It’s an open secret: insurance policies are notoriously complex, often leaving both buyers and industry professionals scratching their heads about covered risks. Ask an underwriter for a clear example of coverage, and you might receive a lengthy, convoluted, and vague response. Such complexity contributes to the commoditization of insurance products, making it nearly impossible for consumers to discern one policy from another. Consequently, this creates challenges for both consumers and companies within the insurance marketplace.

Companies typically strive to set themselves apart in the insurance world primarily through pricing. Unlike charismatic products that captivate potential buyers (think iPhones, Teslas, movie premiers, concerts – things that buyers will eagerly line up for), insurance is typically purchased reluctantly or only when absolutely necessary. Accordingly, buyers are incredibly price-sensitive, particularly in personal lines where cost is often the primary purchasing criterion. (In contrast, commercial lines present a different dynamic; here, insurance buyers must judiciously balance price and coverage needs, as skimping on cost could risk coverage and thus be a dismissable offense.)

Methods to Establish Differentiation in Insurance

Standing out in the insurance market isn’t easy, particularly when dealing with the insurance policies themselves. As an undesirable purchase, insurance must aggressively vie for attention, market effectively, and sell convincingly. Below are some strategies to achieve differentiation that competitors can’t easily dilute.

Standing out in the insurance market isn’t easy, particularly when dealing with the insurance policies themselves. As an undesirable purchase, insurance must aggressively vie for attention, market effectively, and sell convincingly. Below are some strategies to achieve differentiation that competitors can’t easily dilute.

1. Competitive Pricing

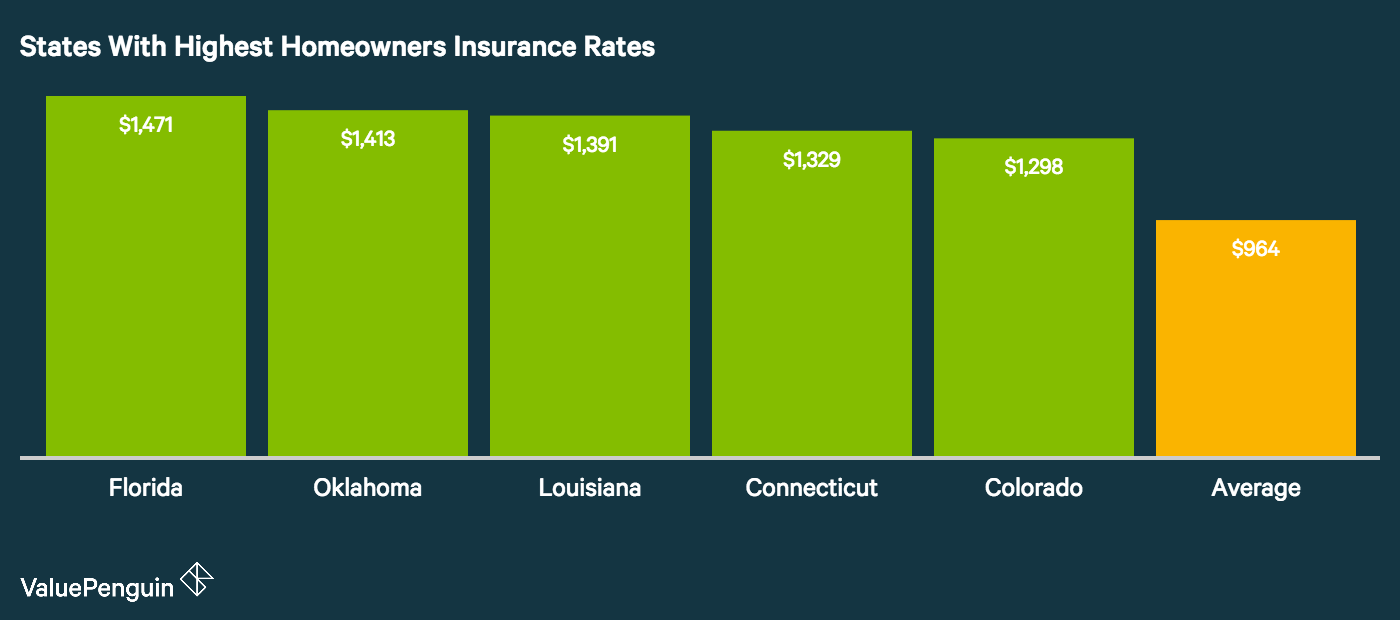

While competitive pricing attracts more clients in a highly price-sensitive market, relying solely on price can initiate a harmful race to the bottom. Striking a balance between competitive rates and other value-driven propositions is essential to avoid commoditization. Most companies should not attempt to differentiate based on price simply because most companies cannot maintain that strategy. Being the low-cost provider usually requires ruthless overhead expense management, a data advantage, an analytical advantage, a distribution advantage or some combination of these.

2. Enhanced Customer Experience

Simplifying and enhancing the customer experience can significantly distinguish an insurance company from its peers. Streamlining the buying process, offering quick applications, ensuring rapid decision-making, and simplifying the policy and all aspects of engagement can boost customer satisfaction and increase loyalty.

3. Targeting Affinity Groups

Focusing on specific affinity groups—such as professional organizations, alumni networks, or hobbyist clubs—can forge community bonds and loyalty. Tailored policies addressing the unique needs of these groups can enhance this connection further.

4. Offering Novel Solutions

Filling market gaps by introducing unique insurance offerings can set a company apart. Catering to niche markets or emerging risks not adequately covered by traditional insurance can serve to demarcate an insurer from competitors.

5. Providing Higher Coverage Limits

Offering significantly higher coverage limits compared to competitors can draw clients looking for extensive protection. This strategy is appealing in both personal and commercial lines where suitable coverage is critically important.

6. Streamlined Claims Process

The claims process is a pivotal interaction for customers. Simplifying this process to ensure speed, minimize hassle, and lower the risk of denial can substantially boost customer satisfaction and uniformly differentiate an insurer.

7. Building a Trusted Brand

Cultivating a powerful and reputable brand can foster trust and reliability. High brand prestige not only cultivates loyalty but also supports premium pricing, as customers may pay more for perceived excellence and security.

Moving Beyond Easily Replicable Strategies – Defensibility

A vital overarching principle is that such differentiation will only be effective if it’s defensible—sufficiently unique and robust to prevent easy replication by competitors. There’s minimal benefit in differentiating unless the competitive advantages you set are secured and not subjected to rapid or inexpensive imitation by others. Differentiation is only as valuable as the differentiated returns those activities generate above and beyond your competition. This is what economist and investor Hamilton Helmer defines as “Power”, which will be the subject of the next series of articles.

A vital overarching principle is that such differentiation will only be effective if it’s defensible—sufficiently unique and robust to prevent easy replication by competitors. There’s minimal benefit in differentiating unless the competitive advantages you set are secured and not subjected to rapid or inexpensive imitation by others. Differentiation is only as valuable as the differentiated returns those activities generate above and beyond your competition. This is what economist and investor Hamilton Helmer defines as “Power”, which will be the subject of the next series of articles.

Recap

Distinguishing oneself in the insurance sector is undeniably challenging but far from impossible. By emphasizing competitive but balanced pricing, enhancing customer interaction, targeting specific groups, incorporating unique solutions, offering generous coverage, providing seamless claims processing, and developing a reputable brand—insurers can achieve sustainable and defensible differentiation. These concerted strategies will not just attract new clients; they will cultivate loyalty among current customers, ultimately securing long-term triumph.

While insurance might never become a product that people enthusiastically seek out, companies that strategically achieve resolute differentiation can genuinely connect with consumers and gain a significant edge over the competition.

About Nicholas Lamparelli

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

.jpg) Nicholas Lamparelli

Nicholas Lamparelli