Disclaimer: We try to write articles that are informational and interesting for insurance professionals, and we very rarely talk about our employers’ specific products or services. Whenever we do, we fully disclose the connection. This is one of those times. Today’s article is about a product that Tony’s employer, American Modern Insurance offers. We decided to feature this product because it is truly a very cool product that is not common in the market, and we thought the article would be useful to a large variety of insurance professionals, especially high-network focused personal lines agencies. This is not exactly a Sponsored Post since InsNerds is not getting paid to run it; Tony is on American Modern’s payroll.  After the 2008 financial crisis slashed property values around the country, many investors rushed out to buy properties and got great value for their money. Today, 30% of the country’s housing stock is held as a rental. Whether they were buying them to hold as rentals or to repair them and “flip” them, those properties have traditionally been insured under DP-3 and DP-1 policies in the personal lines space. Most agents can handle this for their customers, but if one of your investors ends up with a lot of properties using separate personal lines policies can become a real hassle, and they are usually not purchasing the most appropriate coverages through a personal lines policy.

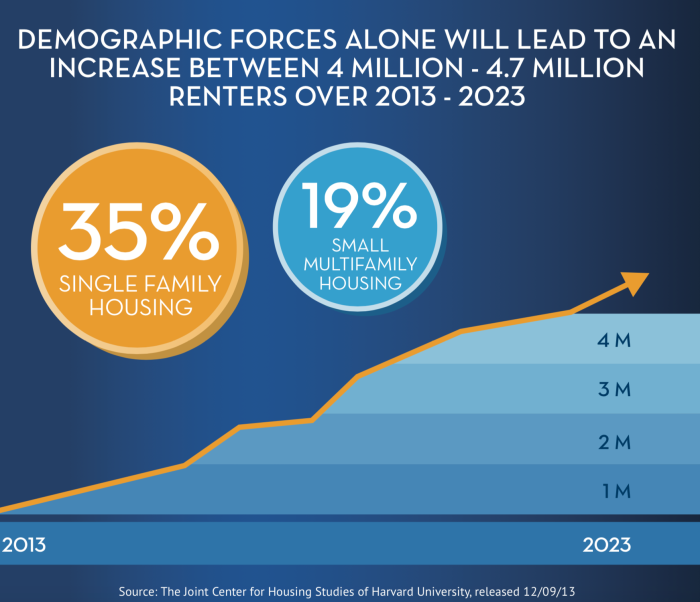

After the 2008 financial crisis slashed property values around the country, many investors rushed out to buy properties and got great value for their money. Today, 30% of the country’s housing stock is held as a rental. Whether they were buying them to hold as rentals or to repair them and “flip” them, those properties have traditionally been insured under DP-3 and DP-1 policies in the personal lines space. Most agents can handle this for their customers, but if one of your investors ends up with a lot of properties using separate personal lines policies can become a real hassle, and they are usually not purchasing the most appropriate coverages through a personal lines policy.

An investor who owns 10 or 15 properties covered with DP policies gets 10 or 15 separate bills each month. Needless to say, this is a royal pain for the customer and gives you a chance to be the hero! Once your insured’s portfolio has grown to this many properties he or she probably employs a maintenance person and maybe even a property manager, in other words, he or she is no longer a novice landlord. His or her real estate investments have grown into a business and proper business coverage is now a necessity! This is where a 10+ Scheduled Dwelling policy can help you out. The 10+ program, is built from the ISO Commercial Property Package with some significant improvements. The policy essentially allows you to place all of your investor’s residential properties on a single commercial lines policy with customized coverages. There is literally no limit to how many locations can go on a single 10+ policy, and the customer gets one single bill at the end of the month making you the hero in his or her eyes. One bill per month, one single policy and one single renewal date.  You can schedule one-to-six unit family homes, condos, manufactured homes, and even vacant land on the same policy. Essentially, you can cover most properties that people live in, with the exception of apartment buildings. We can even do light mixed occupancy, so if a property has light commercial (an office or a retail store) on the first floor and residential on top, or if a duplex has light commercial on one side and residential on the other, 10+ can do those too. The insured can choose which properties to cover using replacement cost or actual cash value settlements, can choose which coverages they need between property, business income, inland marine, earthquake (in some states), crime, business personal property, etc. It can be written with the co-insurance of their choice; basic, broad or special perils; a wide range of deductibles; buried utility line coverage and even personal and advertising injury liability. This last one is super important because it means they are covered in case of wrongful eviction, which they might not be under a DP-3 policy. The program is designed for above-average condition dwellings that have not been vacant for more than 24 months. Once your insured has 15 or 20 dwellings, there is a good chance one or more of them will be vacant at any given time. As you know, most carriers really don’t like vacant dwellings. The ISO Commercial Property Package policy penalizes locations which have been vacant for more than 60 days by taking away theft, vandalism and water coverage; and by penalizing any claim by 15%. That’s one of the major advantages of our 10+. American Modern specializes in vacant properties and knows how to underwrite them and how to do so profitably. American Modern gives back vandalism and water coverage by endorsement, and the policy doesn’t penalize you on the payment of claims on vacant locations. Note that you still don’t have theft coverage after 60 days vacant, but it’s much better than the ISO standard policy.

You can schedule one-to-six unit family homes, condos, manufactured homes, and even vacant land on the same policy. Essentially, you can cover most properties that people live in, with the exception of apartment buildings. We can even do light mixed occupancy, so if a property has light commercial (an office or a retail store) on the first floor and residential on top, or if a duplex has light commercial on one side and residential on the other, 10+ can do those too. The insured can choose which properties to cover using replacement cost or actual cash value settlements, can choose which coverages they need between property, business income, inland marine, earthquake (in some states), crime, business personal property, etc. It can be written with the co-insurance of their choice; basic, broad or special perils; a wide range of deductibles; buried utility line coverage and even personal and advertising injury liability. This last one is super important because it means they are covered in case of wrongful eviction, which they might not be under a DP-3 policy. The program is designed for above-average condition dwellings that have not been vacant for more than 24 months. Once your insured has 15 or 20 dwellings, there is a good chance one or more of them will be vacant at any given time. As you know, most carriers really don’t like vacant dwellings. The ISO Commercial Property Package policy penalizes locations which have been vacant for more than 60 days by taking away theft, vandalism and water coverage; and by penalizing any claim by 15%. That’s one of the major advantages of our 10+. American Modern specializes in vacant properties and knows how to underwrite them and how to do so profitably. American Modern gives back vandalism and water coverage by endorsement, and the policy doesn’t penalize you on the payment of claims on vacant locations. Note that you still don’t have theft coverage after 60 days vacant, but it’s much better than the ISO standard policy.  Property coverage is available up to million per location and general liability (GL) coverage is available on a blanket basis at M/M. If your insured requires more liability, you’ll need to put an excess policy on top. Please keep in mind that the liability coverage is a GL not an umbrella. It only covers your insured for liability incurred from their landlord and home flipping business, not their personal liability which remains covered under their homeowner and umbrella. Personally, I have been fascinated by this product since I started with the company because it’s so different from anything I’ve worked with before and I have seen a large need in the market for it in my home area of California, that’s why I wanted to get the word about it. There are of course many more details to consider, please feel free to comment below with any questions or comments. If this product sounds like it would be a good match for your agency, send me a private message. If you’re not in California, I’ll have to refer you to another teammate, but I’m happy to answer your questions either way.

Property coverage is available up to million per location and general liability (GL) coverage is available on a blanket basis at M/M. If your insured requires more liability, you’ll need to put an excess policy on top. Please keep in mind that the liability coverage is a GL not an umbrella. It only covers your insured for liability incurred from their landlord and home flipping business, not their personal liability which remains covered under their homeowner and umbrella. Personally, I have been fascinated by this product since I started with the company because it’s so different from anything I’ve worked with before and I have seen a large need in the market for it in my home area of California, that’s why I wanted to get the word about it. There are of course many more details to consider, please feel free to comment below with any questions or comments. If this product sounds like it would be a good match for your agency, send me a private message. If you’re not in California, I’ll have to refer you to another teammate, but I’m happy to answer your questions either way.

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.