“The smart speaker may rock the insurance industry in ways that it doesn’t want to roll. It may be the one consumer trend that takes nearly all insurers off guard.” – Denise Garth, Majesco

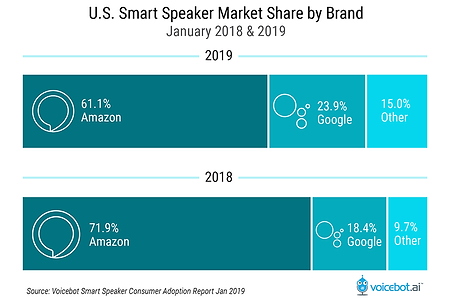

Today’s most successful brands are active and available wherever their customers are, and increasingly those customers are engaging with brands through smart speakers and voice assistants like Amazon’s Alexa, Google Assistant and Apple’s Siri.

According to a growing body of experts, voice computing is poised to be the next mainstream business channel alongside email, phone and web. Some of the more bullish predictions are even comparing voice computing to the early days of mobile.

Yet in spite of these apparent trends, fewer than 1% of U.S. P&C insurers are active in the voice game today, and insurtechs are even scarcer on the ground.

Is the industry just biding its time, or falling dangerously behind?

Voice lessons: The state of voice computing today

As with other consumer trends, speed, efficiency and convenience are driving the shift toward voice. And the shift is accelerating. According to a white paper by Ruder-Finn published this March:

-

There has been a 78% growth in the number of smart speakers in U.S. homes in the past year alone.

-

Close to one quarter of all U.S. adults now have access to a smart speaker, and this number is expected to reach 75% by 2020.

-

The total number of devices (including phones) that currently have access to various voice assistants is one billion.

Even more arresting are the predictions for next year. By 2020, Gartner predicts that voice-activated searches will account for 30% of all web-browsing sessions and comScore predicts that 50% of all searches will be voice searches.

Spending via voice — currently minor — is also predicted to take off, with voice commerce rising from current levels of $2-3 billion annually to anywhere from $40 billion to $80 billion (depending on the source) by 2023.

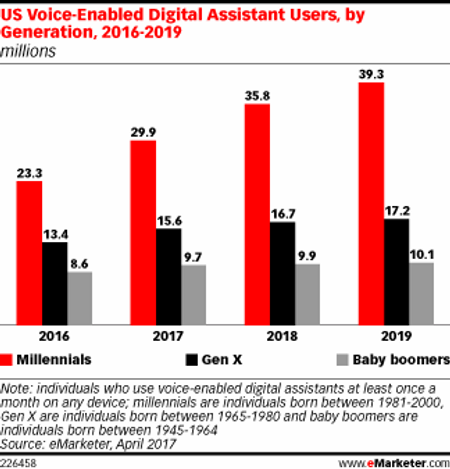

And as in other areas of technology today, the generational behavior gap is substantial. 40% of millennials use a voice-enabled digital assistant at least once a month, compared to just 10% of baby boomers (Source: eMarketer).

Alexa, how much life insurance should I have?

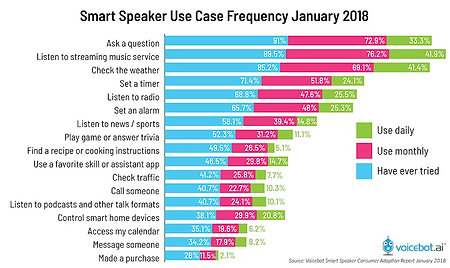

So we know smart speakers and voice assistants are proliferating, but what are people doing with them and what’s the opportunity for insurance? Right now playing music is the most popular activity, followed by checking the weather and asking questions. Setting alarms, checking the news and searching online are popular too.

It doesn’t quite add up to the pervasive and intimate relationship we have with our mobile phones, and that might explain why 99% of P&C carriers are still on the sidelines.

This March Coverager hosted a webinar called Modern Insurance and Voice Computing, where their findings revealed both a lack creativity by carriers and an apparent lack of interest by consumers. Among other things they shared that

-

25% of insurance skills help to demystify insurance terms.

-

Only 20% allow you to get a quote.

-

Only 9% of skills go beyond insurance.

-

40% of skills had no user ratings.

As of this writing the highest number of reviews for any insurance skill was 18 (Allstate) while the industry average was below 10, suggesting a low level of engagement with the skills that are available. It’s no wonder when you see what’s on offer.

The state of insurance and voice today

The U.S. market has approximately 30 Alexa insurance skills, with only 17 P&C carriers in the game out of over 2,500. Most are large carriers.

Liberty Mutual was first out of the gate in 2016. Their skill offered estimated auto quotes and answered common questions about auto and property insurance. The state of the art hasn’t advanced a great deal since.

Across the industry, current offerings are basic, uneven and comprise just a small subset of what these firms make available online. They include FAQs, quizzes and definitions, product information, tips for homeowners and business owners and the ability to find an agent near you. A few let you check your billing and payment status. Some offer quotes (though not firm ones). The more advanced skills give you personalized information about your policies and even let you initiate and track claims.

There are a few carriers, though, that are inching ahead of the pack. Here are three in ascending order of value:

-

Travelers’ Home Central skill offers proactive seasonal tips and reminders to homeowners. Other insurance skills offer tips, but you have to ask the right questions to get them.

-

MetLife offers a skill for its vision and dental policyholders that allows them to research dental procedures, find nearby providers and even get ballpark costs for procedures. This might not be the sexiest use of the technology, but it is unique and practical, and it gives us a glimpse of a future where service providers and the entire insurance ecosystem are connected through voice computing for a more seamless and pervasive customer experience.

-

Nationwide’s skill integrates SmartRide, its usage-based auto insurance program. SmartRide uses telematics to give drivers personalized feedback, helping them to make better decisions and earn discounts for safe driving. The skill allows participants to check their weekly driving trends and discounts by voice instead of just online.

This integration of a modern, engaging product offering with daily relevance and a gamified experience into their voice offering gives Nationwide’s customers a compelling reason to engage with the brand through voice on a consistent basis, and it gives the rest of the industry a superb example of how they too can leverage the unique capabilities of voice for greater impact and stronger relationships.

For even greater inspiration, look beyond our shores to Germany, where consumer expectations are higher and a majority of the country’s top insurers are active in the voice game.

According to Dario de Wet of Anthemis Insights, approximately 50% of German consumers already envision completing the end-to-end insurance process using voice technologies. And now that’s possible. The first German insurer to launch an Alexa skill, Deutsche Familienversicherung (DFV), recently teamed with Amazon and Amazon Pay to become the world’s first insurer to enable customers to purchase an insurance policy entirely by voice. You can see it in action here on YouTube.

This was for a relatively simple product, though, and as Rob Galbraith, technologist and author of The End of Insurance As We Know It points out “Most quoting requires far too many questions and potential paths, making it hard programmatically to train the AI and not a great customer experience.” He does think we’ll get there. Just not right away.

“As consumers gain more comfort with voice tech AND insurers streamline their processes, as they have already been doing for personal lines and small commercial in digital channels, I think you will see more with fuller capabilities.” – Rob Galbraith

“I don’t think this will be common until 5-10 years from now,” he says. “I can see a slow ramp up in voice followed by an explosion of functionality as it becomes more mainstream and better understood and more players deploy pieces of functionality out there.”

Will the industry find its voice?

If voice does emerge as the next mainstream business channel, then the mandate for insurers is clear. They will need to make the entirety of their offerings (marketing, sales and service) available through voice channels. And they will need to find creative ways to harness the unique opportunities for engagement and service that voice computing makes possible.

Given the enormity of the challenge, and the many other technology priorities that carriers are grappling with, it’s no wonder that most are still holding their tongues.

At a minimum, every insurer needs a strategy in place for voice, and a sandbox to experiment in and get comfortable with the medium. It’s still early days, but not for much longer.

Ray Wang, founder of Constellation Research, advises brands to get into voice early to experiment and then see what the results are. As he says, “early adopters in early forms of media channels often reap disproportionate benefits vs. those who come late.”

So for those few carriers that are in the game today:

-

Congratulations, you’re a leader, and

-

You have a long road ahead of you.

If you’re an insurer or insurtech and you’re rolling out a new voice experience, we’d love to hear about it.

About Scott McDonald

Scott helps global brands to thrive in the digital age by moving faster and focusing more relentlessly on their customers. He is an Inc. 500/5000 entrepreneur and a co-founder of Modern Accelerator, a digital innovation and design consultancy in based in New York.

Scott helps global brands to thrive in the digital age by moving faster and focusing more relentlessly on their customers. He is an Inc. 500/5000 entrepreneur and a co-founder of Modern Accelerator, a digital innovation and design consultancy in based in New York.