This is the second, and final part, to our article from earlier this week. Make sure you check that one out if you haven’t yet for the first four forces.

5. Blockchain:

The best known example right now is BitCoin, but there are others, such as Etherium and RippleLabs. These are all decentralized systems for money transfer which could eventually be used for insurance and other risk management application. We can barely begin to imagine how this will evolve but we wanted to make you aware of them. The systems are set up to provide an avenue for the transfer of value without the need for the central structure usually provided by a financial institution. These systems may have an impact on the already growing cyber liability concerns. The systems may also affect claims payments and investment income. It’s a very complex world right now, and not quite ready for prime time, but keep an eye on them on the horizon and you’ll be among the first in the industry to understand it when it comes.

6. P2P Insurance:

Peer-to-Peer Insurance is essentially the idea of bringing people together through a social network, online, to share risk. In essence, this idea goes to the root of insurance, especially of mutual insurance and fraternals of the past, a group of people come together to split the risk of something between themselves. It can also be thought of us as bringing the power of captives into the personal lines side of the industry.

A few examples of P2P insurance are already in existence. Friendsurance, from Germany, which claims to be the first company to add social networking to the insurance equation, the company helps them buy insurance and then they use their social network to share the risk of their deductible. In the UK there is Guevara, which lets you pool your premiums online and any money left over from paying your claims at the end of the year stays with the group and lowers your premium for next year. Also in the UK we found BoughtbyMany, which allows you to create a buying group of like-minded people to buy insurance at discounted rates. People have created groups for “Over 50s with iPads and iPhone insurance”, “Travel Insurance for People with Diabetes” and “Labrador Owners Pet Insurance” among many others. You can create your own group or join an existing one and get carriers competing for your business. It’s something like program business for the personal lines market and driven by the consumer. France has InsPeer.me also using similar ideas.

Obviously not all will succeed, PeerCover, which was built on Ripple Labs technology already went belly up. It offered the opportunity to build “compensatory groups” where the group decides what it will cover and who to accept into the group. The company might have perished, but you can bet the idea will be improved and tried again.

7. The Sharing Economy:

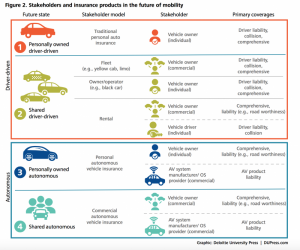

You can be pretty sure that the trend of increasing participation in the sharing economy will continue, because it makes a lot of economic sense and it appeals to the desires of the Millennials who are gaining more economic power by the day as more of them move up in the world. Insurance companies will need to adapt to the new world where people share instead of owning more and more. Airbnb, Uber, Lyft, and their ilk, have already started having their days in court but the answers to the questions posed in these cases are not always clear. A common thread is when is personal use supplanted by business use, and if our clients are using their personally owned property to profit, how does their personal insurance respond? Just a couple of months ago, Erie Insurance unexpectedly became the first auto carrier to offer an endorsement for Uber/Lyft work on their personal lines policy. For now it’s only available in a couple of small states but it’s a sign of bigger things to come. Disclaimer: Carly works for Erie, but on the commercial lines department and was not involved in the Uber/Lyft endorsement.

8. Wearables:

FitBit has started a craze in wearable technologies that allow us to measure in real time many aspects of our lives. A wearable is any smart device designed to be worn on your body. The FitBit, for example, lets you collect data on your health and activities throughout the day which you can later analyze to help you optimize your health. FitBit-like technologies will start to get integrated into our health and life insurance programs allowing the insurer to give discounts to those who manage to hit defined goals proving that they are leading an active and healthier life. More advanced wearables such as Google Glass also have the potential to change many parts of our industry allowing agents and risk managers to much better document visits to their customers, claims to make faster and better assessments of damage and maybe even sales to have access to up-to-the-second data on anyone they are trying to sell to.

Since we love under promising and over delivering here’s one more bonus force:

Bonus: Non-traditional companies using their reach for insurance distribution:

Walmart, Overtstock.com and Google (in the UK) are just a few of the companies that have not traditionally been insurance distributors but are getting into the game in different ways. We predict this is just the beginning. While Google, Amazon and Facebook are probably never going to become insurance carriers, they very much realize that they are sitting on a gold mine of information on their customers and are very likely brainstorming and preparing to bring out disruptive new ways to sell insurance to their customers. Think about it: If you are under 35 chances are all three of those companies have so much data on you that they could probably give you a personal lines quote without having to ask you to input any information at all. The question is not whether, but rather when and how, at least one of them will be jumping in. My bet is Google will be ready sometime this year.

This is kind of what it looks like when Google is coming after your business:

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.