It’s been a crazy last few days! On Thursday, June 1st, we submitted the final draft of our book Insuring Tomorrow to Amazon (about 6 hours ahead of the deadline), and we spent the weekend sending advance copies to a few chosen influencers in the industry. The reviews have started coming in, and we’re feeling more and more confident that we hit a home run!

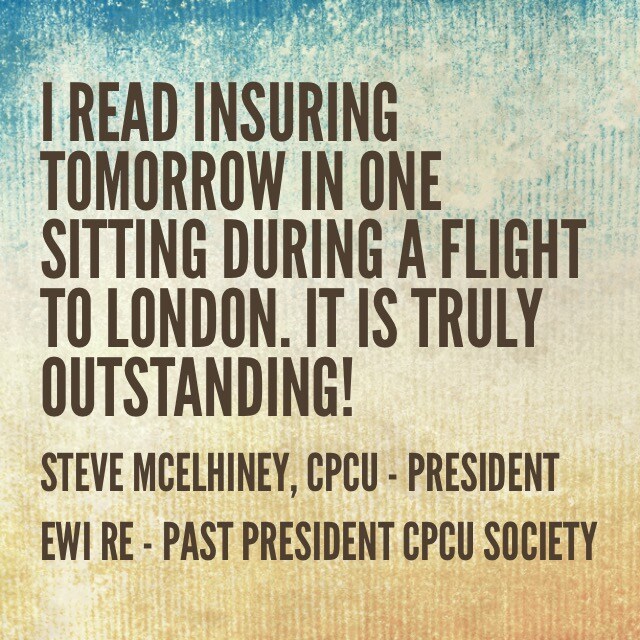

“I read Insuring Tomorrow in one sitting during a flight to London. First, of all, I’d like to say that I’m very proud of you for writing this. It is truly outstanding!

I learned a lot from reading it. I loved the point about Millennials as a different Culture. That is so true and pithy. Drone parents – I had never heard that one. All of the comments as to how employers can better attract, on-board, and retain Millennials was very, very insightful. Great stuff.

As an employer who has had a few Millennials leave, it needs to be stressed as well, give us a chance too to adapt, adjust and modify our cultures. Employers are trying hard (although much, much more needs to be done. The manager is not a mind reader – it is incumbent upon the Millennial to communicate often their frustrations and ambitions.

Your points about Gaming was actually helpful to me in better understanding my 23 yo son. I now get it!

My son-in-law (who works in insurance claims and is frankly frustrated) tells me constantly how all the “Millennial experts” are always not Millennials (and are often 60+). You have a unique opportunity to the a “Millennial expert who actually IS a Millennial”! Think about that – your book will be an excellent platform.

Regarding the more readable job descriptions – we need to find a way to take HR out of some of that process. I find that most are written purely from a HR/prevention of litigation standpoint and they end up being these obtuse descriptions that even the hiring manager doesn’t understand!

Regarding mentoring, as you know I do a lot of it on an informal basis. It needs to be better organized – the industry won’t do it, maybe a social media platform is a better way to go.

Finally, it is important to stress the Millennial phenomenon is a global one. It is not just a US thing at all. I see it in London, Shanghai and India.

Your book is ready to go – no need to change anything.

Think of how the first Millennial Insurance Commissioner will approach this business?

Thanks for doing this for the industry.”

Steve McElhiney, CPCU – President EWI Re, Inc – Past President CPCU Society

“Essential reading for insurance executives to compete in the war for talent. Tony Canas and Carly Burnham have written an essential guide for insurance executives and professionals seeking a competitive edge by winning the war for talent. The authors are co-founders of the highly influential InsNerds.com blog and have been leading experts on recruiting and retaining Millennials in the insurance industry. They start by clearly articulating the problem – the insurance industry is rapidly graying as the average professional is 60 years old! The proportion of works 55 and older is 30% higher in the insurance industry than others in the economy. Some reasons for this include the economic crisis of 2008 which caused many employees to delay their retirements, leading to a “barbell” demographic effect of many older, tenured employees at the top of the organization and many younger employees at the bottom filling entry-level positions with less talent in between.

According to one estimate, the industry will have a talent shortfall of 400,000 jobs within the next decade. Part of the big challenge for the industry is that Millennials do not see insurance as an exciting field to work in. This is due to a variety of factors – lack of advancement opportunities, lack of stimulation for the highest education entry-level workforce in history, lack of shared values between Boomers and Millennials with dated expectations by Boomers that Millennials “pay their dues” before moving up into positions of higher authority – all leading to perceptions of insurance as “boring”. According to one survey, only 4% of Millennials have an interest in working in the insurance industry! This is despite the fact that insurance has many of the qualities that Millennials are looking for in a job, namely challenging work, the ability to have a societal impact, and room to grow in their career.

The authors spend the bulk of their book on how employers in the insurance industry can improve their ability to recruit and retain Millennials. Much of their sound advice revolves around laying out the clear generational differences in attitudes and beliefs between Boomers and Millennials, and they show how employers must rapidly adapt to this new reality by changing the way that recruit and retain talent. The insurance industry has previously enjoyed a talent pool that was highly loyal and most employees stayed for their entire careers with one employer. Those days of lifetime employment are gone! Millennials can be very loyal and dedicated employees, but they also are looking to advance quickly to leverage their investment in education (and pay off student debt). Millennials have unprecedented opportunities to change employers given how many opportunities are available, and they often do not stay in the insurance industry. This is particularly true if they are stuck in an entry-level call center position with limited flexibility!

Canas and Burnham start with the basics and work successively through several chapters with more advanced techniques to help improve your ability to engage and retain the biggest generation in the workforce today – Millennials. The authors state that Employers do not have to adopt every single recommendation outlined in the book, but selecting a few and working to refine them over time should vastly improve a firm’s ability to compete in the war for talent. While insurers are moving rapidly (finally!) to replace legacy systems and get digital, leveraging technology such as artificial intelligence and machine learning, they still need people to be the lifeblood and driving force in their organization. With the Boomers that are retiring en masse, firms are losing vast quantities of expertise and tacit knowledge that are not capturing in procedural manuals and internal documentation. To maintain their ability to stay afloat and rapidly adapt to change, organizations must find ways to successfully recruit and retain top talent going forward.

The authors end with a preview of Gen Z and how their attitudes and beliefs towards work are shaping disruption again in the talent war. This book is essential for all insurance executives to read and keep close by on their bookshelf to design, implement, and evaluate their success in competing on talent, which should be at the core of any successful business strategy.”

Rob Galbraith, CPCU, CPCU, CLU, ChFC

“Great read! I’m not a proper insurance nerd and often find self help or educational insurance material dry and uninteresting. Which I imagine is exactly how Millennials interpret the same material! Insuring Tomorrow is engaging, most importantly it provides specific strategies for how to deal with Millennial culture. It’s brilliant! Honestly the best book I’ve read on understanding culture since Malcom Gladwell’s Outliers. Very relevant and necessary reading for all leaders in the insurance industry!”

Jeremy Weyrauch, AINS

“Tony Cañas shared an advanced copy of his new book (co-authored with Carly Burnham) and I read through it in one sitting this weekend. That’s somewhat remarkable because I’m not an avid book reader and I’m weary of Millennials studies. They tend to homogenize, generalize and stereotype this age cohort. Sure enough, this book is guilty at times and will come across to some readers as a “gimme more benefits, time off, fun, and automatic rewards for more education” Millennial manifesto. Yet, I found the tone of the book refreshing and constructive. The authors speak from their own experiences and genuine passion for the industry to provide insurance company executives a compelling call to action to solve the aging workforce problem.

Two intriguing employee benefit ideas the authors propose – college loan debt repayment (reverse-engineered tuition reimbursement) and paid sabbaticals – could become unique competitive advantages for smart insurance companies. These employee benefits might be too costly and difficult to administer so they would likely need to be tailored as performance-based incentives for top talent rather than broad-based entitlements. Two other great suggestions – more flexible remote work environments and turning insurance carrier call/service centers into talent mines – are elegant solutions because they not only would help to recruit and retain Millennials but would be cost-effective strategies for insurance companies.

If there’s a disconnect in the book, the authors missed an opportunity to more directly tie their recommendations for fulfilling Millennials’ talents and career desires with the insurance companies’ needs beyond replacing aging talent: better customer experiences and stronger business results. My other disappointment about the book is that it all but ignores the industry’s distribution channel, which is a crying shame because property and casualty insurance is a distribution business! Top agents, brokers, wholesalers, program managers, etc. offer Millennials diverse and high growth career opportunities. Plus, these firms are often more innovative in creating flexible work environments and diverse career paths than insurance carriers.

My final two criticisms are nitpicks and just my opinions. First, I’m not on board with encouraging more Risk Management and Insurance college majors. The industry would be better served casting a wide net to recruit bright people with broad college education foundations. Second, I’m surprised and perplexed by the authors’ advocacy for the CPCU designation. As both a CPCU and CIC, I speak from personal experience. CPCU is your dad’s insurance designation. CIC is the more practical and relevant insurance designation today.

Kudos to the authors for their passion for our noble industry and for their contributions to help attract and retain its next generation!”

Jim Caragher – CEO at CIB

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

-

This author does not have any more posts.

Related Posts

-

Insuring Tomorrow: Engaging Millennials in the Insurance Industry - The Book

Update: The Book is Available Now, Click Here to Order. This is the 900 word…

-

10 Commandments for Young Insurance Professionals

I. Thou shall start working on CPCU right away, and join the society. II. Thou…

-

We Must Retain our Millennials in Insurance - Here's How

2017 Update: We now have published a book about Millennials in Insurance. Click here. …