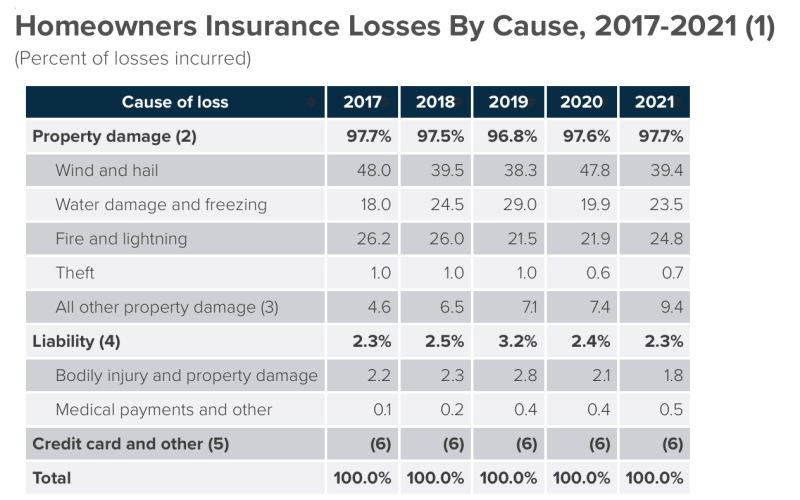

Internal water claims are the 2nd (or 3rd) largest source of aggregate loss that homeowners experience after catastrophic wind/hail.

It is a significant source of frustration to property owners because losses can be caused by slow, undetectable leaks that over time create the mess. The mess gets even worse for multi-story structures where water can create a mess in the immediate area of a leak and the floors beneath it if not caught in time.

This is one area where technology is coming to the rescue with sensors that can detect leaks. Some sensors can sense changes in humidity that signal a leak may have occurred and other sensors can be applied directly to the plumbing pipes where software can measure flow, changes in flow and whether a leak may be occurring (some of these sensor will even shut the water off or can be controlled via bluetooth or remotely)

In this episode of Profiles in Risk, Tony talks about water damage with Yaron Dycian, Chief Product and Strategy Officer at WINT Water Intelligence. They specialize in managing water in buildings which comes in through dumb pipes and is used by dumb valves and faucets. It’s an unmanaged resource! Managing water is becoming a serious issue, even in the developed world. Unbelievably, about 25% of all water in a building is wasted because of death by a thousand cuts! Water damage in buildings is one of the very highest causes of property losses and WINT can radically improve that.

Yaron Dycian: https://www.linkedin.com/in/yarondycian/

WINT Water Intelligence: https://wint.ai/

About Nicholas Lamparelli

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

Nick Lamparelli is a 20+ year veteran of the insurance wars. He has a unique vantage point on the insurance industry. From selling home & auto insurance, helping companies with commercial insurance, to being an underwriter with an excess & surplus lines wholesaler to catastrophe modeling Nick has wide experience in the industry. Over past 10 years, Nick has been focused on the insurance analytics of natural catastrophes and big data. Nick serves as our Chief Evangelist.

.jpg) Nicholas Lamparelli

Nicholas Lamparelli