This article originally published on InsNerds.com

Disruption in Insurance

For any company, it’s good to be relentlessly focused on the customer: success means knowing what they want and delivering that with discipline and low prices.

Or maybe not! The amazing thing about disruption theory, as defined by Clay Christensen, who coined the term in his 1996 HBR article and subsequent book, is that it reveals this strength to also be a deadly weakness.

Christensen defines disruption as entering a market from an overlooked customer base, of which he says there are two kinds: low-end footholds and new-market footholds. Low-end footholds start with “less demanding customers” in the sense that they consume much simpler, lower quality products than the mainstream market. The disruptor then progresses up to higher margin customers. In new-market footholds, the entrant competes against non-consumption first by generating new customers entirely and then moves into an incumbent’s turf later. In both cases the endgame is equivalent products to the incumbent’s but at dramatically lower prices.

Getting beat out by a disruptor really sucks, and we think of these losers as.. well, losers. But those customer bases aren’t overlooked by accident. It just isn’t obvious how their needs map onto the mainstream customers’ needs. And, most of the time, they don’t! In every market, there is a constant buzz of startups and weaker incumbents with bad ideas or bad timing or both. Then, suddenly, some technological breakthrough silently opens up a channel for disruption, and one or more of those stupid ideas becomes brilliant. Discipline kept incumbents from wasting time on the idea, and that was the right move, until they got crushed: real disruption is a deeply unfair and terrifying beast.

To me, the best example of real disruption in insurance comes from developing countries in the form of microinsurance. Check this out from the MicroEnsure website:

We have introduced new forms of protection for emerging customers, including micro-health, political violence, crop and mobile insurance all over the world. In each case, we didn’t start by designing a product in a board room – we visited our customers in markets and villages to understand how they cope with the variety of risks in their lives.The result of this client-centric approach is a new suite of solutions, and the opening of a new market for insurance.

This hits both of Christensen’s entry points: new and low end! In listening to MicroEnsure’s founder Richard Leftly’s InsNerds.com interview, it’s clear he is aware of this, talking about the power of delivering insurance solutions at phenomenally low overhead costs.

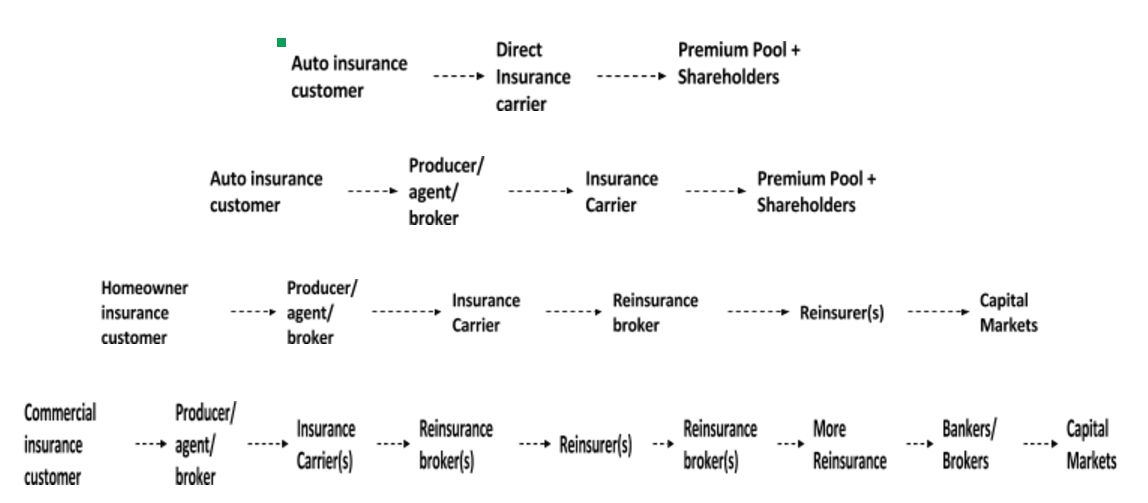

But this isn’t disruption until he moves upmarket, and we must always keep something in mind when applying disruption to insurance: most insurance buying is forced. In developed countries compulsory purchases of home (mortgages) and auto vastly inflate the market. Since regulators need to approve which products satisfy their insurance mandates, very few customers think about what they’re buying. In the bigger picture, disruption is an extension of the age-old business truth that your customers are way smarter than you. Compulsory purchasing makes customers stupid, especially at the low end of the market where normally they’re the smartest in the sense of finding value for money. These folks are already buying the minimum, and you aren’t allowed to sell them anything less! Regulators enforce this, in the sense that the institution is set up to force consumers to buy and force insurers to not lose money.

The challenge for MicroEnsure and any low end insurer is that they are mostly completely unregulated. This threatens their growth in that they will have great difficulty getting their products into a developed market where people are wealthier (so can self insure smaller risks) and regulation is pervasive.

This also threatens them as their home markets develop. China is a hotbed of insurance innovation right now and, no coincidence, is very lightly regulated. Eventually insolvencies will open the doors to regulatory creep. History suggests insurers will adapt to this change by looking more like everyone else!

About David Wright

David's entire career has been in the reinsurance industry and all with Beach & Associates, having first joined the Toronto office as a summer intern trainee broker in 2003. David is an Associate of the Casualty Actuarial Society and CFA Charterholder, with extensive experience in both sales and analytics. He has worked with global and regional clients across casualty, property and specialty lines of business. David now manages the New York office as well as all of Beach's North America Analytics teams. You can listen to his podcast at notunreasonablepodcast.com, follow him on twitter: @davecwright, and sign up for his newsletter at https://webtrough.com/signup/

David's entire career has been in the reinsurance industry and all with Beach & Associates, having first joined the Toronto office as a summer intern trainee broker in 2003.

David is an Associate of the Casualty Actuarial Society and CFA Charterholder, with extensive experience in both sales and analytics. He has worked with global and regional clients across casualty, property and specialty lines of business. David now manages the New York office as well as all of Beach's North America Analytics teams.

You can listen to his podcast at notunreasonablepodcast.com, follow him on twitter: @davecwright, and sign up for his newsletter at https://webtrough.com/signup/