One of the trickiest things about the insurance industry is that while it is an absolutely incredible career, it is sometimes not a good job. Am I confusing you yet? Good! Let me explain.

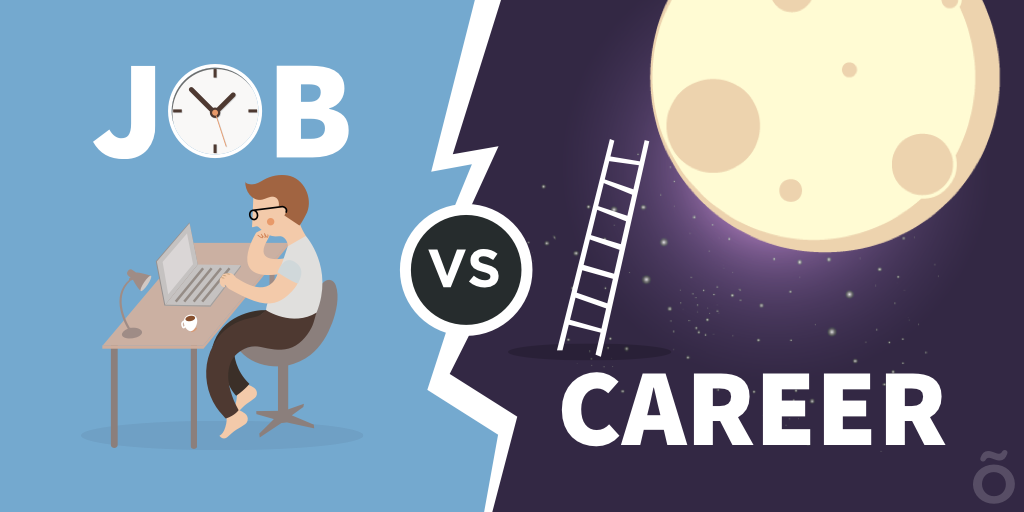

A job is short-term while a career is a long-term and that makes all the difference. Given this difference, the characteristics that make a good job differ somewhat from those that make a good career. A good job has good pay, an acceptable level of work/life balance, and involves you doing something you don’t hate on a day to day basis. Whether that good job is providing any sort of long-term growth or opportunities really doesn’t matter that much, after all, it’s just a job. As long as the pay is enough to make up for the short-term pain of showing up every day and doing things that aren’t as interesting and fun as staying home and playing video games or going out with your friends, then it’s a good job.

On the other hand, a good career is much more about growth potential. A good career might be stressful in the short term, it might not pay as much as you would like (especially for the first few years), and it might require you to get some extra education before you can really get the job (and pay) you want. But in the long-term a good career rewards your short-term sacrifice with growth (both in knowledge and pay), better work-life balance, a more interesting day to day and/or lots of freedom and opportunities.

Entry level insurance jobs can be crappy jobs… Entry level claims people generally get paid low salaries that don’t quite make up for the amount of stress they bring with them. Entry level agency roles can often be low-pay, high stress and sometimes don’t even offer benefits! And let’s not even talk about entry-level call center jobs which sometimes chew through our young talent like melting snowmen in mid-spring. But they can all lead to an awesome insurance career!

Many who have never chatted with me will wonder what I’ve been smoking to say that insurance is an awesome career. Well, here goes: Insurance is endlessly interesting. Name another industry that doesn’t know their cost of goods sold (COGS) until months, years or decades after selling its products. I’ll wait here… We sell nothing but promises, which we price using insane math. We sell it without knowing how much it’ll cost us to fulfill any individual promise and, somehow, we’re profitable in the end. It’s incredible! Absolutely EVERYTHING in the economy requires insurance. Without insurance, the economy simply doesn’t function. You can’t buy a house, drive a car or start a business without insurance. You can’t afford to take many risks without insurance, and without risk-taking the economy literally grinds to a halt. Oh, and we do good things for the world since we help people get back on their feet when they’re down. How cool is that?

Have I got you convinced that insurance is at least an interesting career where we also get to do good? Good. But does that make it a good career? Well, it’s a start. You also have to take into account that the average age in our industry is 59 and nobody grows up wanting to work in insurance. RMI graduates only fill 10% to 15% of the needs of the industry, meaning that 85% to 90% of us came in without any insurance knowledge. This means that regardless of what you majored in there’s a solid career for you here. Unemployment in the overall economy is around 4% and it’s down to a crazy low 1-2% in insurance. The US Dept of Labor estimates that just to make up for upcoming retirements we’re going to need 400,000 new insurance professionals in the next 5 years. I can basically mathematically guarantee that if you get 2-3 years of insurance experience and some extra education you will be in the driver’s seat of your career and in high demand for the rest of your working life. That’s what I call an awesome career (with sprinkles on top)!

So how do we bridge the gap between the not-so-good entry-level jobs many Millennials and Gen Zers start their insurance careers at and the incredible insurance careers they can have if they just stick around for a while?

Well, that’s the tricky part. There’s no simple answer. We have written many articles, and a best-selling book, on the topic. What do you think we should do?

About Antonio Canas

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.

Tony started in insurance in 2009 and immediately became a designation addict and shortly thereafter a proud insurance nerd. He has worked in claims, underwriting, finance and sales management, at 4 carriers, 6 cities and 5 states. Tony is passionate about insurance, technology and especially helping the insurance industry figure out how to retain and engage the younger generation of insurance professionals. Tony is a co-founder of InsNerds.com and a passionate speaker.