This article became the base for a whole chapter on our 2017 Best Selling Book “Insuring Tomorrow: Engaging Millennials in the Insurance Industry”.

Lots of companies are struggling with retaining their Millennials, who have thus far proven to be a fickle bunch. A survey in 2013 revealed that a third of the responding companies admitted to turnover of 15% or more of their Millennial employees. This is one of our favorite topics and we have given some ideas before on how to make the most of your Millennials, but this one idea we offer today is so big, we wanted to make sure it got its own article.

Remember when tuition was a thousand dollars for the year and you used to work the summers and make enough money to pay for college without taking student loans? We don’t! But our parents have told us those were the good old days…

It’s no secret that Millennials are the most educated generation ever, but also the most indebted for that education. When we made this suggestion on Nationwide’s in-house social network, Yammer, last year, it received wide support from the Millennials who largely swore this would win their loyalty, but then came replies complaining that it’s unfair to help Millennials pay for their outsized student loans when they should have just worked through the summer to pay for the whole year of tuition and thereby avoided student loans.

While many millennials worked evenings, weekends, and summers all through college, paying their full tuition out of pocket was simply not a possibility because the cost of college has increased by 1,120% since 1980. That’s not a typo. Tuition has increased to more than 10 times what it used to be. In 1978, when today’s 55 year olds were starting college, total tuition, room and board at the average public university was just under $ 2,000, minimum wage was $ 2.65 an hour, meaning it would take you 752 hours of work (not counting taxes) to pay for school for the year. By 2006 when today’s 26 year olds were starting college total cost had risen to $ 11,034 while minimum wage had only grown to $ 5.15 so it would’ve taken you 2,142 hours of work (again not counting taxes). For most people, it became literally impossible to work their way through school to avoid student loans.

One of Tony’s very good friends from Nationwide Insurance, started working there full-time in the mail room right after high school at the young age of 19. She took advantage of Nationwide’s tuition reimbursement program and got both her Bachelor and Masters degrees part-time while also getting promoted several times out of the mail room, into a finance position and finally into a very awesome middle level role. She was incredibly smart to go this route, and we should use her as an example for future generations on the smart way to pay for your college while getting real life work experience.

Unfortunately, most Millennials didn’t get such great advice, instead we were generally told to follow our dreams, go to the best school you can get into regardless of cost, study what you love, and give it your best. We were told we’d get a great salary once we graduated, and we believed it. Then, we graduated into the greatest economic recession in 80 years and found ourselves to be over-educated, moderately-paid, low-level employees. Sadly, middle class salaries didn’t inflate to match the 1,120% increase in tuition.

Most large companies generously offer $5,250 a year for “tuition reimbursement” which is great. Unfortunately, this can only be used to pay for tuition expenses incurred today, not to repay the tuition from a few years ago that allowed Millennials to get in the door with the company.

There it is. The one benefit that will make a huge difference in retaining your Millennials: retroactive tuition reimbursement! Nothing beats the loyalty you’d get if you started allowing us to use the tuition reimbursement money to repay our existing student loans, which after all were used to get us in the door. Would you have hired us without a degree? Nope, we didn’t think so. Realistically, Millennials are not the only employees who would appreciate this benefit, either. Many Gen Xers still have student loans up for repayment, and Baby Boomers may have student loans if they were laid off during the recession and went back to get further schooling.

We understand that current IRS regulation doesn’t allow tax-preferred treatment of retroactive tuition reimbursement but that doesn’t mean it’s impossible to provide the benefit. In the short term, employers could simply do it in a taxed manner, just giving their employees the $5,250 and retaining the taxes, so we’d end up seeing something like $3,500 after taxes. Then, help us lobby for change to the tax code to get tax-preferred status in the future. Employees want to see the companies they work for supporting the causes that truly affect them; and lobbying alongside us to get tax-preferred status for a valuable benefit would buy a lot of goodwill.

You can even make it contingent on performance, something like a bonus you only get if you meet the requirements, and the check could be made directly to your student loan servicer. You can even force repayment if we leave the company within a year or two, just like most companies do for tuition reimbursement.

Think about it. It costs the company 1.5 to 2 times our annual salary to replace one of us. You’re already offering the tuition reimbursement money. Offering it in a way that most benefits your employee force will save you a ton of money in the long-term, differentiate you in the hardening hiring market, and buy you a much more engaged workforce that will not forget you went out of your way to help with their student loans.

This crazy idea is not common, but it’s also not unheard of. The Feds are already doing this: Teach for America offers ,290 to pay off your student loans after 2 years of service and other federal agencies are allowed to contribute up to ,000 per year (,000 max total per student) to their employees for existing educational debt. It is also common practice in the medical and legal fields.

The point is let’s be creative. Let’s work together to come up with win/win solutions that will help an overburdened generation pay their student loans.

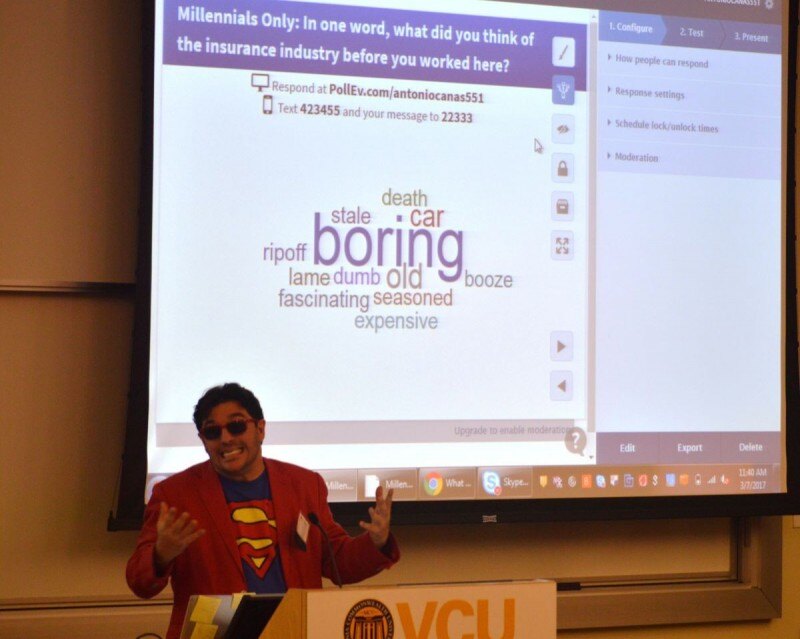

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.