2 min read

Does More Money Equal a Better CX?

Does More Money Equal a Better CX? by John Bachmann Spoiler Alert: I don’t think paying more money on a Claim ensures a great experience. After...

2 min read

.jpg) Nicholas Lamparelli

:

Sep 28, 2025 10:34:36 AM

Nicholas Lamparelli

:

Sep 28, 2025 10:34:36 AM

While the insurance sector has long prided itself on stability, analytical rigor, and process excellence, these very strengths might be limiting our potential for meaningful value creation. Drawing from Roger Martin's insightful analysis of executive leadership styles, it's time for an honest examination of leadership in insurance.

The Current State

Insurance executives are undeniably qualified operators. They excel at managing complex operations, understanding actuarial science, navigating regulatory requirements, and maintaining stable returns. However, most insurance leaders today are executing business models they inherited rather than reimagining what insurance could become.

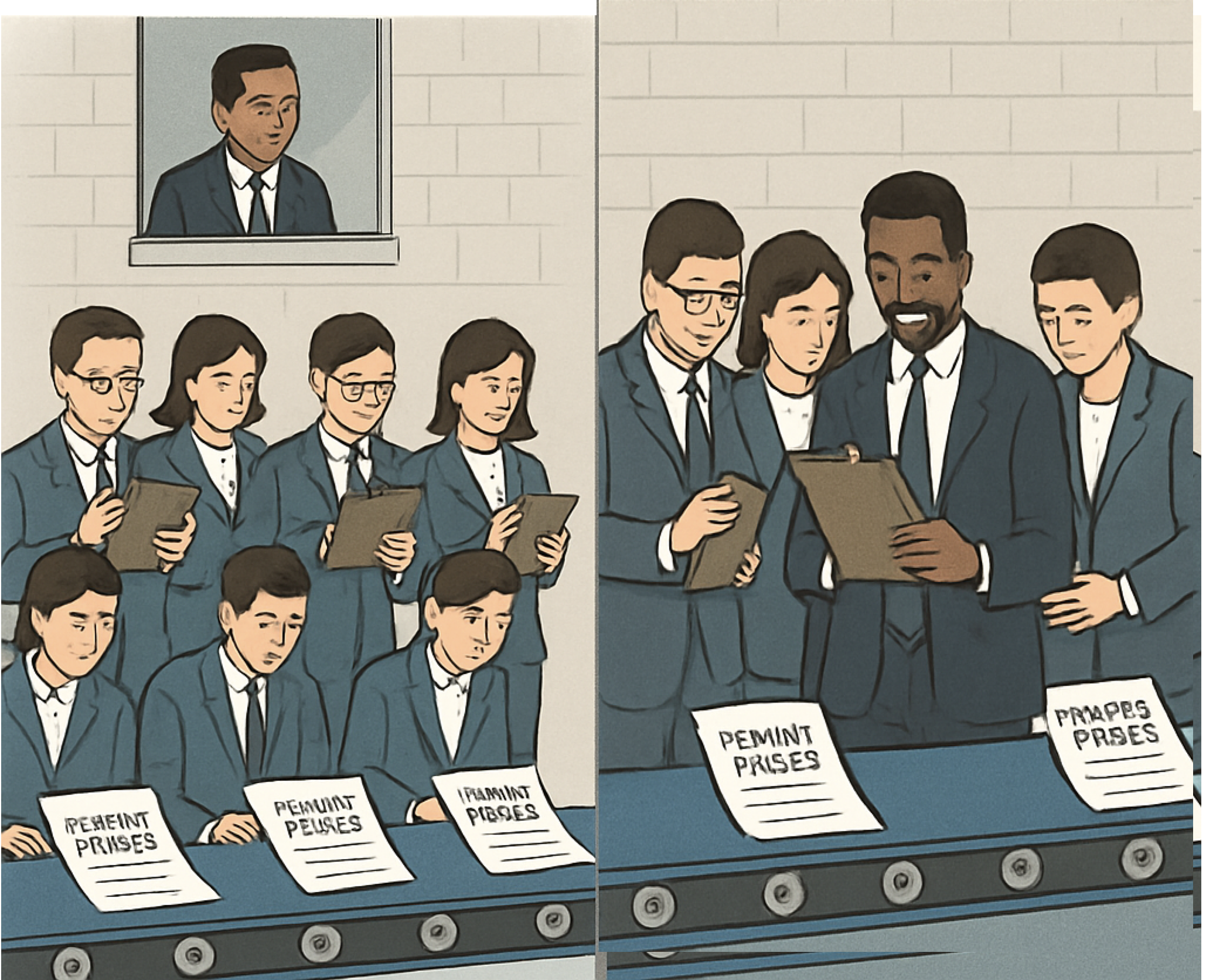

Let's examine the key differences between technocratic and strategic leaders:

|

Dimension |

Technocratic Leader |

Strategic Leader |

|

Job Definition |

Manages people and processes |

Solves critical problems |

|

Decision Making |

Process-driven, relies on established frameworks |

Outcome-focused, willing to adapt approaches |

|

Risk Approach |

Risk-averse, seeks certainty through process |

Calculated risk-taking, embraces uncertainty |

|

Innovation Style |

Incremental improvements to existing models |

Transformative thinking, new business models |

|

Problem Solving |

Delegates issues to direct reports |

Works alongside teams on critical challenges |

|

Focus |

Input and process completion |

Output and results |

|

Planning Style |

Detailed action lists and initiatives |

Integrated strategic vision |

|

Change Management |

Through formal channels and structures |

Through direct engagement and leadership |

Why Insurance Tends Toward Technocracy

The insurance industry's tendency toward technocratic leadership isn't accidental. Several factors contribute:

The Cost of Technocratic Leadership

While technocratic leadership has served the insurance industry well in stable times, it's becoming increasingly problematic in our rapidly changing environment. We're seeing:

The Case for Strategic Leadership

The insurance industry needs more strategic leaders who can:

Making the Shift

Moving from technocratic to strategic leadership requires:

Looking Forward

The insurance industry's future success depends on finding a better balance between technocratic excellence and strategic innovation. While we need the stability and rigor that technocratic leadership provides, we must also cultivate strategic leaders who can envision and create the future of insurance.

The most successful insurance organizations will be those that can maintain operational excellence while fostering strategic thinking. This means developing leaders who understand both the technical aspects of insurance and the strategic imperatives of transformation.

As Roger Martin suggests, it's not about completely abandoning processes or controls...it's about ensuring they serve as enablers rather than limitations. For insurance executives, this means maintaining our industry's strengths while developing the strategic capabilities needed to lead through transformation.

The question isn't whether insurance executives should be technocrats or strategists...it's how we can develop more leaders who can effectively balance both approaches while leaning into strategic leadership when transformation is needed.

2 min read

Does More Money Equal a Better CX? by John Bachmann Spoiler Alert: I don’t think paying more money on a Claim ensures a great experience. After...

5 min read

More Data Is Not Better…Better Data Is Better – Debunking The Myth That More Data & Technology Will Obsolete Insurance by Nicholas Lamparelli

1 min read

Hey Insurance – Ep 37 – Why Your Agency Should Strive to Be More Inclusive by Amy Waninger Insurance</span> - Ep 37 - Why Your...