2017 Update: We ended up writing a book about this topic and it quickly became a best seller. More info here.

Tony has been very active in the industry efforts to recruit and retain Millennials in the insurance industry. He led the session on the topic at the 2014 CPCU Society Leadership Summit in Phoenix, AZ and the 2014 CPCU Society Annual Meeting in Anaheim, CA, and he’ll be speaking in the at the Golden Gate CPCU Society Chapter this Thursday on the topic, too. Since we started working together, we’ve often talked about how tech companies do such a fantastic job of engaging their employees, and we believe the insurance industry could offset the well-documented generational crisis that the industry is seeing by implementing some of the tech industry’s low cost techniques. Below are 7 examples of the kinds of things insurance companies should consider doing to engage and retain millennials:

1. Make their first day memorable:

Remember the excitement of your first day of school? Many of us get the same giddy feeling when we’re going to our first day at a new company. We have high hopes for the future and are excited to set up a new desk and meet fellow employees. However, the first day is usually a lot of HR paperwork and IT hassles. In place of this, we envision a true orientation: an introduction to the culture, being handed your box of business cards, and finding your hardware and software all in place and ready for you to be productive from day one. Bottom line is, the first day needs to be more than the required HR paperwork, it needs to be something they can brag about to their friends.

2. Have a clear and objective evaluation system:

The expectations for your employees should be direct. Every employee ought to know how they will be ranked for their performance reviews, and there should be measurable objectives that have a clear and meaningful link to improving the performance of the company. We can all think of examples where we were given statistics on our performance that seemed to be kept simply for the point of having statistics, and if your employees are being rated based on these kinds of statistics, they will recognize it and become disengaged. During Carly’s time working in call centers, this was one of the most frustrating things. There were “metrics” that were measured which did not have a common-sense justification and often seemed to frustrate customers more than anything when she and her co-workers would try to fulfill them.

3. Give constant and honest feedback:

Millennials truly value feedback. They have grown up with it coming from many directions and typically being immediate, if not always fully candid. In the business setting, feedback can often be distinctly delayed and is still often lacking in full transparency. Many workplaces are still reliant on an annual or semi-annual review, and many managers could benefit from training on how to deliver candid feedback-a good resource is Fierce Conversations by Susan Scott, while their employees could benefit from learning how to receive it-we recommend reading Thanks for the Feedback by Douglas Stone & Sheila Heen. We are not saying they need constant positive feedback, we are saying they need constant honest feedback, and by constant we mean weekly! It doesn’t have to be anything formal, just a quick touch base with their manager, don’t make it too big of a deal.

4. Challenge them:

Many Millennials are high achievers. They grew up going from athletic practices to music lessons to drama classes and still fitting in full-time school and continued this throughout college. They are looking for careers that offer room to grow and will benefit from being given a stretch assignment. Most Gen Y’ers are used to working on teams and asking for guidance, so they’re typically not afraid to ask for help if they feel they’re in over their heads. If you’re going to remember one thing from this article make it this: Don’t make it easy, make it challenging and interesting. If it’s too easy it’ll get boring quickly, and they’ll run for the door.

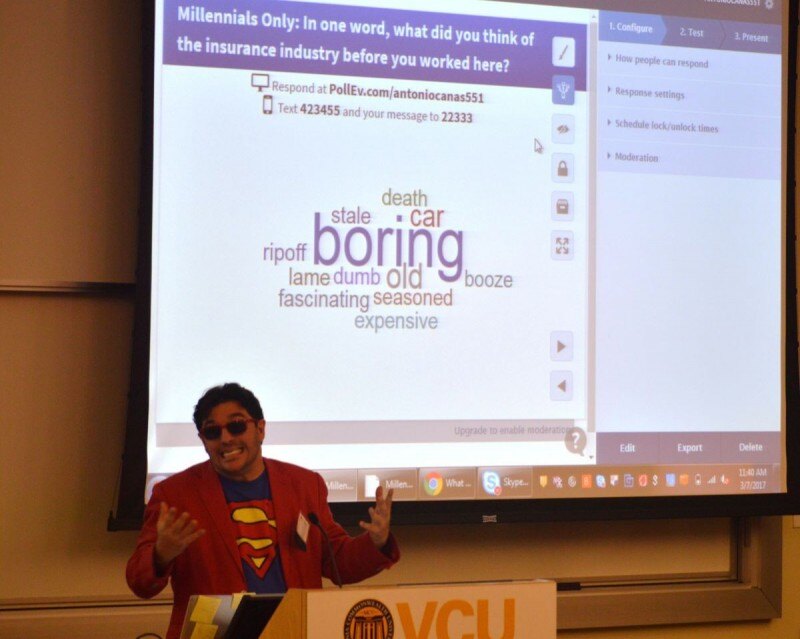

5. Ask for their opinion:

This generation is used to being asked for their opinion. Our parents often involved them in decisions that affected them. Even if the company can’t change a policy to fit our ideals or if the information you have doesn’t support following our suggestions, we will feel more like we’re part of the team if we are able to voice our thoughts, and we hear an answer explaining why the company is choosing to continue without change or adopting a different solution. And who knows, we might even have a good suggestion from time to time!

6. Become a Mentor:

Most of us have close relationships with our parents, and growing up, we have had teachers, professors, coaches, or other adults in our lives as mentors. Those are relationships that we value and understand. We want to learn from those around us who have had experience! There is a lot of knowledge in insurance that will be passed down verbally and learning a company’s culture is best facilitated through mentorship. This type of relationship can be rewarding for both participants.

7. Help them see possible career paths:

Entry level roles in the insurance industry have changed quite a bit recent decades. Twenty to thirty years ago, an entry level position for a college graduate might be a multi-line underwriter or a field adjustor. With the advances of technology, changes in the distribution channels and decades of corporate cost-cutting, most entry level positions that Millennials find themselves in are highly specialized. That is, you might start as an adjustor who can only handle the Medical Payments portion of an auto claim, or you might be a Customer Service Representative in a call center who only handles questions about billing.With such a small portion of the policy being your responsibility, it can be hard to understand how important insurance is to the economy and finding meaning in your work may feel impossible. This can get boring quickly for an educated Millennial and it’s hard to see the light at the end of the tunnel unless we show it to them explicitly. Showing these employees who are new to the industry the broader picture and educating them about what a long-term career could look like if they commit to the industry, exactly what they should be doing to grow, by educating themselves through designations and company sponsored training, is key to retaining Millennial employees. Make sure they know what an awesome industry to work in insurance is.

If you’re in the Bay area and would like to attend Tony’s “Recruiting and Retaining Millennials in the Insurance Industry” session at the Golden Gate CPCU Society this coming Thursday, January 15, please click here.

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.