Those crazy kids that Carly and I spend so much time talking about are now officially the largest generation in the workforce making up 53.5 million compared to 52.7 million Gen Xers and 44.6 million Baby Boomers. Those numbers are based on brand new research by the Pew Research Center, are accurate as of Q1 2015 and don’t even include the 1.8 million kids that will graduate from college this year. Millennials now make up roughly a third of the workforce and are on track to be over half by 2020.

Our insurance industry really can’t hide anymore. The average insurance agent is 59 and the average CPCU is 54. The Baby Boomers, who were born between 1946 and 1964, represent a huge percentage of our industry and they have served us well, with decade long tenures often in the same company. But the last Baby Boomer turned 50 last year. In the overall economy, 10,000 Baby Boomers will retire per day for the next 15 years. Out of 2.3 million professionals in the property & casualty industry in the US, more than 1 million are retiring in the next 10 years. That’s 43%! The industry is expected to create 400,000 jobs by 2020 and the few Risk Management and Insurance university programs only feed 15% of our staff needs.

Gen X is a smaller generation, 25% smaller than both Millennials and Boomers. While they will be absolutely necessary to maintain operations and to lead the industry as the Boomers retire, there’s simply not enough of them to fill the power vacuum.

The corporate world in general, and HR in particular, as it exists today was largely created to manage the very large Boomer generation and it really hasn’t changed much because the Boomers have remained the bulk of the workforce for decades, overpowering every other generation with their larger numbers. Now, the Millennials will be able to use their growing numbers to force the corporate world to change and compete for their services.

The Insurance Industry is doing valiant efforts to attract new talent with programs like InsureMyPath and InVest and that is absolutely necessary, but it is not enough. We have to retain and grow the people we have. Between 2008 and 2012, while hiring in the rest of the economy was frozen, we hired thousands of young college graduates and put them in entry level roles (especially at the big carriers), many of them in call center positions that were designed for high school graduates. As career options have improved with the economy, we will lose much of our young talent unless we can figure out ways to engage them and help them fall in love with the industry.

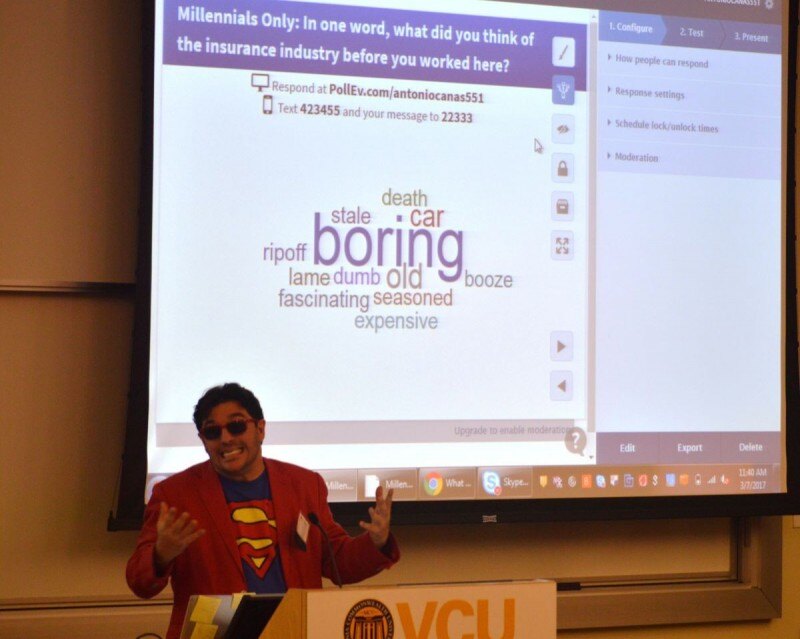

Carly and I have been very involved with this issue since we helped create the Des Moines chapter of Nationwide’s Gen Y Associate Resource group in 2012 and we have talked to many young insurance professionals around the country. Unfortunately, we have confirmed what McKinsey and Deloitte have found in their own surveys: Millennials think our industry is boring and even those that work in the industry have no idea of the amazing opportunities they’ll have if they stay and focus on growing. Every carrier and every agency needs to explicitly help their Millennials realize that this is a wonderful place to grow and help them visualize the career paths in the industry that are available to them.

This is a giant topic, and it’s very hard to give it justice in an article. If I peaked your interest in the demographic crisis and how to fix it, please take the time to watch the video of my session at the 2015 Ohio Insurance Education Day below:

Giving this interactive session is one of my favorite things to do. If you’d like me to speak at your industry organization or company please click here.

2017 Update: We wrote a bestselling book about this topic – Insuring Tomorrow: Engaging Millennials in the Insurance Industry.

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.