates, and a lot of risk and concentration on the coast, but now you’ve got massive nuclear jury verdicts on the liability side, compounding those issues. So there’s been pressure to keep the rates and the underwriting to maintain consistent loss ratios.”

“It’s been an issue the last several years that the industry has lost a lot of money on the property side, particularly the severe effect of storms, particularly the Midwest,” agreed Titzer. “We collectively as an industry have a profitability problem. Using data to become more efficient and addressing those issues, I think is important to a lot of people.”

Implemented effectively, AI and data are shifting how both legacy and new companies are getting to a better technical underwriting price, and therefore hopeful loss ratios and combined ratios will follow—especially in CAT-intensive property markets.

AI: Fatigue-Inducing or Facilitator for Customer Excellence

Whereas AI has achieved buzzword status, every panelist on stage and most members of the audience acknowledged they are using AI to become more efficient in their insurance roles, with ChatGPT or other chat tools being the most prominently used.

Switchenko pointed out that AI is not new, even if the inundation about it feels new to insurance professionals. Wearables, drones, chat bots, and other automations have been around the industry for a decade or more. “It has been around for a lot longer than we’ve been calling it AI,” she said. The responsibility lies with each company to accurately evaluate what challenges AI can solve for their customers. “Don’t just say, ‘Hey, this thing is shiny and new and we need to do this,’” she cautioned. “Ask yourself: What is the customer really looking for? What are they willing to pay for?”

Titzer agreed, “this is not a new problem at all, adding her company provides aerial imagery or models that offer underwriters insight into roof age or roof condition. “Add in all the data you could get from a customer at the end, they can now take pictures of their houses, without you having to go send out an inspector.”

All of the panelists agreed that AI isn’t a total replacement for underwriters, risk management, or even more traditional insurance processes. But it should be part of the toolkit that augments delivery to customers. “Ask yourself, how does this resource actually help improve the customer experience? How does this help improve the accuracy or quote, does it actually give us better information than what we had before? Are we just adding a million questions to the customer?”

Switchenko advised the importance of putting guardrails around use of AI, and ensuring that any data you use is your own. Terry agreed, stressing that at her company Surround Insurance, team members are encouraged to use ChatGPT but know never to include personal, proprietary, identifying information.

On the actuarial side, Luce sees AI as making the math and financial processes in the industry more efficient.

How Market Segmentation Impacts Digital Adoption

Across small commercial, middle market, and global corporate segments, who is winning the race to implement digitalization? According to Luce, nuanced elements contribute to success or challenges rather than a binary “win or lose” scenario.

“Small commercial companies have lots of policies, pretty stable losses, and a lot of expense and disconnect in distribution,” Luce said. “If you’re in the small commercial space, you need to be focused on agent distribution and connectivity,” and you don’t have the luxury of being expensive because you need to grow customer volume—which can’t be done without a solid network of agents.

In the Middle Market commercial sector, Luce observes the challenge of needing to accommodate both smaller, independent agents and the big national and global brokers. “The bigger and corporate sized accounts spend more money on risk management, claims management, data, and tend to be more connected to the customers,” who at the larger end, have risk managers and greater sophistication around risk and insurance.

At any size, Luce notes that newer players have an advantage of being able to “lay down new tech, and be slick and fast. But you don’t have [a sizable customer base] or leverage with distribution.” On the flip side, he says, large legacy carriers have the advantage of an existing customer base, but are dealing with the complexities of managing extensive infrastructure. The exchange underscored the intricate balance required for success in the dynamic insurance industry.

Moving Forward Collaboratively

The event proved to be a pivotal gathering for insurance professionals navigating the evolving landscape of the industry.

“Even where differences exist across size, segmentation, and history in the industry, there is a lot of common ground in both the challenges and opportunities that modernizing approaches present,” said Kupik. “We’re excited to see more discussions like this as InsurTech New England grows.”

Members of the burgeoning InsurTech New England community seem aligned on “insurtech” no longer defining a segment of the insurance economy, but being something everyone participates in—the modernization of an industry for a more digital population that is eager for the benefits tech-empowered solutions can bring.

Kupik closed by asking panelists and the audience to reflect on what insurtech means to each of them.

“Insurtech is a state of mind,” Terry shared.

About Brett McKenzie

A veteran of Zurich, Fireman’s Fund and Allianz, Brett brings extensive go-to-market and appetite communication experience to her role as Sales Leader at EvoSure. She is based in Chicago.

A veteran of Zurich, Fireman’s Fund and Allianz, Brett brings extensive go-to-market and appetite communication experience to her role as Sales Leader at EvoSure. She is based in Chicago.