2019 video about this article, although the article is more in depth:

I don’t have numbers to back it up. I banged my head against the table trying to get retention by age at a previous employer, but HR wouldn’t budge. Then I banged my head against the wall while writing Insuring Tomorrow trying to find industry-wide numbers, but nobody seems to be measuring it, or at least they’re too embarrassed to publicly share their numbers. So I apologize for writing this article without numbers to back it up, but I would bet my book and speaking royalties in 2018 that at almost every carrier retention of the under-35 crowd is significantly lower than the more mature crowd, and that it’s lower than it was historically for previous generations when they were under 35.

It’s all about the incentives we’re dealing with and the way we were raised. The first of those factors the industry can decide to change, the second we cannot.

Millennials were largely raised by Baby Boomers, who had a distinct parenting philosophy: they wanted us to have it better than they did. We were also spoiled by growing up in the 80s and 90s, a time of historic economic growth. Children who are raised during times of affluence end up a little spoiled and they grow up a little slower. We also saw our parents and grandparents, who were “company men” get downsized in the transition from stakeholder to shareholder capitalism. Many of their pensions evaporated. CEOs of publicly traded companies downsized thousands to hit quarterly numbers. Many found themselves unemployable or underemployed for the rest of their careers. The promise of “put in your time and the company will take care of you” evaporated during our formative years and left a deep impression in our young minds.

We grew up wanting to change the world, do something good for the world and we were the first generation to graduate college with no expectation of lifetime employment. Thankfully Mutuals treated their employees better! Historically almost nobody grows up wanting to work in insurance and our generation is no exception with less than 4% of Millennials reporting an interest in the industry. Young people today are more likely to think insurance is a scam (which it isn’t) than thinking insurance is a great career (which it is). Jason Ryan Dorsey’s Center for Generational Kinetics has done research and found that Millennials have a different definition of loyalty than prior generations. To older generations, loyalty meant “I came, I stayed, I got my gold watch.” To the Millennials, it means “I worked really hard while I was here.”

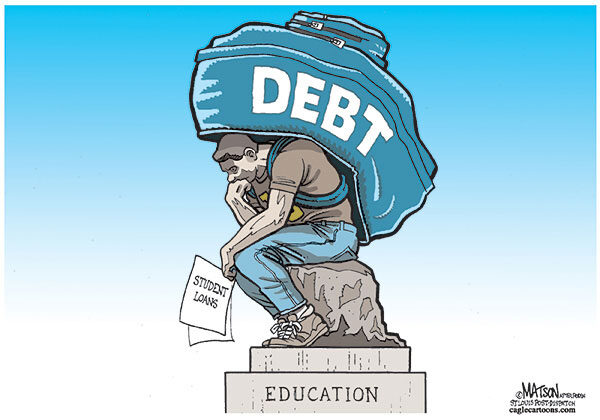

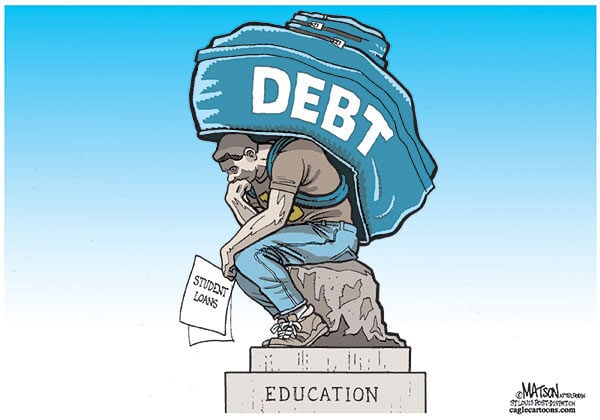

A few of us were lucky to graduate college and join the insurance industry between 2005 and 2007 and had the chance to get promoted to manager level before the crash of late 2008. Those of us who didn’t start in the industry until 2009 or later found a much less friendly industry, where cost-cutting had become rampant, entry-level jobs had largely become thankless call center roles and there was no promise of lifetime employment or even of being rewarded for being loyal to the same employer. Millennials who graduated in 2009 through 2012 found few jobs and even fewer that actually required their college degree, many found refuge in a lowly paid insurance call center which didn’t require their expensive degree, all while carrying an average of tens of thousands of dollars of student loans. We even met a lawyer, who had passed the Iowa Bar, working at a carrier call center. There was a time when most of a large midwestern carrier’s subrogation department had their law degrees for entry-level subro jobs… Can you imagine trying to pay $150k in law school debt on $45k a year?

At most large carriers getting more than a 2% raise is rare, regardless of performance, and promotions were very hard to come by since those more experienced had no openings to grow into and thus were not opening the way to middle-level roles for us. We felt stuck. As the economy improved in 2013 through 2018 a perfect storm of retirements and low unemployment hit the industry. All of the sudden Millennials with a couple of years of insurance experience were 20% to 40% more valuable in the market than what they’re making at their current employer.

Many left the industry, disappointed, and swearing never to come back. Back in the 80s and 90s when an employee left the industry he’d tell his 3 closest friends to avoid insurance. Today they disparage us on social media and told their few thousand closest friends to avoid insurance work. Their scathing reviews live on Glassdoor forever. Out of desperation, many took to getting CPCU (and other designations) early in their careers, as a way out of the call center or entry-level claims.

The talent wars heated up and the taboo on frequent job changes largely disappeared. Changing companies went from being a major black mark on your resume to a question that hiring managers ask but is fairly easy to answer. Take it from this Millennial who had seven jobs at four carriers during his first eight year in the industry. As long as you have a solid explanation for each move (moving on up, seeking growth) hiring managers might not like it but they’re willing to forgive your minor indiscretion, after all they’re desperate for young talent and young CPCUs don’t grow on trees (although they grow at Insurance Nerds).

The emergence of LinkedIn as a recruiting tool has made it easier than ever to get “found”, even for those who weren’t looking to change companies. Millennials making recession level salaries quickly became painfully aware that they could get a 20-40% raise easily if they changed companies once they had some experience, and they told all their friends! At the same time, many HR departments tried to keep costs in check by making it VERY hard to give an internal candidate a large (and well deserved) raise even when getting promoted or changing departments.

The pension plans Baby Boomer and Gen X employees were grandfathered on became much less generous or non-existent by the time we were hired, and the 401k plans that replaced them did not serve the same retention function since they were much more portable. You might lose the unvested part of your 401k, but you could easily make up for it with a big fat raise. Millennials realized that “loyal” employees end up making 50% less than frequent job hoppers and with giant student loans breathing down their necks felt they simply couldn’t afford not to move around.

The end result of this perfect storm was that we changed jobs (and companies) a lot more often than previous generations in the industry did at our age. It was partially a different definition of loyalty, but mostly a rational response to the incentives we were offered. Who in their right mind would have enough loyalty to stay at a job paying 20-40% less than their market value simply to stay at a company that is making no promise of lifetime employment, a pension or even predictable career growth? Especially with the understanding that one bad quarter might lead your CEO to put the stock price over your livelihood and downsize thousands in a single day? Would you?

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.