As part of my job as the Operations Manager for our insurance agency, one of my roles is that of gatekeeper. It’s one of those unsung jobs that fulfill a vital role in almost every organization. Most of us believe that when done right the company stays focused and on track with the CEO’s roadmap, accomplishing the assigned tasks on time and within budget. Saying no is an important part of being a good gatekeeper. It helps the CEO and the companies stay on track with their road map.

And……what’s wrong with that Picture?

It’s really a twofold problem, starting with the adhering with the ‘road map” gatekeeper job description. Roadmaps are not flexible. Making roads require a lot of earth moving equipment, time and tasks. Any adjustment to the mapped out progression is always viewed as expensive and implies failure to the task at hand. In today’s fast-breaking Insuretech world of change, the real peril is strictly following a roadmap and saying no to any outside suggestion that doesn’t adhere to the inflexible map.

What’s a better analogy?

How about the CEO charts out a course instead of making a map? What’s the difference? A charted course is flexible. When making a sea voyage, the captain of the ship clearly knows where she is headed, knows the required provisions needed for the trip, and charts out the intended speed and course to get there at the appointed time. That said the captain also knows that her ships direction of relative movement (a.k.a. DRM) will be heavily influenced by the wind, currents and the sea state. In our world of insurance, that’s called the competitive environment and consumer preferences.

In effect the captain anticipates the need to make course corrections on regular bases. She does this by getting periodic positional fixes of the ship’s location along the way, and then makes the needed course corrections based upon the sea conditions her ship is facing at the time of the positional fix.

Getting back to the company’s Gatekeeper

It’s easier and natural to give any reason to say no verses finding a good reason to say yes. After all it’s ingrained in all of us gatekeepers to believe that any decision that would take the company away from staying on its road map must be a bad one.

Even aircraft carriers don’t like to ride out a hurricane!

Remember the movie The Perfect Storm? I’m sure I wasn’t the only one who cringed at the closing scenes of the movie and yelling at Captain Billy to turn around, cut his losses, and sail into Spain in hopes of fishing another day. So what does that have to do with insurance executives? Again, some course corrections must be taken even if they’re disruptive and not cost effective in the short term.

Stand by for Heavy Seas!

AI, Big Data and direct writing Insuretechs have changed the competitive market place. They have also heightened consumer expectations to be able to purchase coverage and receive service 24/7 with or without human intervention. This is something the bulk of the agency distribution channel, and the legacy carriers they represent, are not able or willing to provide. The gatekeeper is now faced with the unenviable task of still saying “no” to any and all course corrections that take’s his captain’s ship around this perfect storm. After all they have a time schedule to meet, broad ban constraints and a wheel house to attend to. In other words damn the torpedoes and full steam ahead, we can make it over that wave!

So does the movie have to end the same way?

After all Captain Billy doesn’t make it over that huge wave and ends up going down with the ship. Not my idea of a good outcome. Thankfully it does not! There is still time to navigate around this storm, but how?

Here are a few recommended course corrections, in sequential order.

The following recommendations will help all gatekeepers within our industry, to find good reasons to say yes to required course corrections and feel good about it.

First get a good fix of your current competitive position in light of your competition, being sure to assess the relationships you have with supporting vendors and distribution channels. Example: who’s offering quote & bind technology for which line of insurance and how are they doing it? Does it make underwriting sense?

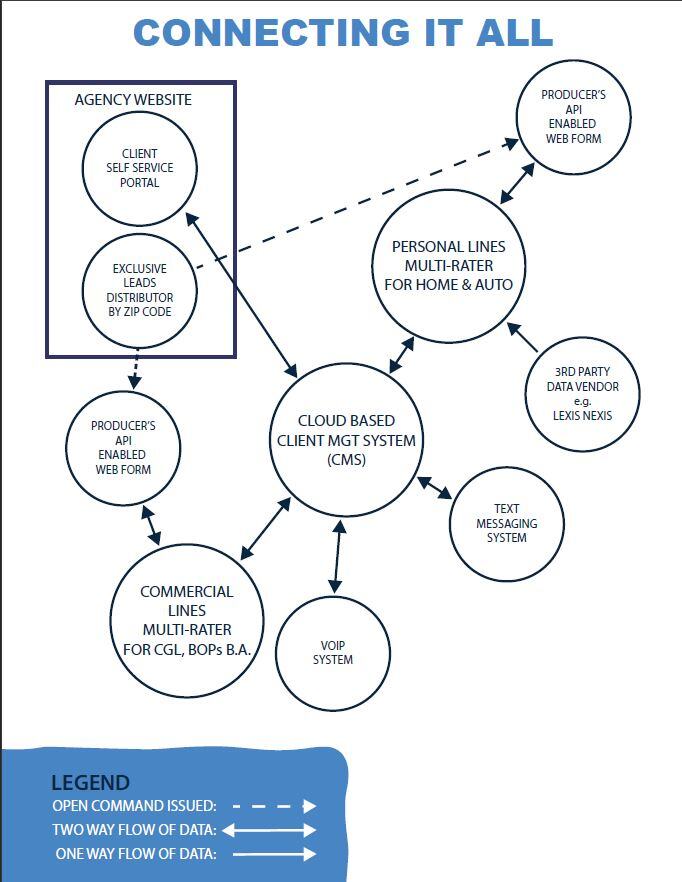

Second, when ready to act, don’t reinvent the wheel if you don’t have to. Example: Personal lines carriers already have working relationships with multi-raters. Why not begin working with these same vendors to offer the “buy now button,” when an accurate eligible quote is presented to the on-line shopper via the agent’s mobile responsive web form?

Third, focus on enhancing the consumer’s on-line experience when mapping out work flows and the underwriting information that’s needed vs. that which is available via a third party vendor. Clearly a balance must be met where sound underwriting is not sacrificed to speed and convenience. I think the late great President Ronald Regan said it best when he coined the phrase “verifiable trust.”

Remember frequent course corrections are less distributive and less costly to the organization compared to resisting change until it’s too late and you’re trying to breach that wave!

About Carl Moulton

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com. I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.

As a second generation insurance professional having served over 30 years in the industry, I am passionate about advancing the success of the local agency distribution channel on line for the benefit of the insurance consumer. It is for this reason Lee Rogers and I have created datMoose, a Co-Op Digital Marketing company. While being a separate business as Florida Insurance Group, datMoose operates as a supporting business along side of the Florida Insurance Group in which I am still the Operations Manager. To learn more about an active Digital Marketing Co-Op being operated by datMoose, please visit InsuranceComet.com.

I am pleased to be a part of Florida Insurance Group which takes the best of both worlds, i.e. the speed and convenience of the web without giving up the role as the consumer advocate with personal service and help to the insurance consumer.