Disclaimer: We try to write articles that are informational and interesting for insurance professionals, and we very rarely talk about our employers’ specific products or services. Whenever we do, we fully disclose the connection. This is one of those times. Today’s article is about a product that Tony’s employer, American Modern Insurance offers. We decided to feature this product because it is a great product that most agencies underutilize. This is not exactly a Sponsored Post since InsNerds is not getting paid to run it; Tony is on American Modern’s payroll.

Collector vehicles… Some are nostalgic. Some are fast and flashy. They’re all usually shiny, well looked-after and beloved by their owners. For most people that have them, their car is their baby, and good things happen when you help them properly protect their baby! That makes collector vehicles a fantastic lead-in for developing an insurance relationship with a new client, especially with high net worth families.

I know what you’re probably thinking. Wait a minute, aren’t collector vehicles fairly niche? How much opportunity can there really be out there?

While it is a niche market, the opportunity to get in the door with a whole new set of customers is fantastic. This year you insure their collector vehicle, next year they are more likely to give you a chance to quote the rest of their stuff.

Here’s a few reasons why it makes sense for you to write more collector vehicles:

1. There are over 11 million collector vehicles registered in the United States:

That doesn’t count every barn car waiting to be found, every salvageable junkyard hulk, or newer vehicles that have the potential to achieve classic status later. And many of the collector vehicles that are registered as such are insured under standard vehicle policies, which tend to be more expensive than a collector vehicle policy.

Why? Because a lot of agents either don’t fully understand the difference between collector vehicle and standard vehicle insurance, or don’t do a good job of explaining those differences to their clients.

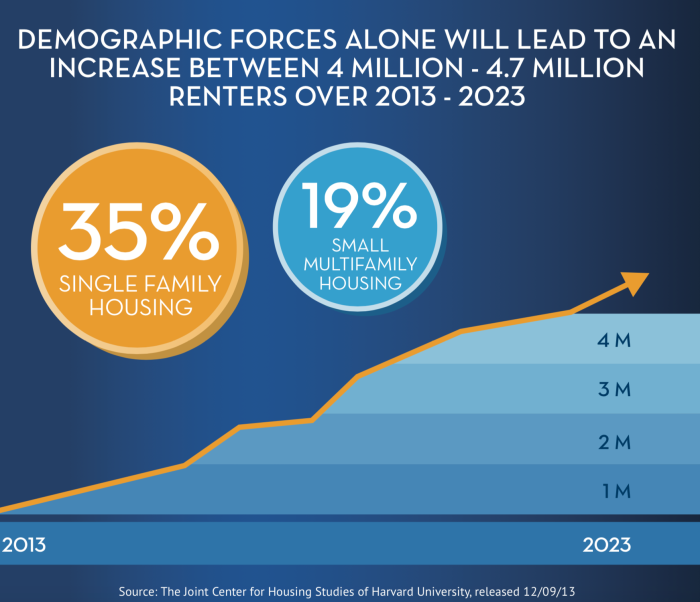

2. Industrywide, revenue from collector vehicle insurance is growing:

According to IBIS World, collector vehicle insurance revenue is on pace to grow $200 million between 2013 and 2018.

That may be partly a function of the rebound in the US economy, as more individuals have been able to afford luxuries. But it’s also likely attributable in part to a relatively low loss ratio.

Collector car enthusiasts love and baby their vehicles. They keep their vehicles under lock-and-key and they’re selective about when and where they drive. And they keep their cars well-maintained. All that translates into less risk on the books, and better profit share for you. You do get profit share for your collector vehicle business, right? If you write good business, you should be rewarded!

3. Collector cars appreciate in value:

In sharp contrast to everyday cars, collector vehicle appreciation makes them attractive not only to true enthusiasts, but to high-income investors. Individuals who have the risk tolerance to invest in collector vehicles are likely to have plenty of other assets that need coverage: homes, businesses, vacation properties, rental properties, and other toys (e.g., motorcycles, boats, etc.).

Additionally, many of these types of investors — and even many regular enthusiasts — own more than one collector vehicle. Thus, insuring one collector vehicle can serve as a fantastic opportunity for an agent to acquire multiple lines of business, and speaking of car collections, the more vehicles the better discounts we can offer them!

4. The collector vehicle market is not limited to old cars:

When most agents hear the words “collector vehicle,” they think of classic or antique automobiles. But the market is a lot deeper than that.

Any vehicle that is sought after as a showpiece is a collector vehicle. Some enthusiasts like classics and antiques, sure. But others look for sports cars and supercars.

Some collect specialty vehicles, like fire engines, military surplus vehicles, or technology demonstrators. Others seek out motorcycles, trucks, or collector car-associated memorabilia (e.g., old gas station fixtures and antique tools). The possibilities — and agents’ opportunities— are vast. As long as it’s in great shape, garaged and not their daily drive vehicle, we can probably help you insure it.

5. Like many other hobbies, there’s a cyclical element to the collector vehicle market:

Many collectors love having projects — they buy cars, fix them up, re-sell them, then buy more vehicles. That means there’s a good deal of turnover already built in to the market, so there’s always opportunity to be had.

Additionally, there are mini-fads within the hobby that become apparent from year-to-year. Some years, antiques are in. Other years, pony cars are the hot commodity. This year, high-performance sports cars were setting the pace at several bellwether shows.

That progression of popularity builds additional turnover into the market. Agents who write collector vehicle should pay attention and use it to guide their prospecting efforts.

Collector vehicles are an under-appreciated market. Develop your expertise and scoop your competition!

Collector vehicle enthusiasts are a pretty tight-knit bunch. But if you can learn how to talk like a “car guy” or “car gal,” you can open a lot of doors to new business.

It’s easy to get started. American Modern has developed an infographic that will help!

Now it’s time to put the plan into action! Find a gearhead buddy and start going to car shows. Walk around, take in the sights and the environment and ask collectors about their vehicles. You’ll find that the majority of them are friendly, ready and willing to tell you everything you want to know about their prized possessions.

This article is a modified version of my teammate’s Levi Fisher‘s article titled “5 Ways That Collector Vehicles Represent a Great Opportunity for Agents” that was published yesterday. Reposted with permission.

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.